Bitcoin Price Prediction: Is it time for the big short?

- Bitcoin price meets a suppressive force near the $24,000 level.

- BTC price shows significant movement in daily transactions, hinting that large players are up to something behind the scenes.

- Invalidation of the uptrend is a daily closing candle below $23,149.

Bitcoin price shows conerning signals behind the scenes. Technichal and On-chain analysis is utilized to gage market behaviour.

Bitcoin price is at a fork in the road

Bitcoin price has shown an applaudable price performance in the last few weeks. The peer-to-peer digital currency has propelled towards a weekly high at $ 24,921 since witnessing a low at 17,592 just two months earlier in July. Despite the 40% rally, the trajectory has not been a smooth sailing ship. Several technical indicators and onchain analysis tools confound the idea of a weakening trend.

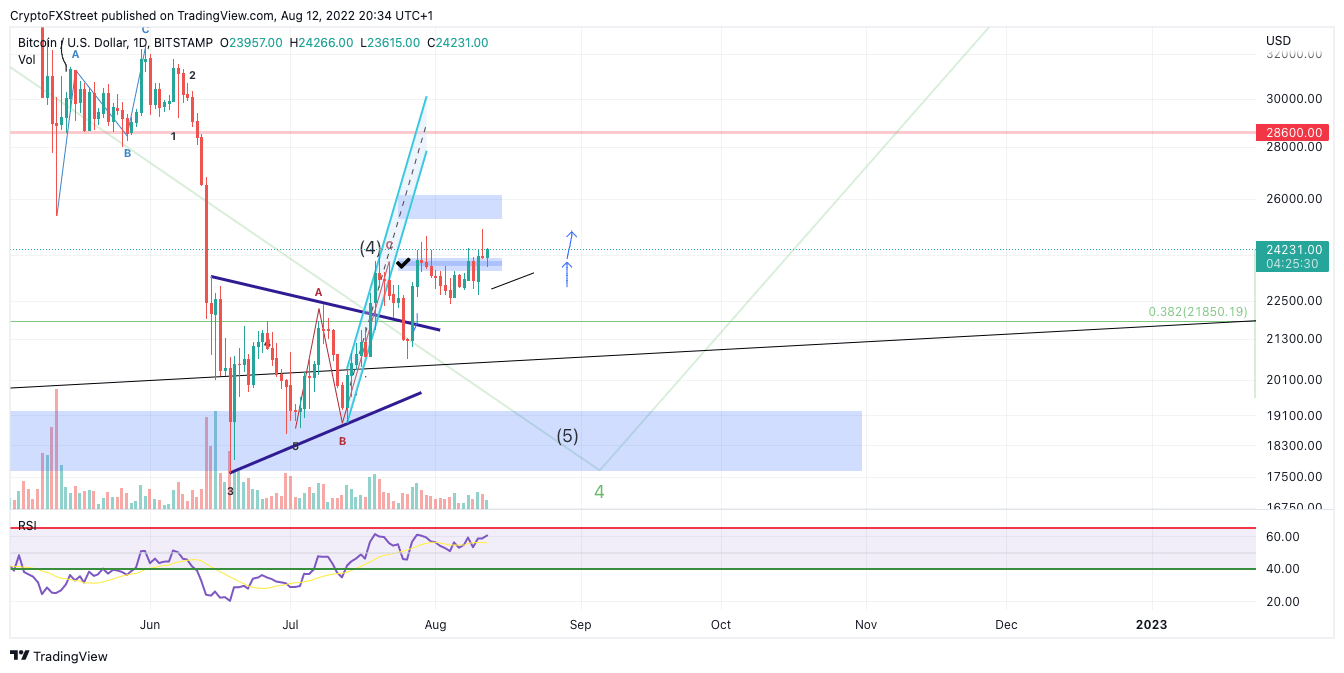

Bitcoin price currently auctions at $24,238. A profit-taking consolidation unfolds near last week’s forecasted target of $24,600. The Relative Strength Index shows classic bearish divergence, while the volume profile indicator shows a lack of interest from large capital players.

BTC/USDT 1-Day Chart

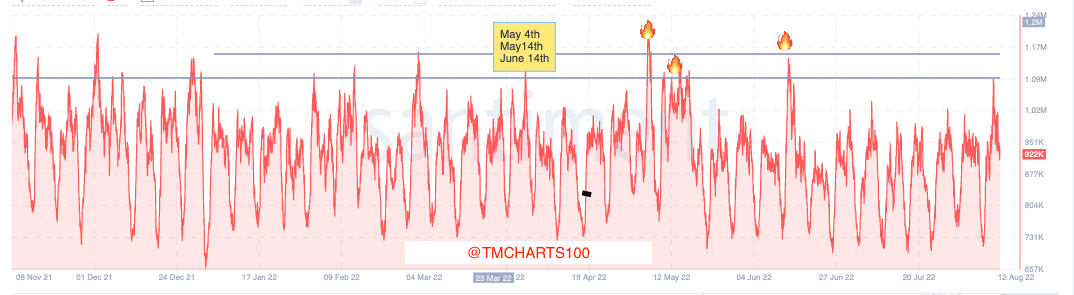

Additionally, Santiment’s Active Transactions Indicator BTC price has shown a considerable uptick in daily transactions. On May 4, May 14, and June 24, the indicator showed a similar sporadic upswing, each time followed by a minimum 20% plummet in the Bitcoin price shortly after.

Santiment Active Transactions 1-Hour Scale

Bitcoin price could still rally higher towards $26,800, but early evidence of the downtrend scenario will be a daily close below $23,149. If the bears can produce said price action, they may be able to induce a sellers’ frenzy targeting $18,500, resulting in up to a 20% decline from the current Bitcoin price.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.