Elon Musk warns of ‘strong inflationary pressure’ as Tesla mulls Bitcoin payments

The world faces “strong inflationary pressure” in the short term, and it may persist, warns the world’s richest man.

In a debate about inflation, some of the best-known names in Bitcoin (BTC) voiced unanimous doubts about the state of global monetary policy.

Future of inflation great unknown, says Musk

As even the United States Federal Reserve admits that inflation may be here to stay, the topic has become especially pertinent for Bitcoiners, given the cryptocurrency’s intrinsically deflationary characteristics.

For Elon Musk, who remains cool when it comes to Bitcoin as a “magic pill” for fiat currency’s ills, inflation is no less of an issue. With over $250 billion in net assets as of this week, potential exposure to devaluating currencies is more of a potential problem than ever.

“I don’t know about long-term, but short-term we are seeing strong inflationary pressure,” he said in a Twitter debate with Ark Invest CEO Cathie Wood and MicroStrategy CEO Michael Saylor.

All were commenting on a previous tweet from Twitter CEO Jack Dorsey, who described inflation as “happening” and apt to “change everything.”

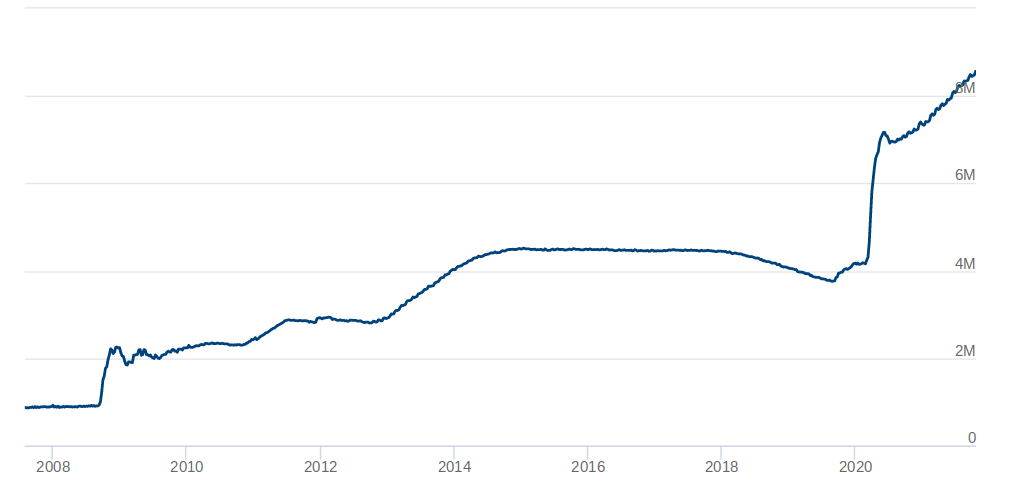

Wood, also a firm BTC supporter, noted that monetary velocity, on the contrary, had been slowing since the 2008 global financial crisis, disguising some of the devaluation impact.

Regardless, when all types of products are taken into account, the true cost of dollar printing far outstrips government claims about how inconsequential inflation really is.

“Inflation is a vector, and it is clearly evident in an array of products, services, & assets not currently measured by CPI or PCE,” Saylor wrote.

“Bitcoin is the most practical solution for a consumer, investor, or corporation seeking inflation protection over the long term.”

Federal Reserve balance sheet chart. Source: Federal Reserve

Bitcoin may yet return to Tesla

Musk’s Tesla passed $1,000 per share for the first time this week, helping spur a dramatic increase in his net worth.

In a filing with the U.S. Securities and Exchange Commission, meanwhile, the company left the door open to accepting Bitcoin for its products in the future.

“During the nine months ended September 30, 2021, we purchased an aggregate of $1.50 billion in bitcoin. In addition, during the three months ended March 31, 2021, we accepted bitcoin as a payment for sales of certain of our products in specified regions, subject to applicable laws, and suspended this practice in May 2021,” the 10-Q document reads.

“We may in the future restart the practice of transacting in cryptocurrencies (‘digital assets’) for our products and services.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.