Here’s where Crypto is heading for the rest of 2021 and beyond

When Bitcoin was born over a decade ago, it was supposed to be a revolution in the finance ecosystem nobody believed in at the time. During their brief existence, cryptocurrencies have grown into a $2.7 trillion market, gave birth to entire new industries like NFTs, sparked heaps of innovation, and made governments and central banks increasingly fearful of them. What about ordinary people? Should we remain wary of crypto or embrace it?

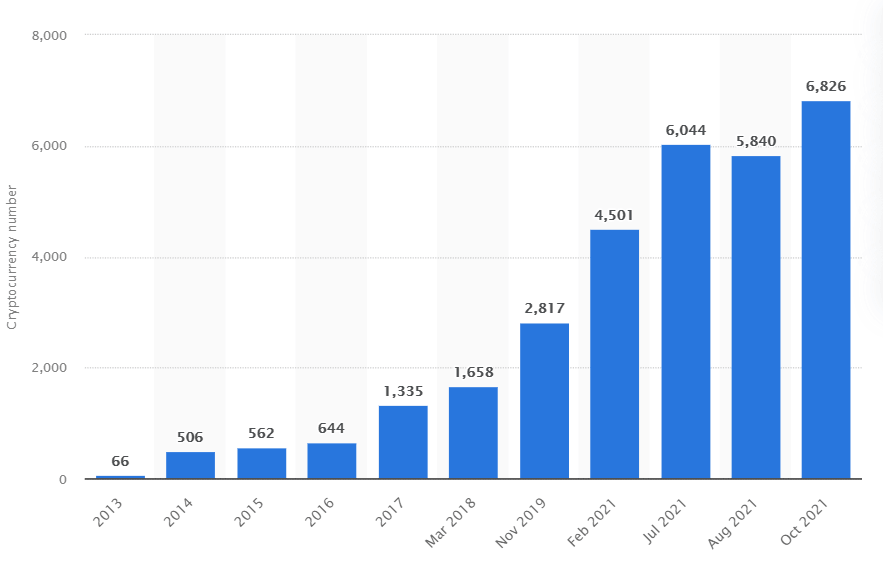

Whether we like it or not, digital currencies have reshaped the global financial system, and the way people buy, sell, and save, with the number of active cryptocurrencies growing exponentially from a marginal amount of digital coins in 2013 to almost 7,000 worldwide as of October 2021.

Source: Statista.com

2021 is a banner year for crypto

The year 2021 has been a significant year for cryptocurrency. The crypto industry has seen new price records in Bitcoin in April and October, talk about crypto regulation, and growing institutional investment. Thus, investors poured $1.47 billion into digital asset products last week, the largest amount on record, a report by CoinShares showed.

All along, there has been an extraordinary amount of interest and attention paid to the crypto space, not just among investors but also among the general public. But what’s next? There’re almost no doubts that this year is a part of a bigger story. Investors, central banks, regulators, financial firms, and governments are all reviewing the way blockchain-based currencies will alter their world.

In a sign that crypto is becoming more mainstream, Tesla said it plans to resume the practice of transacting in digital assets for its products and services. This is what the company wrote in its recent quarterly SEC filing: “We believe in the long term potential of digital assets both as an investment and also as a liquid alternative to cash."

The overall cryptocurrency market capitalization has reached a new record of $2.7 trillion last week, fueled by a crypto rally across the board. It has more than tripled since January, when it stood at $770 billion. And it's twice as much as silver's $1.3 trillion and a percentage of gold's $11.4 trillion.

Source: TradingView

Year-to-date, BTC price has increased by 109%. Having jumped by 38% in October alone, it hit a record high near $67,000 last week, following the launch of the ProShares Bitcoin Strategy ETF. At the time of writing, bitcoin traded at $60,480.

Source: TradingView

BTC soars on inflation fears, not ETF launch

Most experts associated the recent upswing with the Bitcoin-linked ETF’s debut on Wall Street. However, according to JPMorgan, this was largely due to growing inflation fears rather than the ETF’s success. Investors seek safe havens for their cash and believe bitcoin can be a better hedge than gold.

"While we accept that bitcoin momentum has shifted steeply upwards since the end of September, we are not convinced the anticipation of BITO's launch was the main reason," analysts at JPMorgan wrote in a note. "Bitcoin's allure as an inflation hedge has been strengthened by the failure of gold to respond in recent weeks to heightened concerns over inflation, behaving more as a real rate proxy rather than inflation hedge," they said.

Is Bitcoin in rocketship growth or about to crash?

There are various analysts’ opinions about where BTC is heading. Interestingly, Alessio Rastani, a crypto analyst and technical analysis researcher, has recently unveiled his BTC price prediction based on the Elliott Waves theory, the key takeaway of which is that price moves in repeating up-and-down patterns called waves. They, in turn, are caused by market sentiment.

According to Rastani, we currently could be in Wave 3 which would be followed by a wave 4 correction looking like a long-term bear market. When Wave 4 completes, the next major Wave 5 bull market would take place, peaking at over a $200K level, with both waves taking several years.

But how can we know that Wave 3 is over? Rastani said this would probably happen when we pass the $100K level and when the market sentiment becomes overly bullish. According to him, we’re still far from that moment and we’ll likely get there within the next 12-18 months. Citing research by behavioral finance expert Jason Goepfert, Rastani said this would coincide with a stock market’s and a global economic recession.

Well, that might be true, as history repeats itself, and if we look at BTC price from the very beginning to the present day, we can see that price patterns repeat.

Source: Statista.com

Other strategists suggest that the next Bitcoin test could be around $90,000. “Initial upside targets of Bitcoin above $65,000, lie near $72,500 and then at $89,000 and are thought to be within reach of this breakout of former peaks,” independent research boutique Fundstrat said.

According to Bloomberg analyst Mike McGlone, Bitcoin could reach $100,000 sooner than expected. BTC is in the midst of a supercycle, positioning it to outperform commodities in 2022.

In my previous price prediction, I said that a correction was likely as BTC hit an all-time high. This is what currently happens. The technical picture supports the case for a deeper pullback. However, I still believe that the level of $78,000-$85,000 by the end of the year is the most likely scenario.

BTC price and crypto regulation

What I'll be keeping an eye on next is how the crypto market reacts to potential regulation. Cryptocurrency, once unregulated and free for all, is likely to live within some rules and boundaries soon. Regulation is among the most important factors affecting bitcoin price, however, this is not always bad news. Based on price responses, traders prefer a legally defined status and a light regulatory framework.

Regulatory bodies around the world are claiming territory in the cryptocurrency regulation space. Thus, Reuters reported the FDIC chair said US officials are exploring how to allow banks and their clients to invest in crypto assets. There might be more clarified rules concerning cryptocurrency custody that facilitate client trading, and even permission to use crypto as collateral for loans, or to add digital assets to balance sheets.

Final thoughts

It’s an important part of my day-to-day work as a Head of PR at a big crypto exchange to keep my finger on the pulse of crypto developments and notice how they affect digital assets’ prices. In my view, this year has shown that crypto is now even more sensitive to crypto-related news. It feels like it started after the WSB gate a year ago, which was definitely a precedent. Since then we’ve seen the market following Elon Musk’s tweets, El Salvador’s making cryptocurrency legal tender, or even the most recent Doge vs Shiba skirmish.

BTC has hit all-time highs twice this year, with price corrections being shorter than ever before. A possible explanation is the fact that institutional and wealth management sectors are becoming more involved in crypto assets. According to some analysts, crypto prices are whale-driven to a large extent, so it’s crucial to pay close attention to them. Thus, following the recent purchase of 596 bitcoins by the third largest Bitcoin whale, BTC price was up 3.7% for that day.

There’s a growing interest in crypto among major companies and officials around the world. In a historic move, El Salvador was the first country to officially adopt Bitcoin as legal tender. This is in contrast with other countries that are making the most effort to develop their own centralized digital currencies. Following Bahamas’ rollout of its “sand dollar” last year, China and Nigeria came out with their CBDCs this year. Norway, Japan, Indonesia, Sweden and South Korea announced digital currency plans. Ghana, Morocco, Egypt, Kenya, and South Africa are also exploring the technology’s feasibility.

At the same time, Bitcoin’s adoption by tech giants like Visa, MasterCard, PayPal, along with Amazon’s plans to accept BTC payments all contribute to the crypto industry’s earth-shattering growth.

While exact predictions are impossible, we can keep abreast of global developments in crypto regulation and adoption to get a better understanding of the market environment.

Author

Mike Ermolaev

Independent Analyst

Mike Ermolaev is the founder of Outset PR. The agency helps tech companies, especially blockchain and Web3 projects, get the desired recognition thanks to its wealth of media connections.

-637710169224299799.png&w=1536&q=95)

-637710169993927476.png&w=1536&q=95)

-637710170611874465.png&w=1536&q=95)

-637710171774274712.png&w=1536&q=95)