Neo Price Analysis: NEO makes long-awaited debut into the DeFi space

- Neo’s Flamingo Finance is an interoperable full-stack DeFi protocol.

- NEO bears took back control following three straight bullish days.

Neo enters DeFi with Flamingo Finance

Neo is looking to enter the blockchain space through Flamingo Finance, which will launch on September 23. Flamingo Finance will be an interoperable full-stack DeFi protocol

The #Flamingo Litepaper V1.0 is now available!

— Flamingo Finance (@FlamingoFinance) September 9, 2020

https://t.co/52sy7ZApsx

Product launch is set for 23rd Sep. We’ve shortened the “#MintRush” to 1 week so that all early participants will get more $FLM rewards and a more intensified #DeFi experience.

Be ready for the! pic.twitter.com/mSUwOe14Ov

Flamingo was developed in NGD’s (Neo Global Development) incubator initiative. As per its whitepaper, Flamingo will have the following five components:

- Wrapper: Cross-chain asset getaway for Bitcoin (BTC), Ethereum (ETH), Ontology (ONT) and Cosmos-SDK based blockchains.

- Swap: On-chain liquidity provider.

- Vault: Asset manager.

- Perp: AMM-based perpetual contract trading platform

- DAO: Decentralized autonomous organization. A system that runs and updates by itself.

Flamingo Finance will be supporting Bitcoin itself at a later stage.

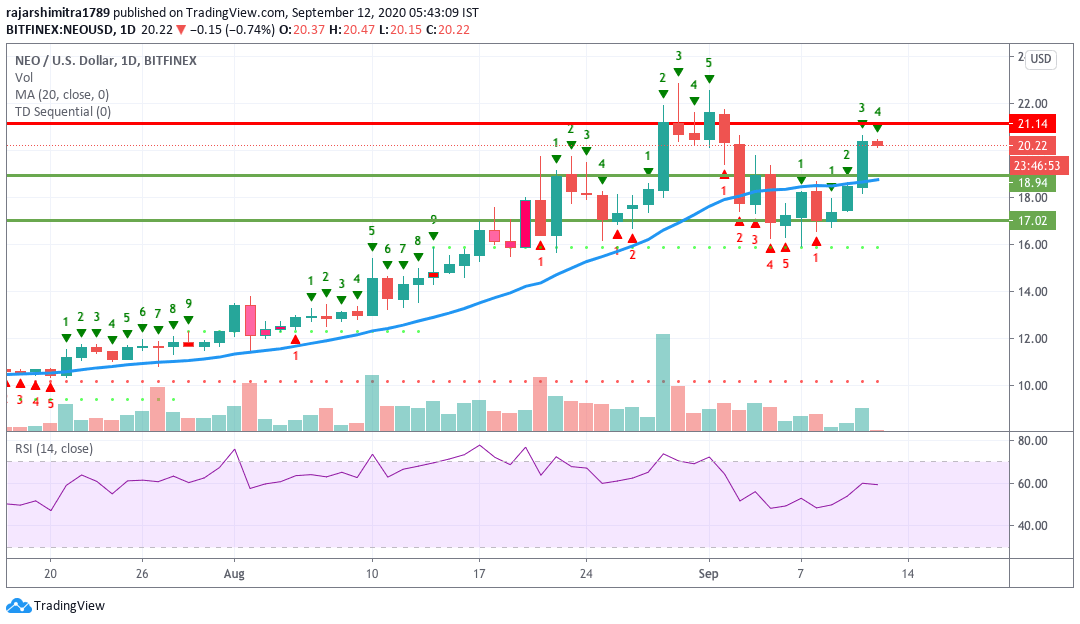

NEO/USD daily chart

NEO/USD went down from $20.45 to $19.95. Before this, the buyers have remained in control for three straight days, wherein the price went up from $16.98 to $20.45. The relative strength index (RSI) is hovering around in the neutral zone, which shows that the buyers can still take back control of the market and aim for the $21.14 resistance line.

NEO/USD 4-hour chart

The 4-hour NEO/USD chart is on the verge of bearish reversal. The buyers have lost momentum at the $20.36 resistance line and the price seems to have charted the bearish morning star pattern. Following that, the price has dipped to $19.98 and is currently aiming for the $19.86 support line.

Verdict

After three straight bullish days, the bears seem to have regained control in the short-term. We can expect them to break below the $19.86 support level and aim for the $19.30 level as well. However, if Flamingo manages to create more hype in the market, we can expect the bulls to come roaring back and regain control.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.