Is this a buy signal for Shiba Inu price or month-end volatility?

- Shiba Inu price shows an attempt to recover lost ground and revisit recent levels.

- Investors can expect SHIB to rally anywhere between 15% to 33% based on bullish momentum.

- A six-hour candlestick close below $0.0000071 will invalidate the bullish thesis.

Shiba Inu price embarked on a massive uptrend after bottoming on June 19. However, the ascent faced issues and headwinds, leading to an eventual retracement. After a brief period of consolidation, SHIB bulls seem tready for another leg-up.

Shiba Inu price anticipates upswings

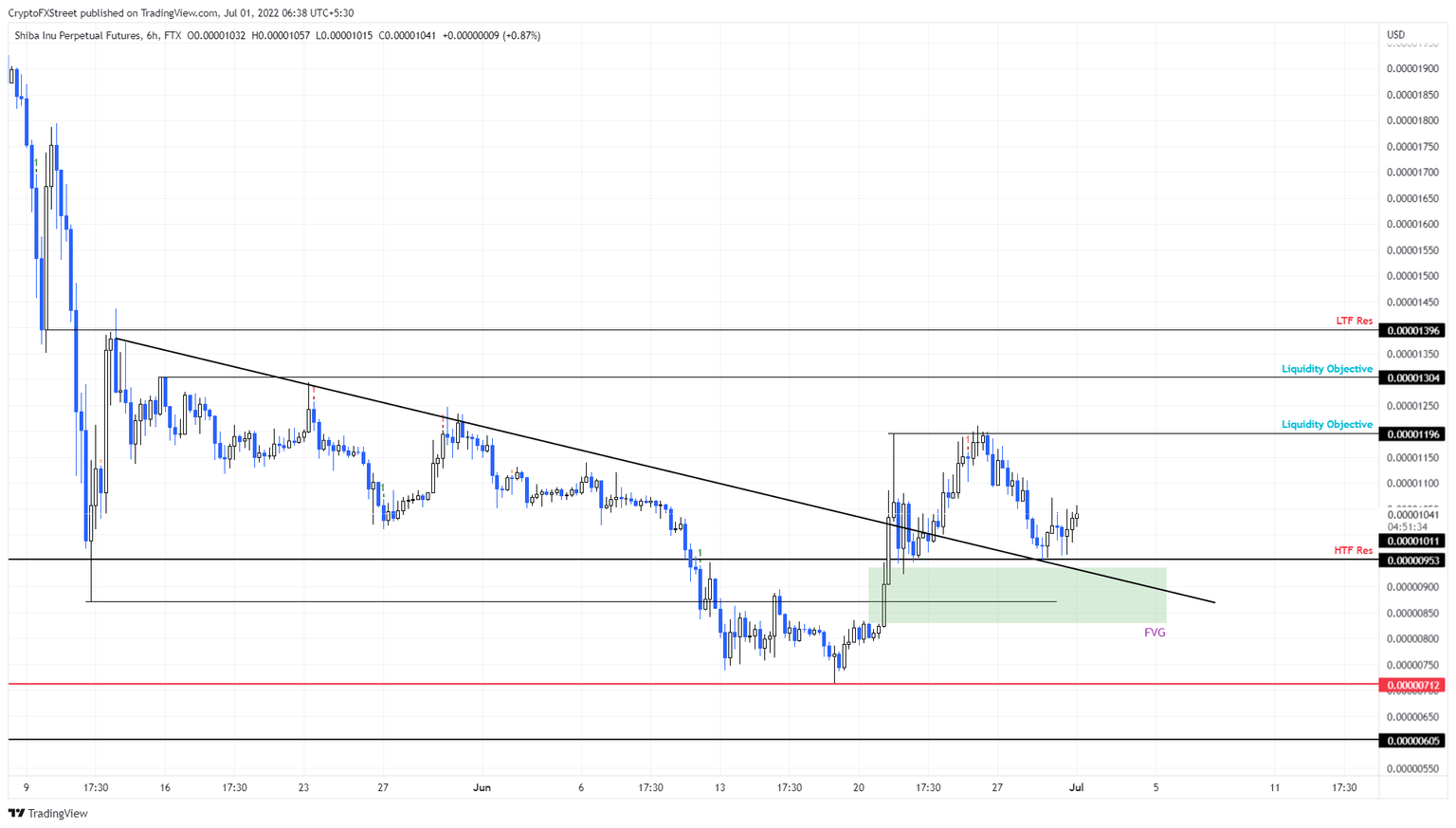

Shiba Inu price rallied 50% between June 20 and June 21, flipping the high-time-frame resistance barrier at $0.0000095 into a support floor. Interestingly, this run-up also converted the declining trend line into a support floor. After a swift retracement followed by a consolidation, SHIB triggered another 30% leg-up that set a swing high at $0.0000121.

However, the lack of momentum and worsening market conditions led to a 21% pullback to retest the aforementioned support barrier at $0.0000095 and the declining trend line. SHIB buyers seem to have made a comeback, which has resulted in a 11% move so far.

If this trend continues, Shiba Inu price could rally 15% from the current position to retest its first liquidity objective at $0.0000119. Beyond this level, the meme coin could revisit the $0.0000130 barrier after a 25% gain.

However, the rally would constitute a 33% upswing if Shiba Inu price can retest the $0.0000139 hurdle, which is where the short-term local top could form.

SHIB/USDT 4-hour chart

Regardless of the bullish outlook in the market, investors need to note that this could just be month-end volatility. During the monthly or weekly closes, the market tends to be more volatile than usual, causing investors to get caught off guard in squeezes. Moreover, Shiba Inu price has a Fair Value Gap (FVG), extending from $0.0000082 to $0.000093, which could be filled if market makers start to sell.

If this situation escalates and investors begin to book profits, pushing Shiba Inu price to produce a six-hour candlestick close below $0.0000071, it will create a lower low and invalidate the bullish thesis.

This development could see SHIB crash 15% to the next support level at $0.0000060.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.