MATIC price could crash 20% if bulls buckle under pressure

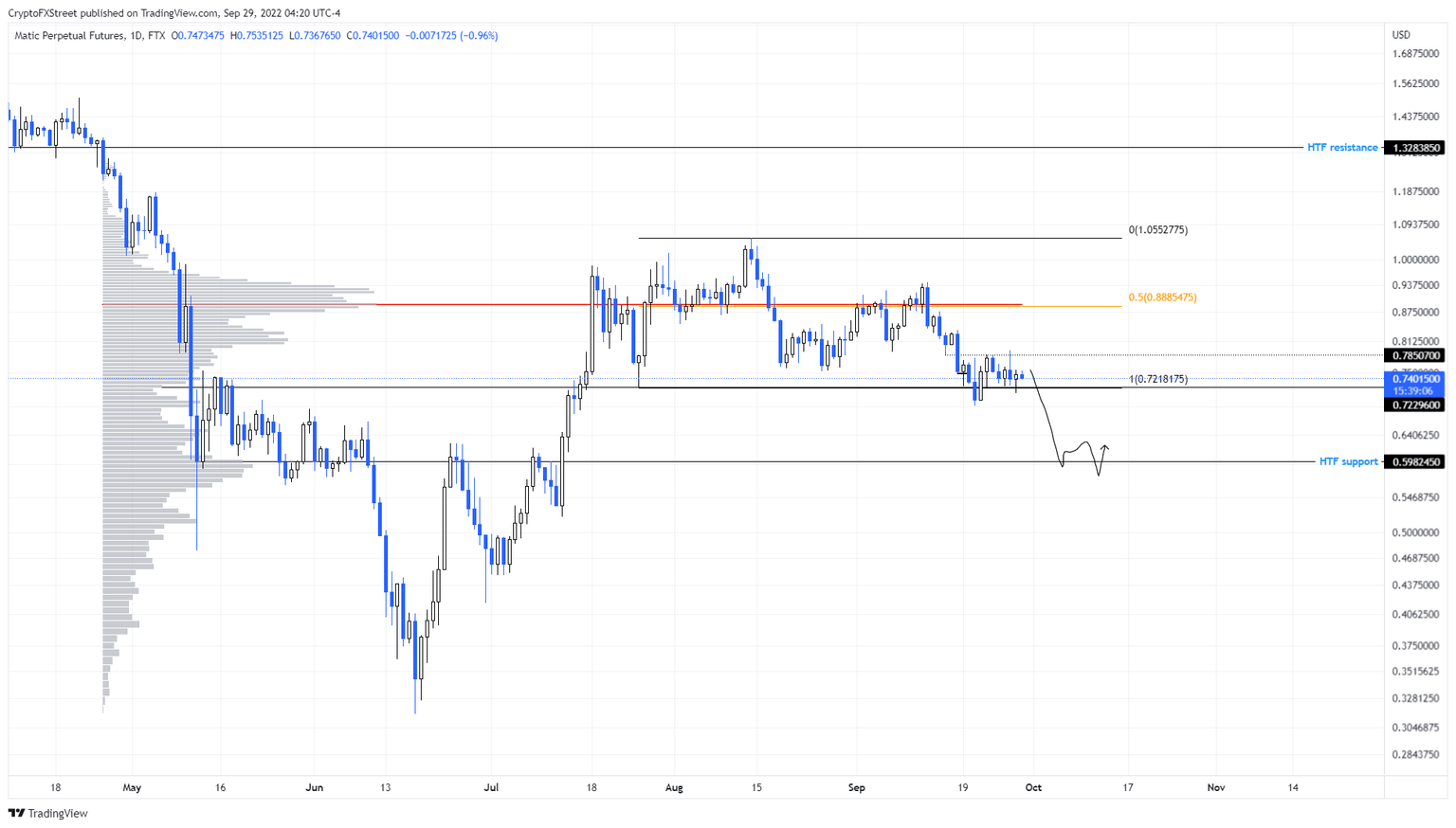

- MATIC price shows a tight consolidation around the range low at $0.721.

- A breakdown of this level could trigger a 20% correction to $0.598.

- On the other hand, a resurgence of buying pressure that flips the $0.885 hurdle into a support level will invalidate Polygon’s bearish fate.

MATIC price prepares for a volatile move as it continues to consolidate for nearly ten days. This development could result in a bearish move, especially if the immediate support level is breached.

MATIC price ready to show its hand

MATIC price has been rangebound between the $0.721 and $1.055 barriers for over three months. Over the last ten days, however, it seems to be hovering around the range low and is showing signs of breaking down.

Supporting MATIC price and its bearish outlook is the $0.721 to $0.598 low volume node gap represented by volume profile. This gap is an imbalance, which will be filled quickly upon the breakdown of the $0.721 level.

In total, investors can expect MATIC price to drop nearly 20% from its current position and form a base around the $0.598 barrier.

MATIC/USDT 4-hour chart

Regardless of the imbalances, investors should pay attention to Bitcoin price, which determines the directional bias of the crypto markets, including altcoins such as Polygon. If the big crypto decides to head higher, MATIC price will follow suit.

Under these circumstances, if MATIC price flips the range’s midpoint at $0.888, it will invalidate the bearish thesis and motivate sidelined buyers to step in and propel Polygon to retest the range high at $1.055.

This move, however, would constitute a 42% ascent from the current position and 18% from the said midpoint.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.