'Smart money' is record long on BTC ahead of expected Bitcoin ETF

-

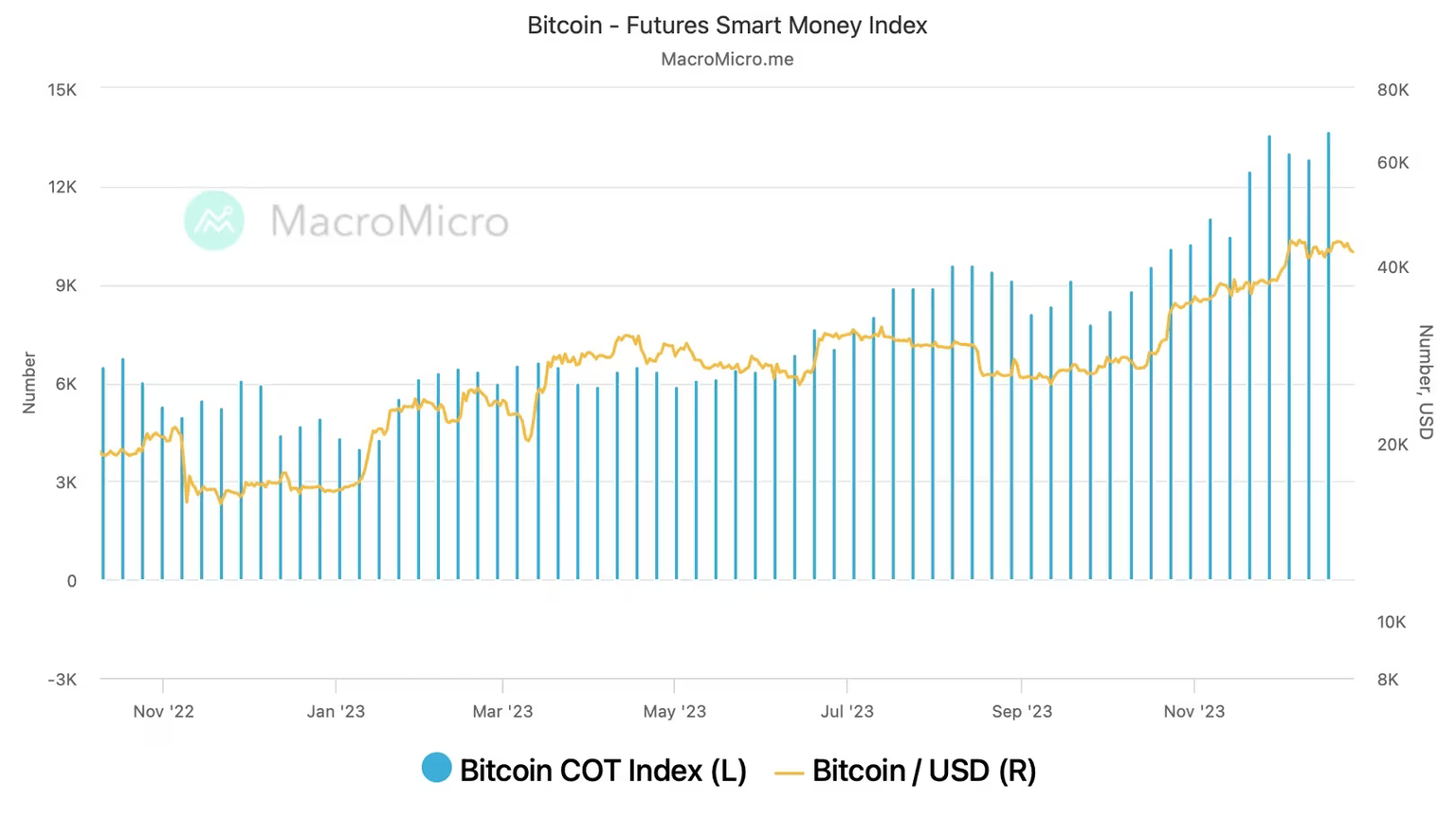

Data tracking website MacroMicro's bitcoin futures smart money index rose to a record 13,711 last week.

-

The record bias for bullish long positions comes days ahead of the SEC's impending decision on spot ETF applications.

-

Some obsevers foresee a classic "sell the news" price action following the ETF launch.

Smart money, or capital investments from institutional investors and knowledgeable market participants, is piling into Bitcoin [BTC] as the U.S. Securities and Exchange Commission's (SEC) deadline to approve a spot BTC exchange-traded fund (ETF) nears.

That's the message from Taiwan-based data tracking website MacroMicro's bitcoin futures smart money index, which tracks the spread between the large investors' long and short positions open on the Chicago Mercantile Exchange. The indicator is based on the CFTC's weekly Commitment of Traders report.

The smart money index rose to 13,711 last week, surpassing the previous peak of 13,603 to signal record net bullish positioning by asset managers and other reportables.

CME's cash-settled standard Bitcoin futures contracts sized at 5 BTC are widely considered a proxy for institutional activity, allowing market participants to take exposure to the cryptocurrency through a regulated venue without having to own it.

Futures are derivative contracts that obligate the buyer to purchase an asset and the seller to sell an asset at a predetermined price at a later date. Going long means being obligated to buy the underlying asset and conveys a bullish bias. Going short suggests otherwise.

The smart money index has risen to a record high. (MacroMicro) (MacroMicro)

The smart money index has risen sharply this quarter amid the spot ETF narrative and strengthening expectations of a Fed rate cut in 2024.

The U.S. SEC has reportedly set Jan. 10 as the deadline for approving/rejecting an exchange-traded fund (ETF) that invests in bitcoin rather than futures tied to BTC. Observers expect record inflows into the asset class following the potential launch of one or more spot ETFs.

The bullish expectations have powered Bitcoin higher by nearly 60% this quarter, opening doors for a potential "sell the news" price action following the launch.

"As we finally approach the launch, we need to point out that it is likely that the actual demand for the BTC Spot ETF at the start will fall short of market expectations. This sets up a classic 'sell the news' scenario in the 2nd week of Jan," Singapore-based QCP Capital's market insights team said in an update published last week.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.