Litecoin Market Update: LTC/USD bears take price below $58

- LTC/USD bears have retained control for the second straight day.

- Pornhub will now accept payments in BTC and LTC for its premium services.

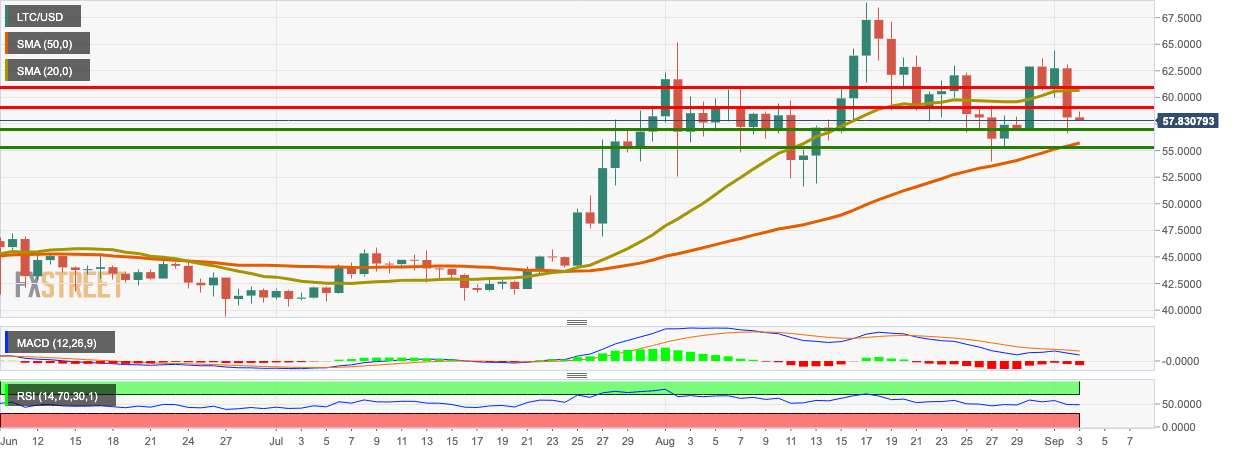

LTC/USD daily chart

LTC/USD bears have stayed in control for the second straight day, going down from $58.12 to $57.95. The MACD shows increasing bearish momentum, while the RSI is trending around the neutral zone. LTC/USD has strong resistance at $59.09 and $60.75 (SMA 20). On the downside, we have a couple of healthy support levels at $57.12 and $55.25 (SMA 50).

Litecoin comes to Pornhub

Pornhub has recently announced that the platform now accepts Bitcoin (BTC) and Litecoin (LTC) as payment for its premium services. The firm started accepting Verge back in 2018 and later added other cryptocurrencies as well. However, this is the first time the company has added globally-known assets.

Pornhub’s vice president Corey Price said:

As a leader in adult content with over 130 million visitors per day, Pornhub is excited to now offer two widely-used and leading digital currencies for our users. Our team continues to pave the way for tech development, testing and implementing new technology for everyday consumers far ahead of the mainstream market.

Pornhub was founded in Canada in 2007. With three billion monthly visitors, it is currently the world’s ninth most popular website. Several cypherpunks believed that porn would be an early adopter of digital currencies. In 2010, Satoshi Nakamoto had said that Bitcoin would be a convenient and secure payment option for people who do not have a credit card or do not wish to use one for pornography-related transactions.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.