Polkadot price to dip before DOT’s next leg up

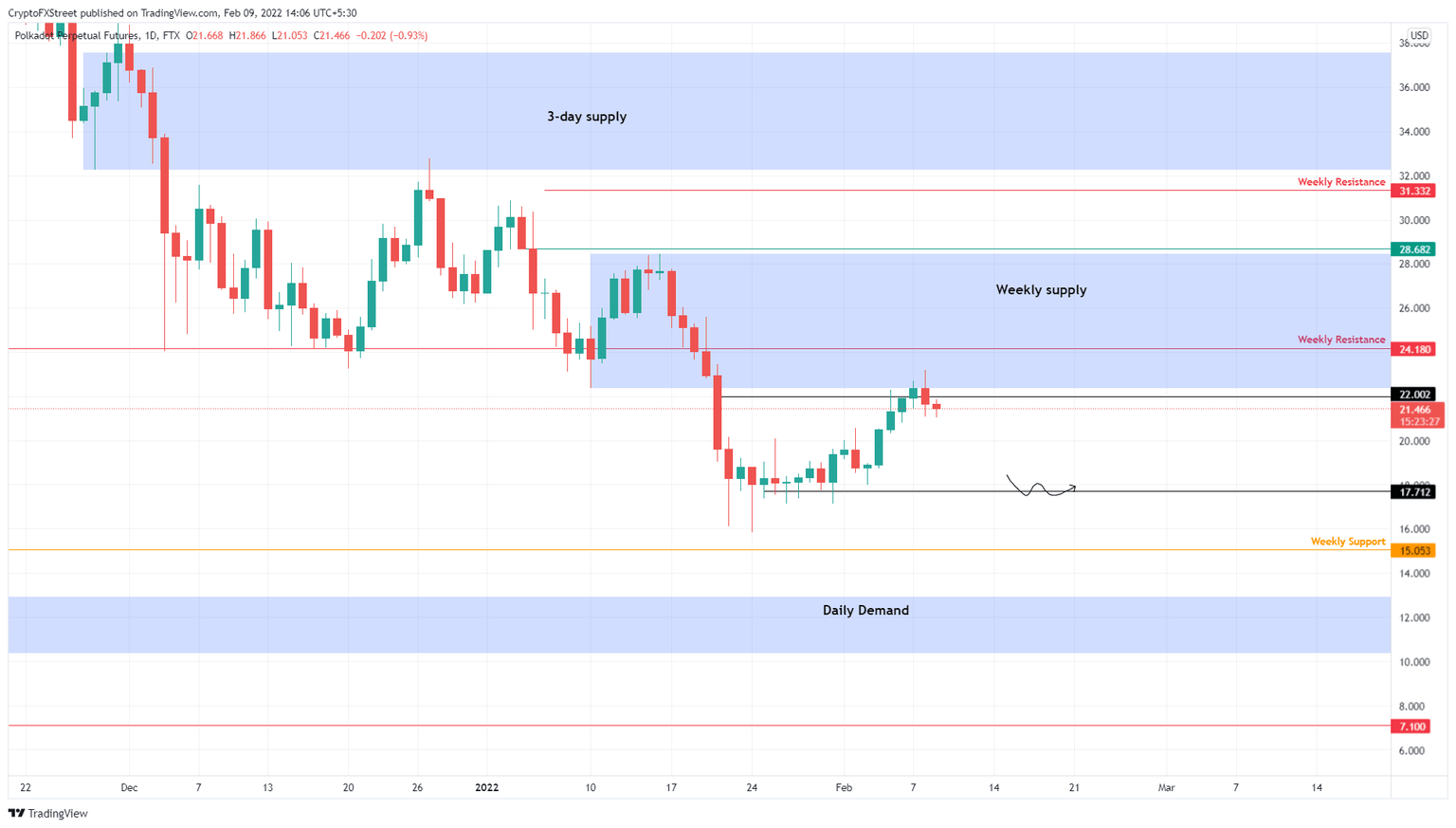

- Polkadot price has seen a reversal after retesting the weekly supply zone, extending from $22.37 to $28.47.

- Investors should expect DOT to retrace to the $17.17 support level before establishing a base for the next leg-up.

- A breakdown of the $15.05 support level will invalidate the long-term bullish thesis and trigger a further descent.

Polkadot price seems to be at a local top, suggesting that a reversal is likely around the corner. This retracement will be a necessary prerequisite for bulls to recuperate and kick-start a new up-leg. DOT could flip bearish, however, if the sellers take control, triggering a steep correction.

Polkadot price needs a break

Polkadot price rose 35% from January 31 to February 8, setting up a swing high at $23.19. This upswing, unfortunately, pierced the weekly supply zone, ranging from $22.37 to $28.47, absorbing the buying pressure, and slowing its advance.

As investors continue to book profits, there is a good chance DOT will retrace to the immediate support level at $17.71 after a 17% downswing. Therefore, interested individuals could enter a short position from the current level - $21.35 to capitalize on the down move to $17.71.

Market participants can book profits at the $17.71 support level, where buyers are likely to accumulate DOT at a discount. Alternatively, investors can wait to enter a long position at $17.71 and book profits at $22.37 and the weekly resistance barrier at $24.18.

Either way, the incoming downswing is an excellent opportunity for both buyers and sellers.

DOT/USDT 1-day chart

On the other hand, if the Polkadot price preemptively pushes higher and produces a daily candlestick close above $24.18, it will invalidate the short idea explained above. This development would hint that DOT buyers are willing to push the altcoin higher.

Only a daily candlestick close above $28.68 will suggest the start of a mid-term bullish outlook. In this case, Polkadot price could make a run at the $31.33 hurdle.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.