Pepe price remains under 50-day EMA, triggering selling spree despite hype around Dogecoin

- Pepe Coin price is down almost 15% in the last 24 hours, outperforming all meme coins in losses.

- The slump has sparked a selling spree among PEPE holders after closing below the 50-day EMA.

- Meanwhile, analysts have big plans for DOGE, speculating that it would retrace the trend leading to the 2021 rally.

Pepe (PEPE) price has extended its downtrend, breaking below crucial support to retest the late June lows. The performance is unorthodox, given that it is the poorest performer among meme coins, despite being the best performer barely a month ago.

Also Read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC breaks crucial support ahead of FOMC meeting.

Pepe price slumps 12% despite Dogecoin optimism

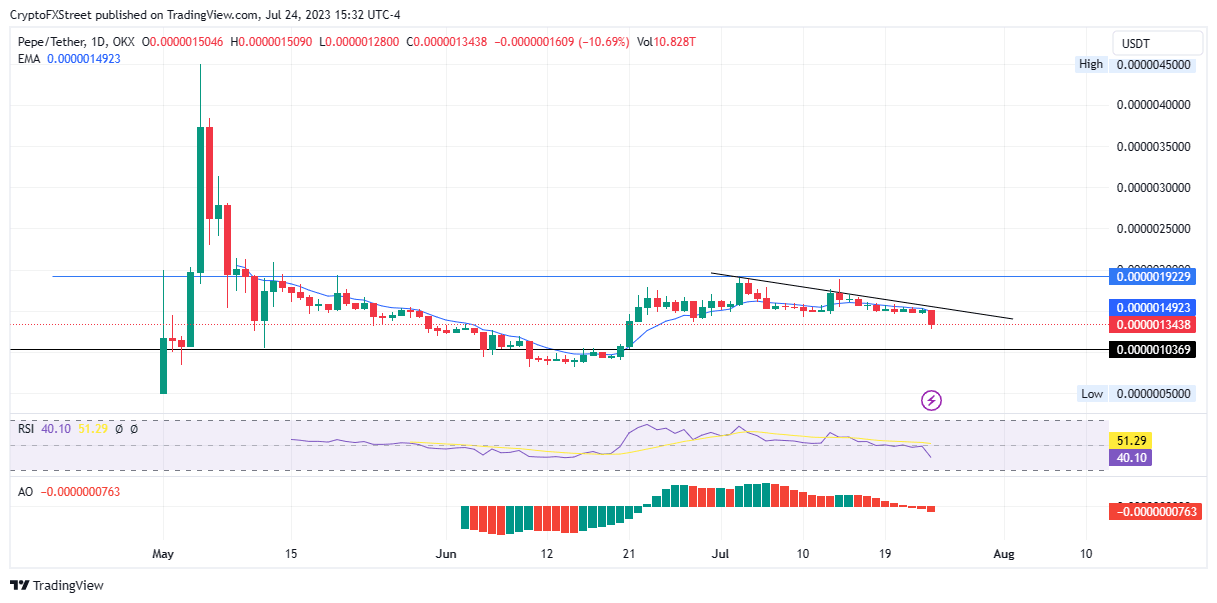

Pepe (PEPE) price has slumped 12% in the last 24 hours, making the sensational token the poorest performer among meme coins. With this dip, PEPE has breached the 50-day Moving Average (MA) at $0.0000014923.

PEPE/USDT 1-Day Chart

The 50-day MA usually acts as a trend filter, so traders looking to book profits against an uptrend wait for the price to close below this moving average. This explains the current dip in Pepe Coin price.

PEPE market outlook relative to Dogecoin price

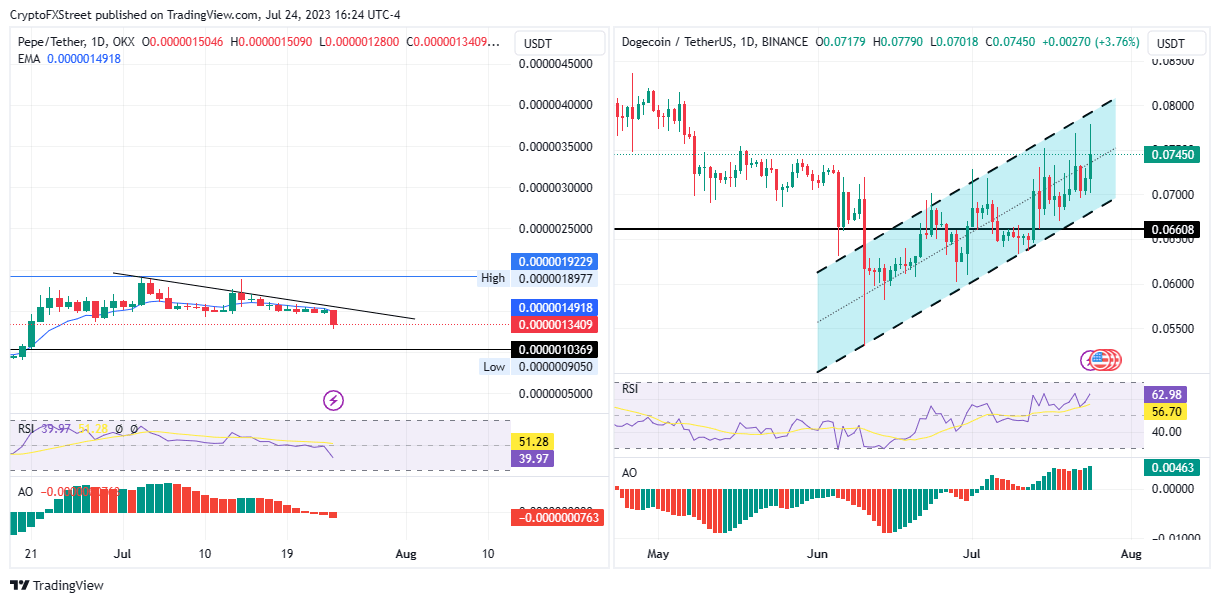

Meanwhile, most meme coin enthusiasts’ eyes are peeled on Dogecoin (DOGE) price as analysts speculate a retracement of the June 2021 rally. The largest meme coin by trading volume is up almost 5% in the last 24 hours. Evidence of the current DOGE hype is revealed in its 370% increase in 24-hour trading volume as its market cap edges toward the $10.5 billion mark.

PEPE/USDT 1-Day Chart, DOGE/USDT 1-Day Chart

Technical indicators point to a continued uptrend as the Dogecoin price consolidates within an ascending parallel channel. Specifically, the Relative Strength Index (RSI) is headed north, suggesting rising momentum.

The Awesome Oscillator (AO) is also soaked in green and high into the positive territory, further tipping the odds in favor of the bulls. Unless profit takers begin to call profits, the Dogecoin price could sustain the uptrend.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.