LUNA price moves sideways, flaunting crucial buy signal

- LUNA price is at an inflection point and ready to climb to $2.60.

- Terra announces plans to develop dashboards for curated data and analytics.

- If LUNA price fails to break above a key descending trendline, trading will range between $2.00 and $2.20.

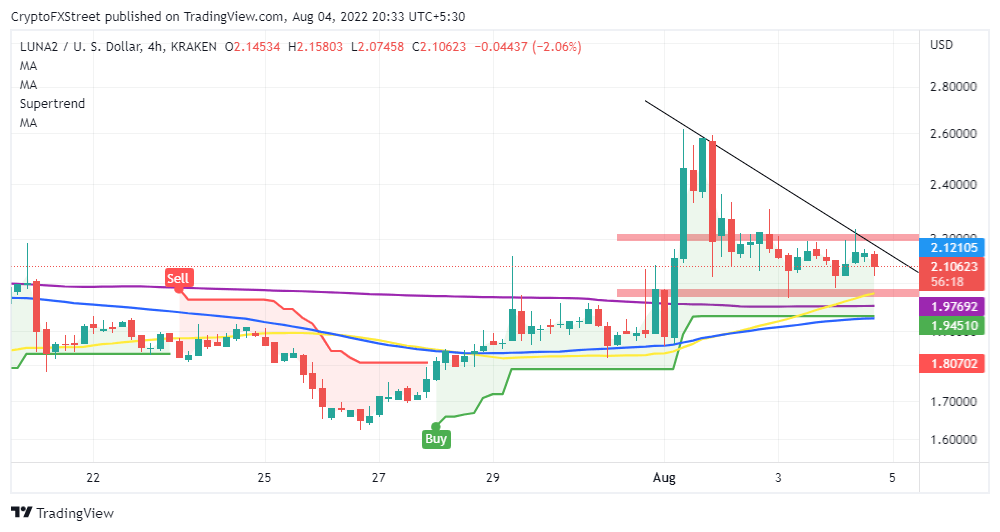

LUNA price ranges between a rock and a hand place following its rejection from $2.60. The token’s immediate upside is capped by immense seller congestion at $2.20, while on the downside, LUNA price sits on solid support established at $2.00. In the meantime, a buy signal presented on July 28 hints at a bullish breakout north of the current market price of $2.15.

Terra to build curated data and analytics dashboards

Terra 2.0, the blockchain-powered by LUNA, announced via Twitter on Wednesday that it intends to develop curated data and analytics dashboards through a platform called MetricsDAO. Educational content and token bounty programs – which allow entrepreneurs to collect funds from investors to launch new coins – will also feature on the consoles.

A blog post published by MetricsDAO illuminated that Terra 2.0 is at a crucial phase of maturity and growth and needs to foster on-chain transparency, touching on analytics and user acquisition. The dashboards will allow Terra’s blockchain to be queried by developers and analysts.

MetricsDAO is tasked with curating the data and availing it on Flipside Crypto, a platform offering an SQL query editor, API, visualization studio and SDK – all free for all users.

Some expected results from this development are access to free and open data, curated educational content, community accountability, bounty rewards and marketing materials.

Although LUNA price may appear stuck in a narrow range, the development team is taking steps to repair the network’s outward image. If these efforts bear fruit, LUNA price will gain momentum while riding on renewed investor interest.

LUNA Price Buy Signal Holds

The Super Trend indicator flipped green on July 28 after sending a buy signal. Traders who heeded the call bagged quick gains when LUNA price spiked from $1.75 to $2.60.

Now LUNA price is expected to return to the same highs by building on the momentum indicated by the Super Trend indicator. A break above the descending trend line will affirm the bulls’ influence, leading to gains up to $2.60.

LUNA/USD four-hour chart

Whereas things may look positive for LUNA price, traders should consider taking profits at $2.40. All factors considered, the bear market is still on. On the downside, slicing through the 50-day SMA support at $2.00 could see LUNA price plunge to $1.75 and $1.65, respectively.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren