Litecoin Price Prediction: A $10 dollar token by 2023

- Litecoin price shows bearish macro signals that investors should be aware of.

- LTC price has breached over-sold territories on the Weekly Relative Strength Index

- Invalidation of the bearish thesis is a re-concurrence of the $140 barrier.

Litecoin price shows a potential macro-sell off underway. On-chain analysis additionally confounds the idea of a macro bearish environment.

Litecoin price in a Grand-Super-Cycle decline

Litecoin price shows concerning technicals that investors should be aware of. Although the digital-silver-to-bitcoin’s-gold token has witnessed a recent 50% rally since the $40 low that occurred during the June 18 sell-off, the LTC price shows a potential grand super cycle decline underway.

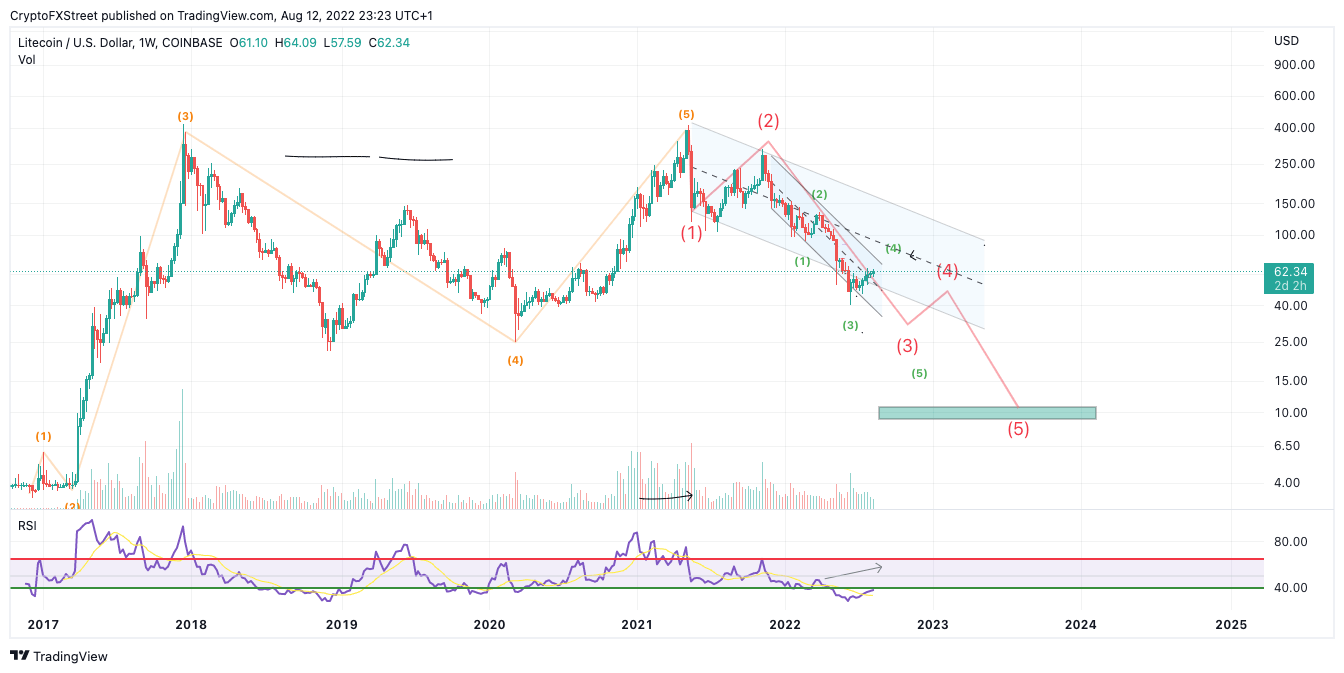

Litecoin price currently auctions at 62.30. From a macro perspective, Litecoin price has printed a clever 5-wave impulse move up from 2017 lows at $3.00 into the May 2021 highs at $413.91. Since the mid-$400 highs were printed, LTC price has fallen sharply with an uptick in bearish volume. The current 50% rally underway is ongoing with relatively less volume than the previous sell-offs.

The Relative Strength Index show the LTC price as oversold on the weekly level, which could lure countertrend traders and investors into buying. An Elliot Wave trend channel marked surrounding wave 1, and wave 2 confounds the idea of an unfolding wave 3 pattern. The $40 low during June definitively closed below the trend channel and can consequently be viewed as wave 3 of a smaller degree. When combined, Litecoin price shows very concerning signals for long-term investors and countertrend traders.

LTC/USDT 1-Week Chart (Possible Count & Trajectory)

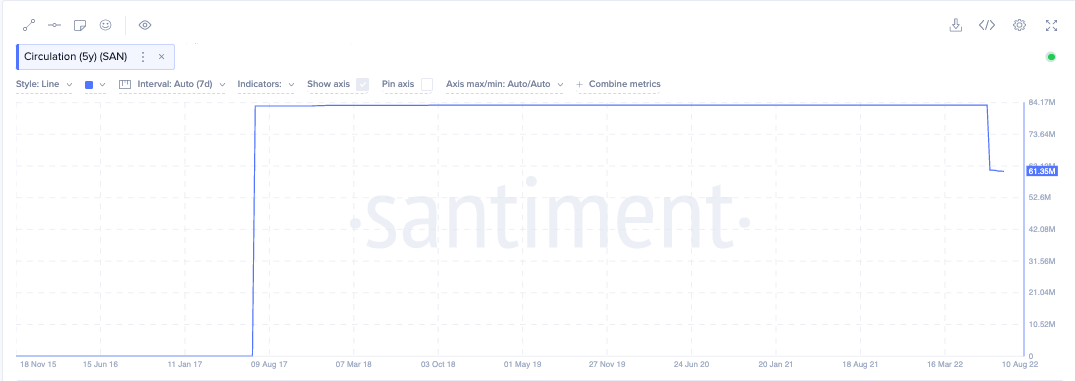

Sentiments 5 Year Circulation Indicator shows the cherry on top of the free-falling cake for the Litecoin price. According to the Indicator, more than 80 percent of the Total Circulating Supply remains in active circulation throughout the last five years. In theory, the indicator translates multiple whales in the market, Influencing the price, with a lack of interest in locking away the Litecoin tokens for extended periods of time. Quite frankly, Litecoin price may be a scalper’s delight amongst highly leveraged and institutional-large-cap market markers.

Santiment 5-Year Circulation Indicator

Unfortunately, Litecoin price may be too susceptible to smart money manipulation to make promising 10x crypto-like returns in the near future. If the technicals are correct, the Litecoin price could plummet to $10 as early as 2023.

Lastly, it is essential for investors to keep an invalidation point in mind as markets can always evolve and change. If Litecoin price can breach the $140 barrier, this bearish macro thesis will be void. A potential rally towards $5,000 will be in the cards resulting in an 8,000% increase from the current Litecoin price.

In the following video, our analysts deep dive into the price action of Litecoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.