Last bear market rally for Bitcoin price is here, and this is where it is capped

- Bitcoin price shows a bear market rally might be cooking on a four-hour chart.

- A breakout above $16,600 will confirm a bullish move to June lows at $17,593.

- Invalidation of this optimistic outlook will occur if the $16,000 psychological level is broken.

Bitcoin price is in a tight consolidative range, vying to breakout. But due to the nature of the market sentiment, investors should not expect a bold and sustained move for BTC until the start of a new week.

Also read: Bitcoin Weekly Forecast: Assessing chances of one last bear market rally for 2022

Bitcoin price reveals a potential bullish outlook

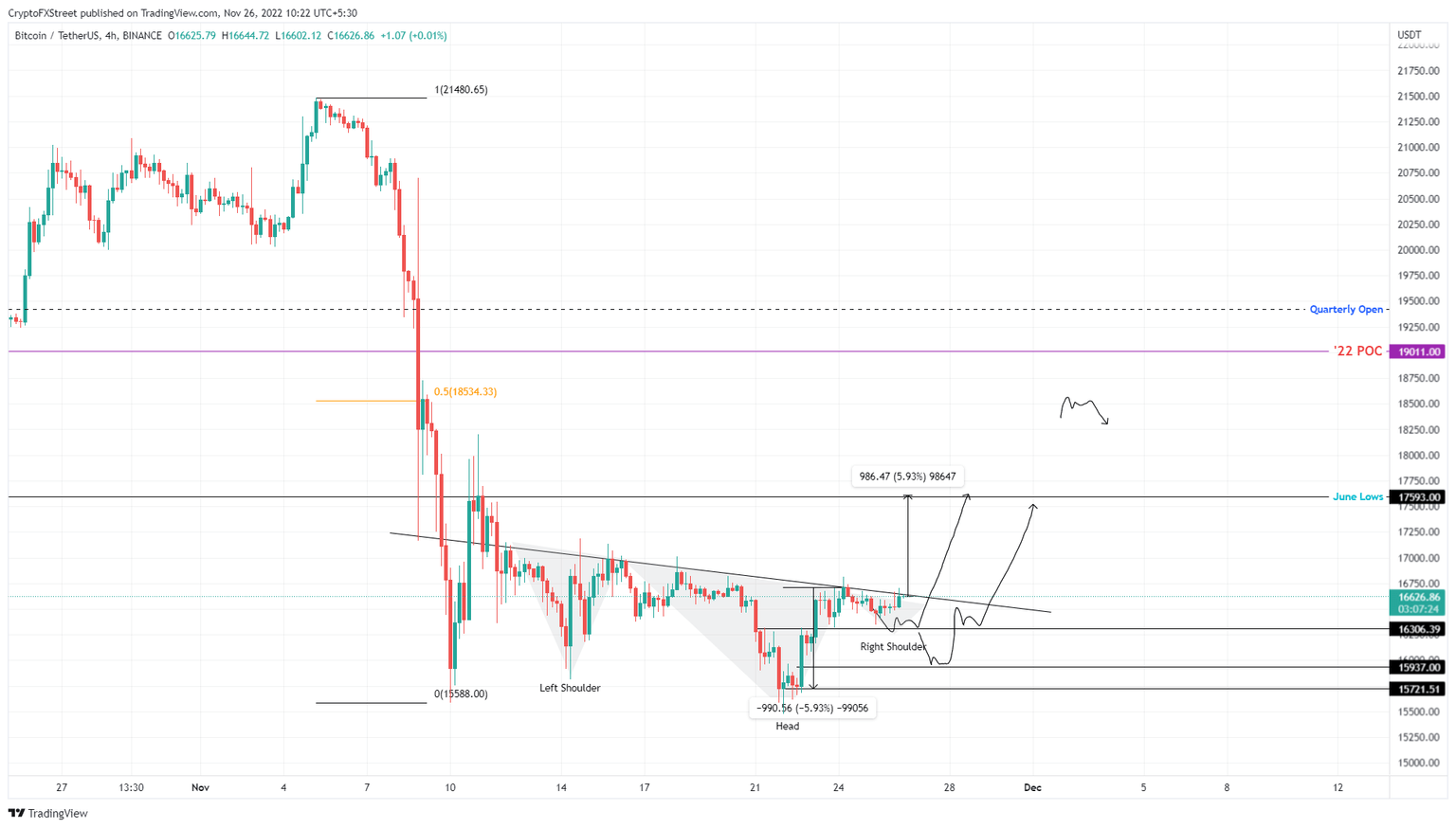

Bitcoin price has formed an inverse head-and-shoulders setup on the four-hour chart. This bottom reversal pattern contains three valleys, with the central one, known as the head, deeper than the other two. The valleys on either side of the head are termed shoulders, hence the namesake.

The 6% move forecasted by this technical formation is obtained by measuring the distance between the right shoulder and the head’s lowest point and adding it to the breakout point at $16,630. Doing so reveals the target at $17,593, coinciding with the June 18 lows.

Hence, this confluence is a strong level to book profit for Bitcoin price traders. It should be noted that BTC is yet to produce a four-hour candlestick close above the neckline at $16,330 to kick-start this inverse head-and-shoulders forecast.

While this bullish outlook is plausible, a flip of the $17,593 hurdle will open the path for Bitcoin price to retest $19,011, the highest traded volume level in 2022. Due to the nature of this blockade, 2022's last bear market rally for BTC is capped at $19,011.

BTC/USDT 1-day chart

On the other hand, if Bitcoin price slides below the $16,000 psychological level and fails to recover, it will indicate a lack of bullish momentum. This move would allow sellers to take control and knock BTC to retest the $15,721 support level. Here, buyers can band together and attempt another recovery rally.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.