Can PEPE price make a 10% comeback amid crypto market uncertainty?

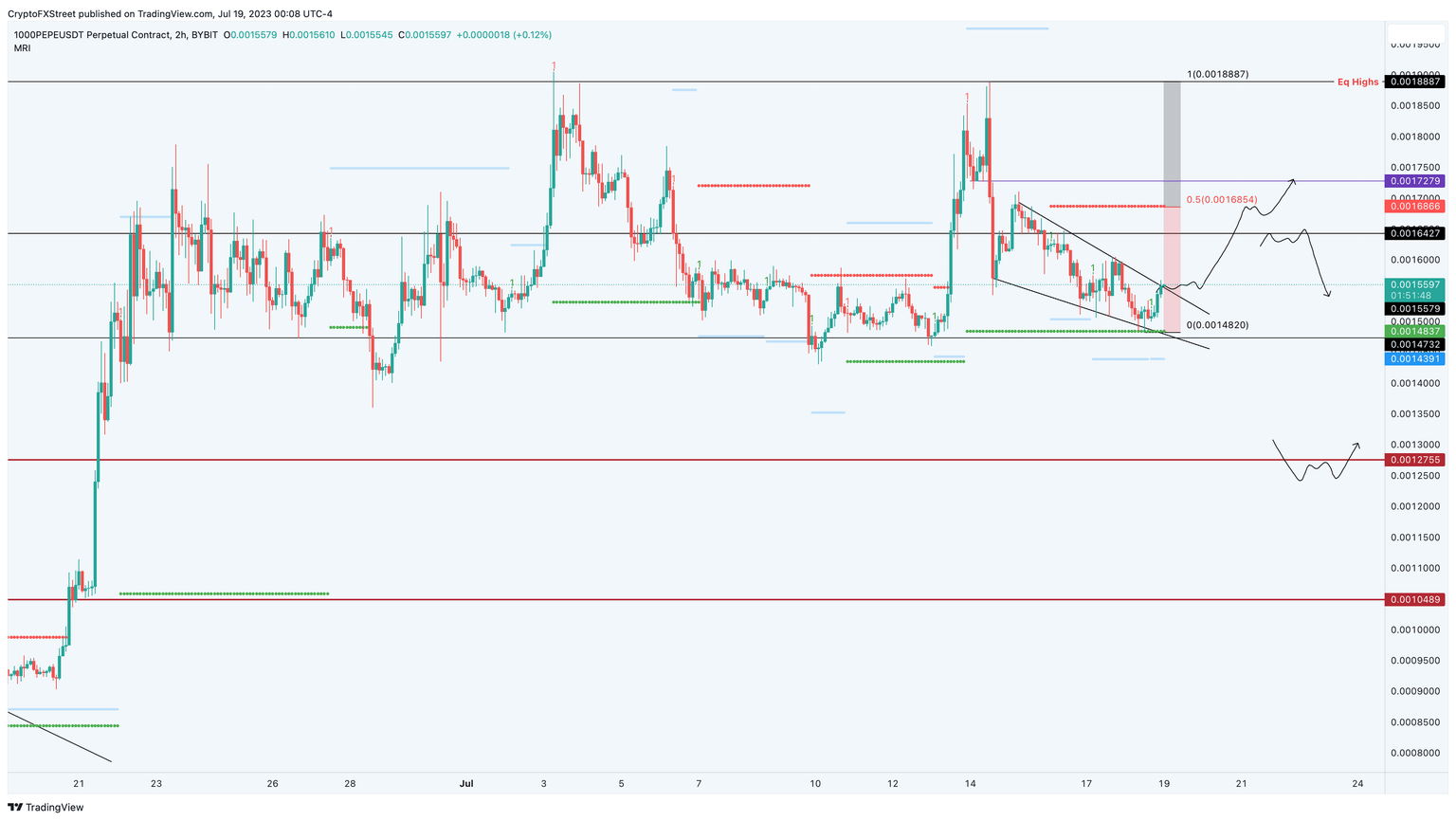

- PEPE price consolidates inside a falling wedge setup as it crashed 21% in the last four days.

- A mean reversion move of the recent slide could propel the meme coin to the range’s midpoint at $0.00000168.

- In some cases, PEPE could revisit the critical hurdle at $0.00000172, which would amount to an 11% gain.

- A decisive flip of the $0.00000147 support floor into a resistance level on the four-hour chart would invalidate the recovery thesis.

PEPE price has been on a downtrend for nearly four days. Currently, the meme coin is on stable grounds and anticipates a bounce that could extend to key hurdles.

Read more: Pepecoin knockoffs turn Dollars to fortunes in strange new ‘2.0’ play

PEPE price at inflection point

PEPE price has shed 21% between July 14 and 18, falling from $0.00000188 to $0.00000148. During this drop, the frog-based meme coin created a set of lower highs and lower lows, which, when connected using trend lines, reveal a falling wedge.

A breakout from this bullish reversal setup could trigger a quick run-up to the immediate hurdle at $0.00000164. Clearing this blockade will open the path for PEPE price to retest the midpoint of the 21% crash at $0.00000168.

In some cases, PEPE price could extend higher and tag the key hurdle at $0.00000172, which has been a source of selling pressure since June 23. In total, a move from the current position at $0.00000156 to the said level would constitute an 11% gain for investors.

PEPE/USDT 4-hour chart

On the other hand, if PEPE price produces a decisive flip of the $0.00000147 support floor into a resistance level on the four-hour chart, it would invalidate the recovery thesis. Such a development could open the meme coin to a steep 13% collapse that retests the $0.00000127 support level.

Also read: Dogecoin Price Prediction: DOGE likely to rally 25% above this level

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.