MATIC price correction provides an opportunity for a reacceleration of the uptrend

- Polygon price is respecting a bearish trend line for November.

- MATIC price sees bulls at ease as three ascending indicators are supporting the uptrend.

- With the correction, MATIC could see 100% upside potential and a $3.0 price target.

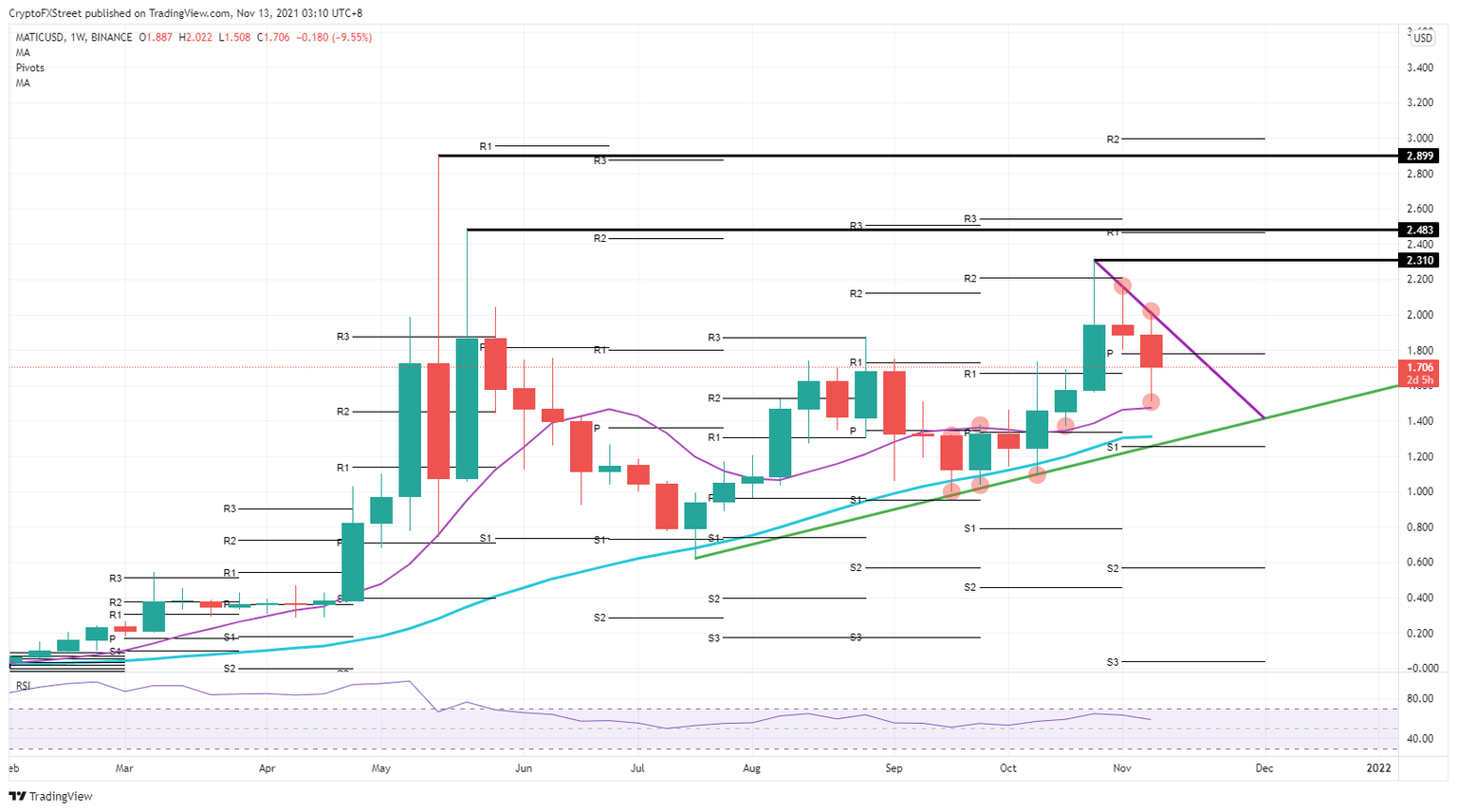

Polygon (MATIC) price is under some pressure, with the upside capped by a purple descending trend line being respected throughout November. With the Relative Strength Index still quite elevated, it looks that bulls are using the dips and corrections as a chance to average in for further longs in MATIC price action. Even if the current support element fails, bulls are in a comfortable driving seat with two other bullish trend elements backing their corner.

MATIC price sees no reason for an end of the uptrend

Polygon price saw this week the topside being respected again, with bulls unable to break above and break the bearish element standing in their way from further upside. Instead, MATIC price corrected further to the downside and made a new low for November around $1.51. Bulls did not sit quietly in a corner scared for what's to come but instead bought in again with the buy-side volume elevated.

MATIC price sees proof of this by-side explosion in the Relative Strength Index (RSI) that is still quite elevated, even when MATIC price made a new low for the month. This shows bulls being very present and picking up MATIC around the 55-day Simple Moving Average (SMA). If that would not do the trick, bulls have the 200-day SMA, the green ascending trend line originating from July and backbone of this uptrend and last but not least, the monthly S1 support level between $1.30 and $1.25.

MATIC/USD weekly chart

With the bulls' presence growing further by the day, expect a breakout anytime soon, with first the break of the red descending trend line that would wash out quite a lot of bears in the process. Following resistance, MATIC bulls would face between $2.1 and $2.5. Certainly, that last one falls in line with the monthly R1 resistance level and would prove to be a tough one to crack. Once through there, MATIC price could rally by 100% and target $3.00 in the process.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.