Near Protocol Price Prediction: NEAR could crash 15% as mean reversion probability spikes

- Near Protocol price has breached a trendline, signaling a bearish breakout.

- Investors can expect NEAR to crash 18% and tag the midpoint of the 121% rally at $3.35.

- A four-hour candlestick close above $4.62 will invalidate the bearish thesis.

Near Protocol (NEAR) price shows clear signs of bullish failure as the altcoin produces lower lows and fractures an important uptrend support line. NEAR holders can expect a quick double-digit pullback soon.

Read more: Bitcoin ETF news and five most asked questions regarding spot ETF approval

Near Protocol price on the verge of a crash

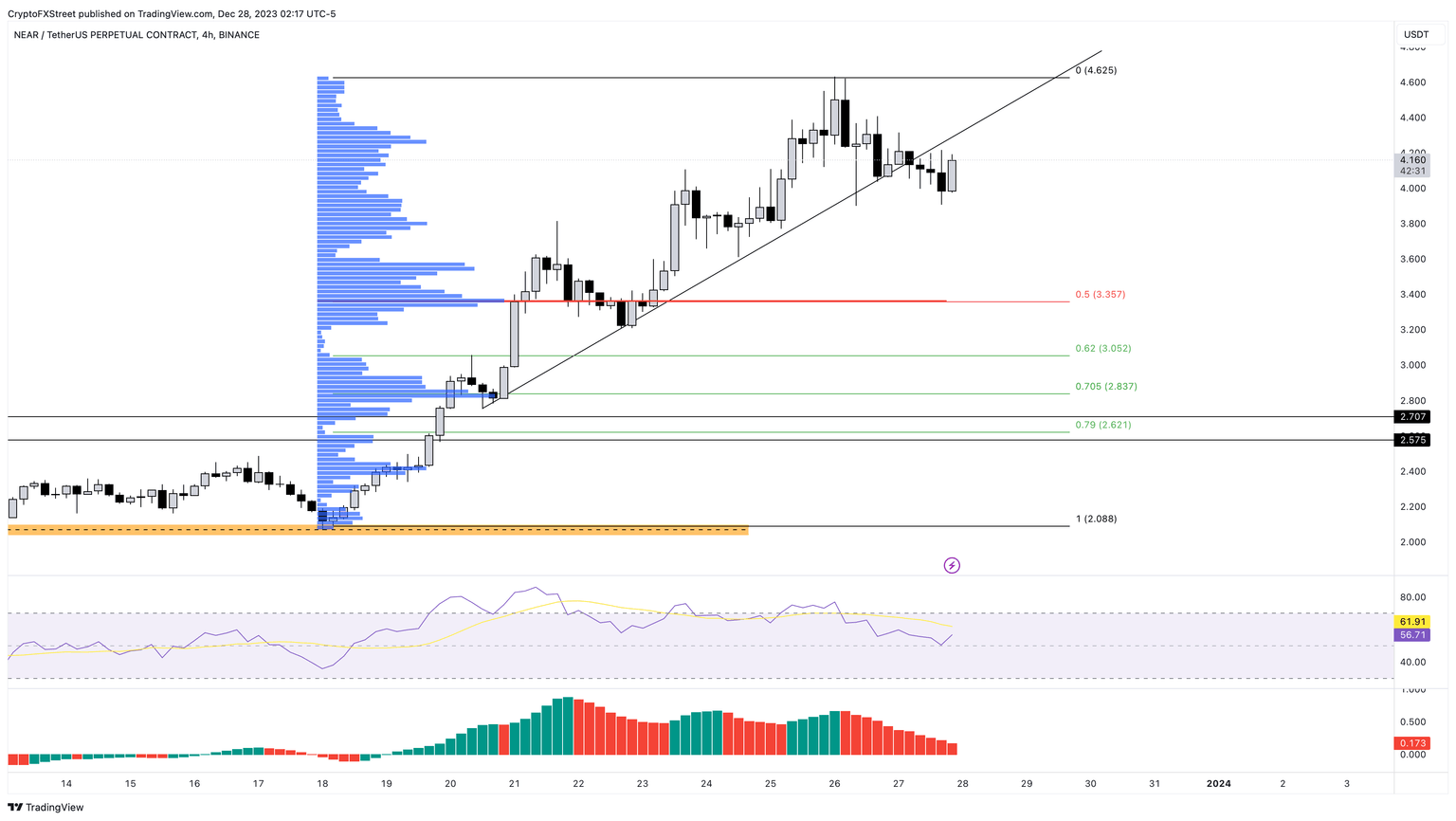

Near Protocol price rallied 121% between December 18 and 25, setting up a local top at $4.62. Since then, NEAR has shed 11% and currently trades at $4.09. This down move has shattered the trendline connecting the five lower highs NEAR produced during its rally, confirming the start of a trend reversal.

The Relative Strength Index (RSI) currently sits at the midpoint of 50, and Awesome Oscillator (AO) is also sliding toward its mean level of 0. A breakdown from both these key levels will confirm the start of a downtrend.

Such a development could see Near Protocol price at least revert to the mean of $3.35. This move would see NEAR shed another 18% from the current level. Beyond this level, the altcoin could slide to the low volume node of $3.05, bringing the total drop to 25%.

In a highly bearish case, Near Protocol price could slide up to the 70.5% retracement level of $2.83.

Also read: MicroStrategy buys $615 million worth of Bitcoin; total holdings exceed Litecoin, SHIB market cap

NEAR/USDT 4-hour chart

While the pessimistic outlook for Near Protocol price makes logical sense, alts are booming due to Bitcoin’s rangebound movement. If this trend continues or if BTC spikes higher, it will reinforce the bullish idea and propel altcoins higher.

In such a case, if Near Protocol price produces a four-hour candlestick close above $4.62, it will create a higher high and invalidate the bearish outlook. This development could see the NEAR token rally 8.1% and tag the $5.00 psychological level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.