Terra's LUNA price finally shows the buy signal you've been waiting for pt.2

- Terra's Luna price consolidates under low volume signaling hodlers in the market.

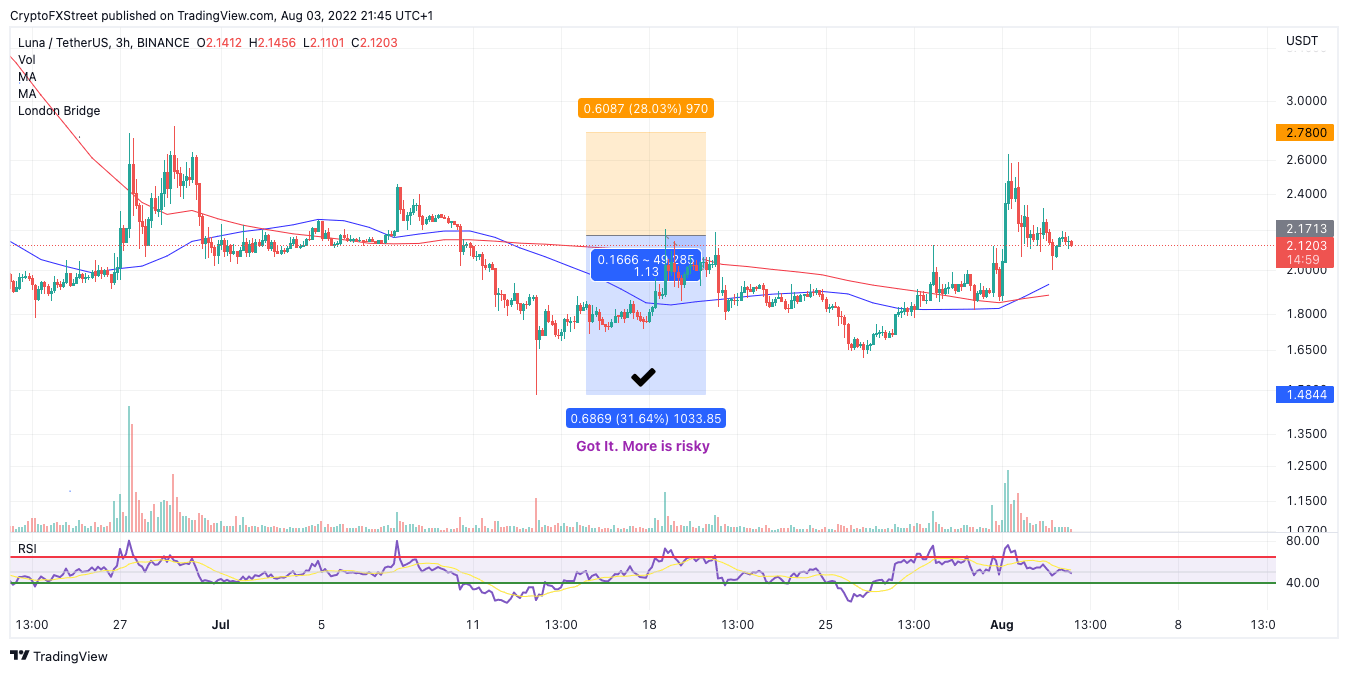

- LUNA price targets a $2.78 liquidity level from a previous bearish trade setup

- the uptrend scenario depends on $1.61 holding as support.

Terra's LUNA price points to a liquiidty hunt in the coming days. Key levels of interest have been outlined below.

Terra's LUNA price wants money left on the table

Terra's LUNA price could begin a charge towards $2.70 liquidity levels. FXStreet subscribers may recall the liquidity zone as it was successfully utilized in a bearish trade idea forecasted on July 6. The recent impulsive technicals suggest market markets are coming back for money left on the table

LUNA price currently auctions at 2.12 as the bulls have managed to breach the $2.00 resistance zone and are testing it as support. For traders looking to take a risk, the trade is justifiable. An additional rally towards $2.78 stands a high chance. The Volume Profile Indicator confounds the bullish stance as the current profit-taking consolidation occurs under relatively low volume. The indicator subtly implies that hodlers are in the market aiming to take profit at higher targets.

Invalidation of the uptrend must be the origin point of the first impulse currently positioned at $1.61. This sets up a 1.35-1 reward-to-risk trade setup for bulls looking to enter the market. Keep in mind that a breach of the invalidation level would jeopardize the entire uptrend scenario. Consequently, the bears could send the LUNA price as low as $1.10, resulting in a 50% decrease from the current market value.

In the following video, our analysts deep dive into the price action of LUNA, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.