MATIC Price Prediction: Polygon needs to correct before shooting 70% higher

- MATIC has hit a curb in the steep ascent of gains.

- Buyers took Polygon profits at $1.57, and it looks that the profit-taking is not over yet.

- Supporting factors are waiting for buyers to re-enter again.

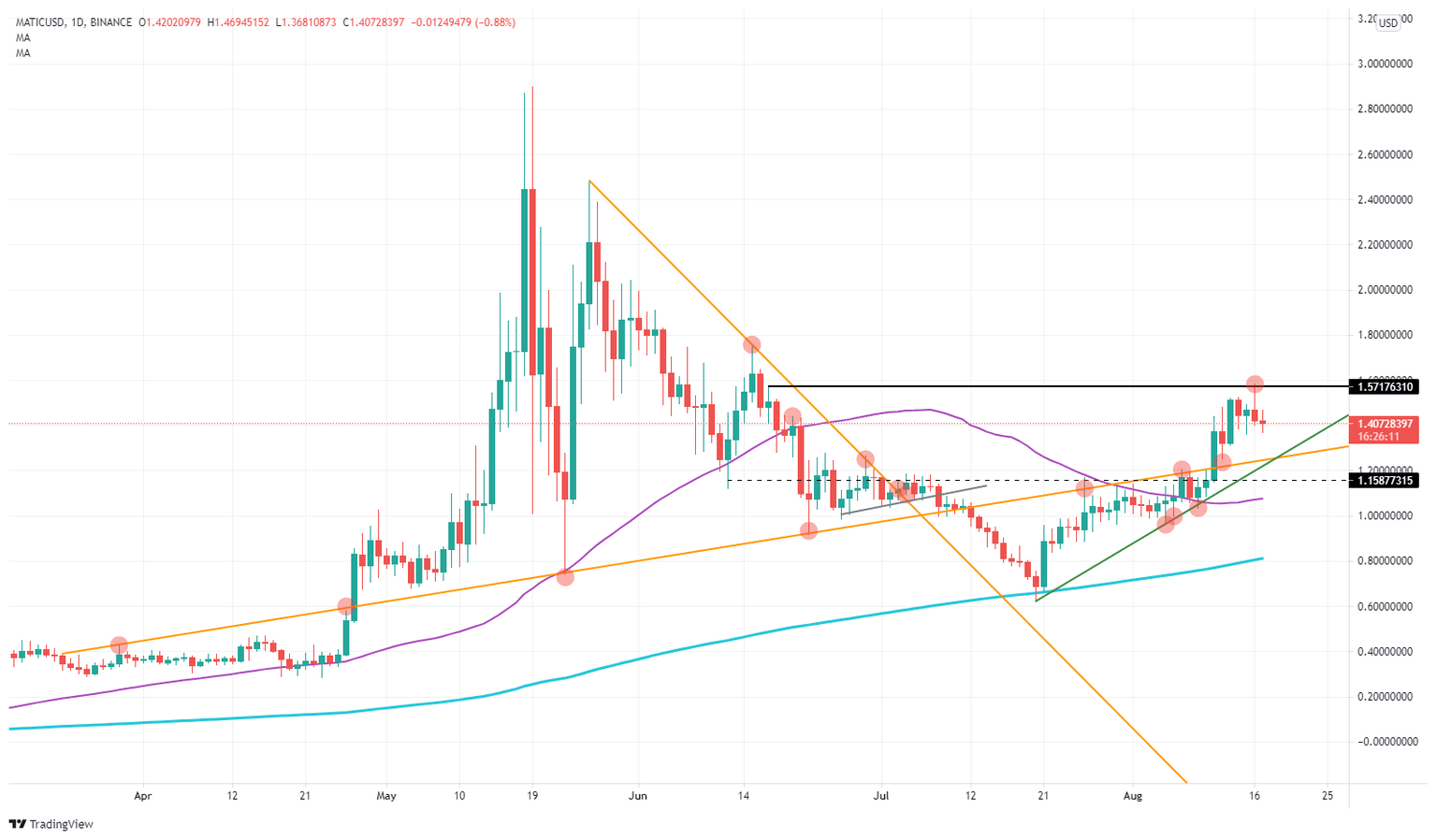

Although Polygon (MATIC) made a new high yesterday for this summer, it does not tell a compelling story for the days to come. Price got rejected at $1.57 and is forming a double top with the high on June 17. Buyers got tempted to take some profit around this level, causing a short-term correction and making other buyers take the money and run. For now, the low of August 15 is holding as near-term support at $1.36, but it is just a matter of time before sellers take over.

MATIC needs to flush out short-term investors, wait for long-term investors to step in

Expect in the coming day some more profit-taking that could result in a correction of 12% to the downside. Looking for support, $1.25 looks good with the yellow ascending trend line originating from March 22 and already shown in the past its importance with multiple tests both to the upside and downside. Secondly, we have the green ascending trend line from July 20 that had three trials, confirming its importance.

A bit lower, the 55-daily Simple Moving Average (SMA) comes in at $1.07. That is still quite far away, but as another supporting power is there, expect short-sellers to buy and close their short positions around $1.25 as multiple support elements are ready to keep the trend pointed upwards.

Long-term buyers who missed the boat back in July will be keen to step in at the above-described level at $1.25. After the profit-taking has happened, Polygon should have a new rally that could push price action beyond $1.57, breaking the double top. In an ideal technical trade, that level should be tested, confirming holding for support and having MATIC push further upwards toward $2. Full completion of the trade would be hitting $2.40 as that was the May 26 high – which amounts to a 70% gain.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.