NEM Price Outlook: Here is what caused XEM/USD 38% jump

- XEM/USD is currently 100% up since its lowest point in 2020.

- NEM has recently launched a marketing campaign through DAO Maker to incentivize users to hold the coin.

NEM is one of the oldest cryptos, coded from scratch starting in 2014 and launched in 2015 using a modified nxt proof of stake mechanism called Proof of Importance or PoI. For the most part, NEM stayed in the top 30 by market capitalization and it’s still currently rank 29 but not a lot of people are talking about it. After successfully launching its Community Hub in May, XEM/USD started picking up steam and created a strong daily uptrend.

The key factors pushing NEM to higher highs

The NEM Hub was developed by DAO Maker and according to the official announcement it intends to incentivize token holders to collaborate with NEM on various activities like marketing, sales, and basically anything that would help the project out by rewarding them with tokens.

The goal of the community hub is to foster community engagement, offer a resource-rich funnel for newly interested users, and offer the small holders an opportunity to earn staking interest, paid by the NEM foundation’s treasury.

Additionally, NEM was one of the few coins that didn’t entirely recover from the crash on March 12, which meant it was only a matter of time before a breakout for XEM/USD. The current market capitalization of XEM is around $464 million, on the verge of beating Ontology at $480 million.

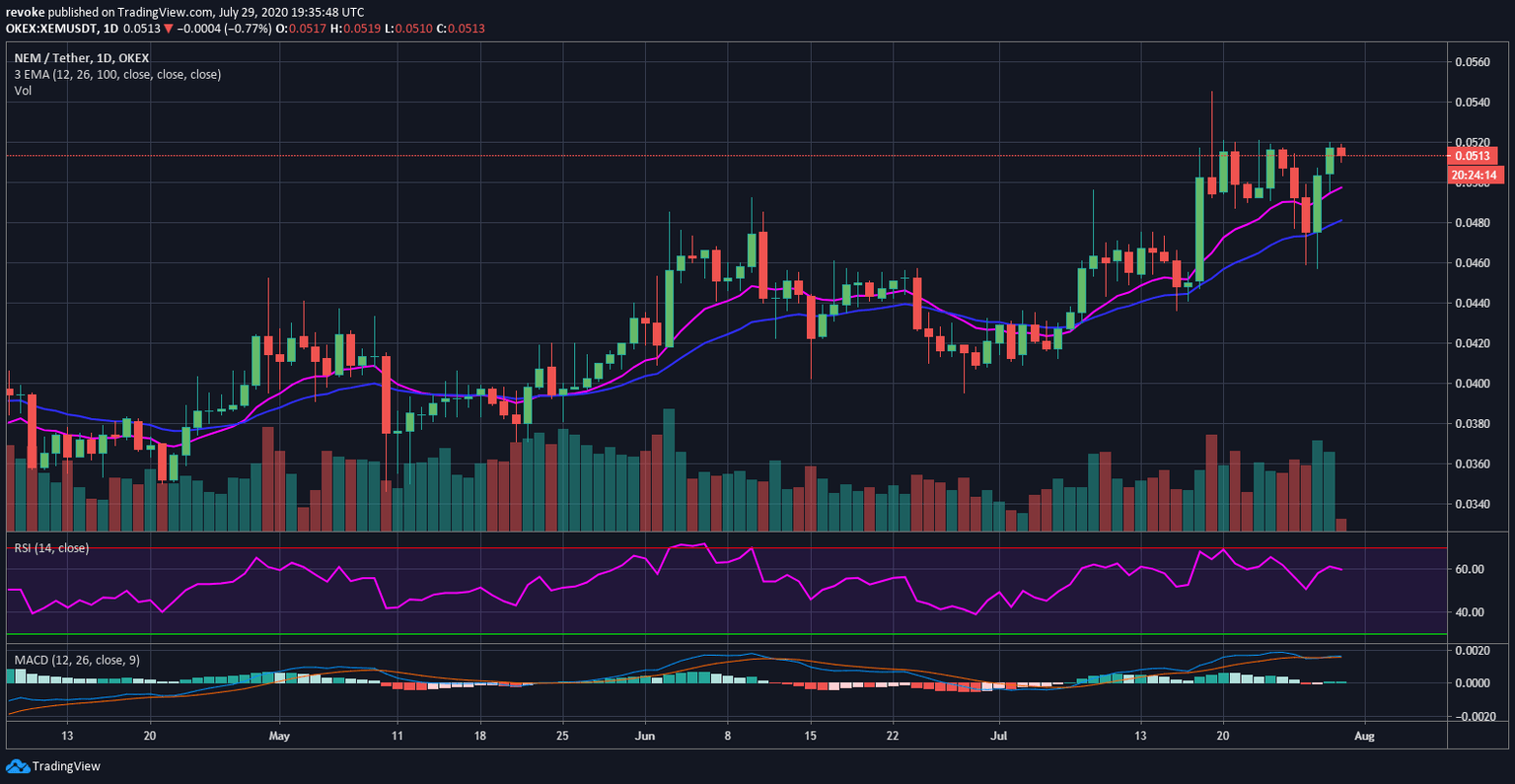

XEM/USD daily chart

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.