Litecoin breaks below the 64.35

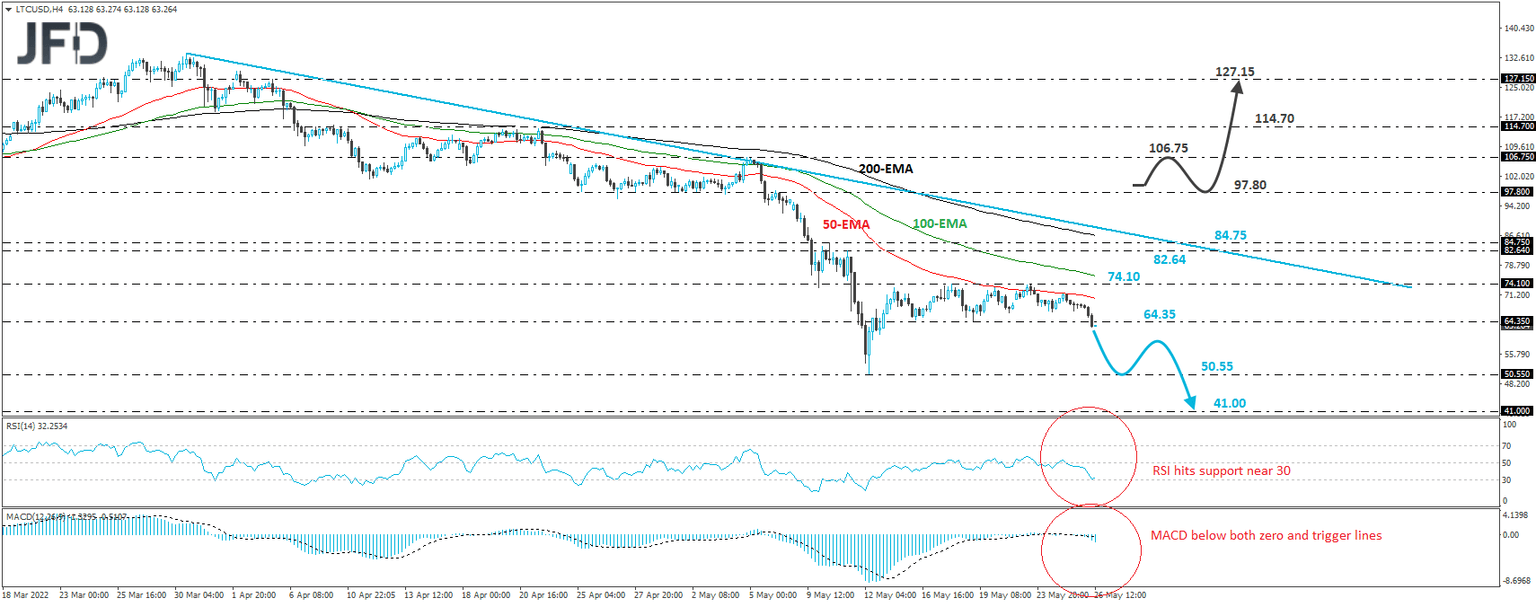

LTC/USD traded lower today, breaking below the 64.35 barrier, marked by the lows of May 16th and 19th. The crypto has been oscillating between that barrier and the 74.10 zone since May 13th, but in the bigger picture, all this was happening below the downside line taken from the high of March 30th. Thus, the break below the lower end of the short-term range, combined with the intact downside line, paints a negative short-term picture.

In our view, the dip below 64.35 may have opened the path towards the low of May 12th, at around 50.55, the break of which would confirm a forthcoming lower low in bigger timeframes and perhaps extend the decline towards the 41.00 zone, marked by the low of September 21st, 2020.

Shifting attention to our short-term oscillators, we see that the RSI moved lower and hit its 30 line, while the MACD lies below both its zero and trigger lines, pointing down. Both indicators detect strong downside speed and support the notion for further declines in this cryptocurrency.

In order to abandon the bearish case, we would like to see a clear break above 97.80. The crypto will be above the downside line taken from the high of March 30th, which may invite many more bulls into the action. The next stop may be the 106.75 barrier, marked by the high of May 5th, the break of which could extend the advance towards the high of April 21st, at 114.70. Another break, above 114.70, could carry extensions towards the 127.15 zone, defined as a resistance by the high of April 5th.

Author

JFD Team

JFD