Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

- Litecoin price briefly touched the $105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during the market crash on December 20.

- Litecoin miners held reserve balances steady in the last three days after offloading 210,000 LTC between December 15 and December 20.

- Litecoin’s Volume Delta technical indicator flipped into positive values, signalling an increase in buying momentum.

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Litecoin snaps 22% rebound to retake $100 territory

Hawkish United States (US) Federal Reserve (Fed) statements triggered a massive crypto market downturn last week, sending the likes of Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC) into double digit-losses.

But as the dust settled over the weekend, strategic crypto traders capitalized on the falling prices to enter new positions.

While BTC and ETH retook key resistance levels at $96,000 and $3,300 respectively, LTC price has also shown early signs of an impending bullish reversal.

The LTCUSDT daily chart above shows how Litecoin price fell to the monthly time frame low of $87 on December 20.

However, bull traders buying the dip dominated the LTC markets over the weekend, driving up prices 22% to briefly reclaim $105 in the early hours of Monday.

Litecoin miners halt $200 million selling spree

Amid last week’s market crash, Litecoin emerged as one of the biggest losers, declining 34% between December 17 and December 20.

On-chain data shows panicking miners also contributed to the accelerated LTC price decline, selling off large quantities of their reserves amid the market sell-off.

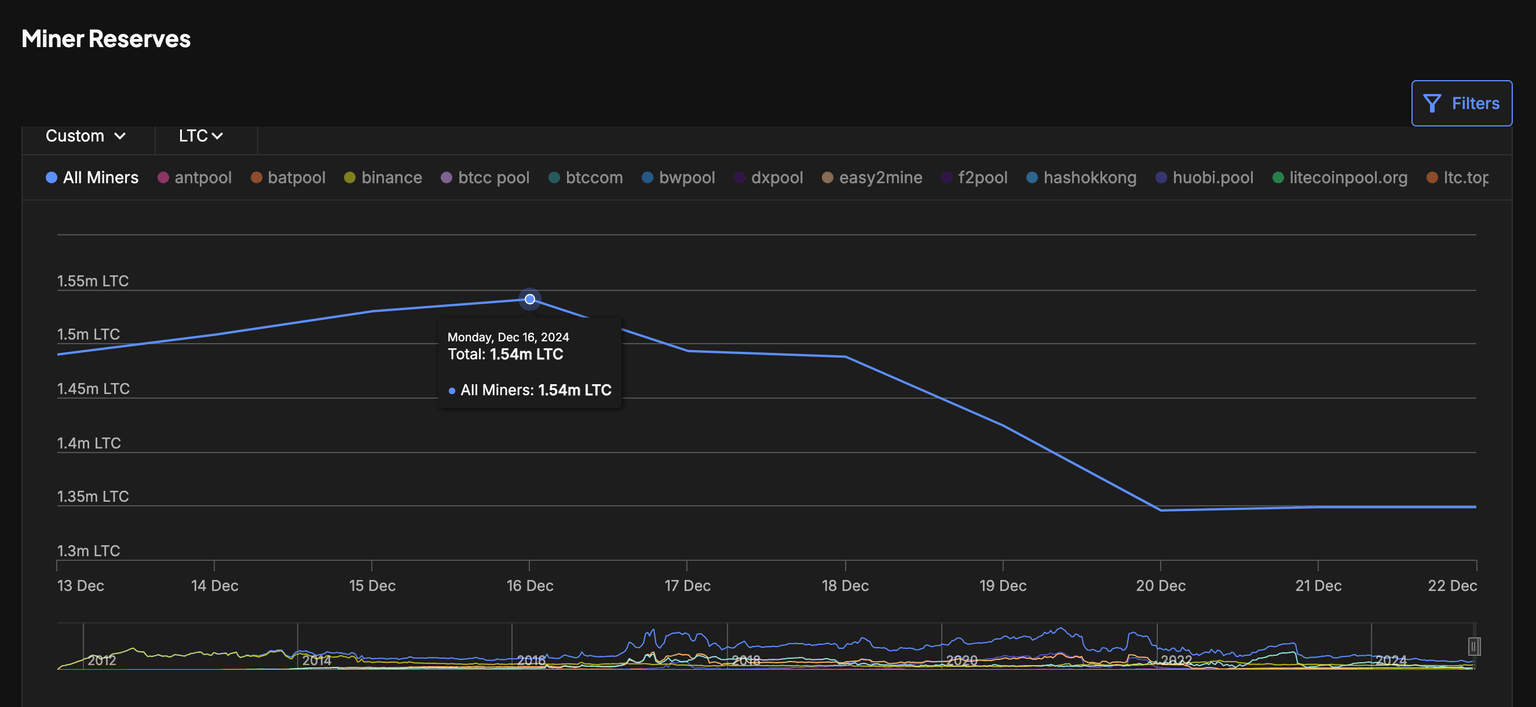

Affirming this stance, IntoTheBlock’s miner reserve chart below monitors real-time changes in miners' trading activity around key market events.

Between December 16 and December 20, Litecoin miners sold off a significant 210,000 LTC, reducing their reserve balances from 1.54 million to 1.35 million LTC.

This reflected panic among miners, likely triggered by the US Fed’s hawkish statement during that period.

However, in the three days that followed, miners stabilized their holdings at 1.35 million LTC, indicating an end to the initial wave of panic-driven selling.

When miners stop selling during a market downturn, fewer newly minted coins flow into the short-term market supply.

This reduction in selling pressure, coupled with miners holding onto their reserves, creates favorable conditions for a price rebound.

Litecoin price forecast: $115 resistance looming large

Litecoin price has reclaimed the $103 level after a 22% surge, but challenges loom ahead.

The Donchian Channels indicate that LTC remains below the upper boundary at $116.88, which aligns with a key resistance level.

If bullish momentum falters near this threshold, it could trigger a retracement as sellers re-enter the market.

While the Volume Delta has flipped positive, signaling an uptick in demand, the lack of sustained volume growth raises concerns about the rally's strength.

Without consistent buying pressure, LTC could struggle to break above the $115 resistance convincingly.

On the downside, the first support level lies at the lower Donchian Channel boundary of $86.69.

A breach of this level could expose LTC to further losses toward the psychological $80 mark.

The bearish scenario would likely materialize if market sentiment deteriorates or if miners resume selling pressure, increasing short-term supply.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.