Polkadot price screams buy as DOT readies for 46% breakout

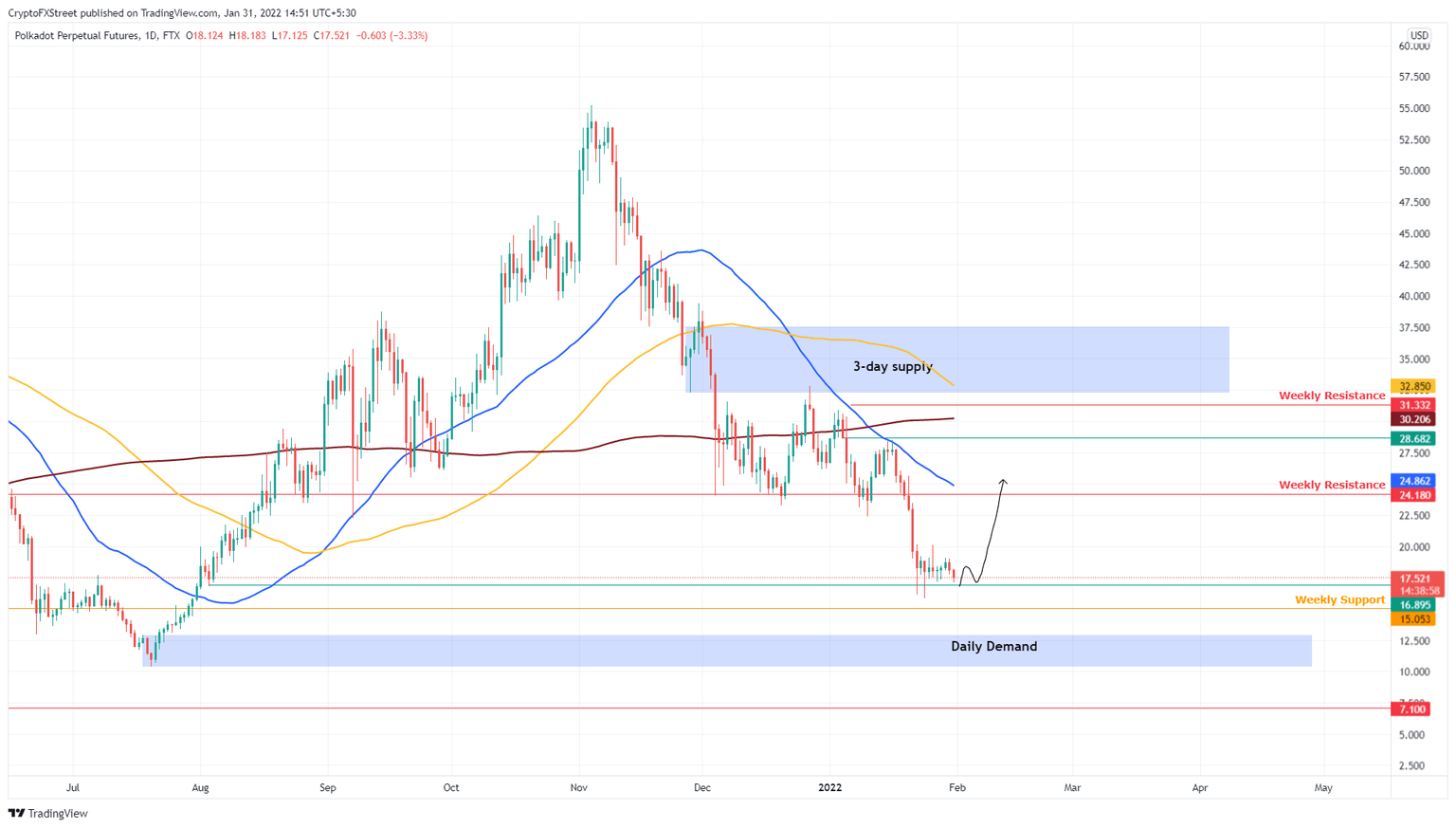

- Polkadot price is hovering above the $15.05 weekly support level, signal a bounce is likely.

- Investors can expect DOT to trigger a 46% rally that retests the 50-day SMA at $24.86.

- A daily close below the $15.05 support barrier will invalidate the bullish.

Polkadot price has been teetering off a crucial support level since January 22. This consolidation seems to be vital to triggering a new leg-up for DOT. Therefore, investors need to position themselves to capitalize on this potential upswing.

Polkadot price to kick-start its recovery

Polkadot price dropped 44% between January 16 and January 24, resulting in a retest of the $16.89 support level. Since then, DOT has tagged this foothold multiple times and is currently consolidating above it.

Interestingly, Polkadot price also has the weekly support level at $15.05, present just below its current position, suggesting a stable footing. Therefore, a resurgence of buyers could kick-start an uptrend for DOT.

Tipping the scales in favor of bulls is the little-to-no resistance barrier present up to the $24.18 hurdle. This development suggests that Polkadot price could be due for a 42% ascent. However, in some cases, the uptrend could extend to retest the 50-day Simple Moving Average at $24.86, bringing the total gain to 46%.

Investors can open a long position at the retest the $16.89 or $15.05 and book profits at $24.18 or the 50-day SMA at $24.86.

DOT/USDT 1-day chart

While things seem optimistic for Polkadot price, a failure from the bulls’ end to band together around $15.05 could be problematic. A breakdown of this barrier could lead to a retest of the demand zone, extending from $10.37 to $12.93.

A daily candlestick close below this barrier will create a lower low, invalidating the bullish thesis. This situation could see Polkadot price dwell as low as $7.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.