One green candle does not make the summer for Solana price

- Solana saw bulls charging on Monday with a 10% gain on the docket.

- SOL price reverses earlier gains as US dollar pressure recommences.

- The risk of a domino effect with EUR/USD breaking below parity could trigger a 47% nosedive move.

Solana price made a solid recovery on Monday on what looked to be another soft patch week with risk across the board. Tuesday is turning out to be a whole other thing, with the US coming out of a three-day weekend, and hedge funds having jumped on comments from ECB hawk Nagel that confirm there is a division within the ECB on tackling inflation and monetary control. With one of the biggest central banks losing control of its monetary stance, a seismic shift is happening with investments shifting away from the euro and moving into US dollars, which is also weighing on cryptocurrencies.

SOL traders are outpaced by the dollar yet again

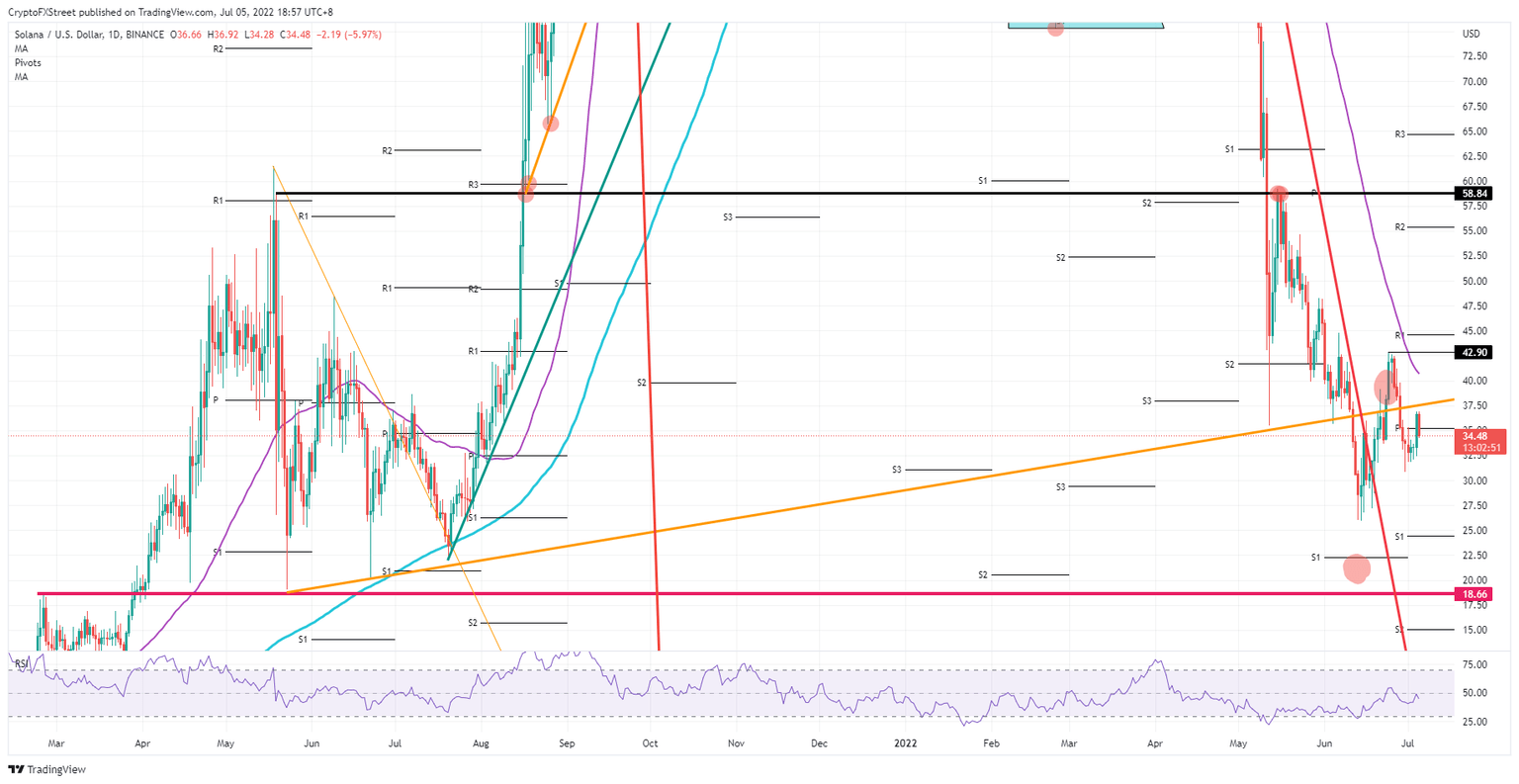

Solana price was set to pop above the longer-term orange ascending trendline and finally tie up again with $40.00. Instead, events took a turn for the worse as US hedge funds corned the FX market this morning and pushed through a massive amount of dollar demand. By doing so, the US dollar strengthened across the board against almost any other asset, dragging cryptocurrencies along for the ride.

SOL price turned out to be no match for the violent motion, and with EUR/USD at 20 year low, the risk is that once the main currency pair falls below parity, a shock could go through the markets, materialize in a massive flow of sell orders and more demand for US dollars. Solana price would initially drop back to the low of 2022, around $26.00, before nosediving towards $18.66. That last level is historically significant and goes back to February 24, 2021.

SOL/USD daily chart

As long as Solana price action can refrain from printing a new weekly low, price action could still surprise the upside. Bulls would jump on the short-term trend continuation and try to break above the orange ascending trend line. From there, the previously projected $40.00 target would come into play again with a 17% uptrend.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.