Why this move from Shiba Inu price could catch investors off guard?

- Shiba Inu price shows that a minor bounce to $0.0000104 seems likely before triggering a downtrend.

- A rejection at the aforementioned level could result in a 20% pullback that fills the FVG extending up to $0.0000082.

- A four-hour candlestick close above $0.0000119 will invalidate the bearish outlook for SHIB.

Shiba Inu price prepares for a quick retracement after nearly a week of recovery bounce. While this run-up was impressive, things are likely going to go slow for SHIB as investors continue to book profits.

Shiba Inu price at a decisive moment

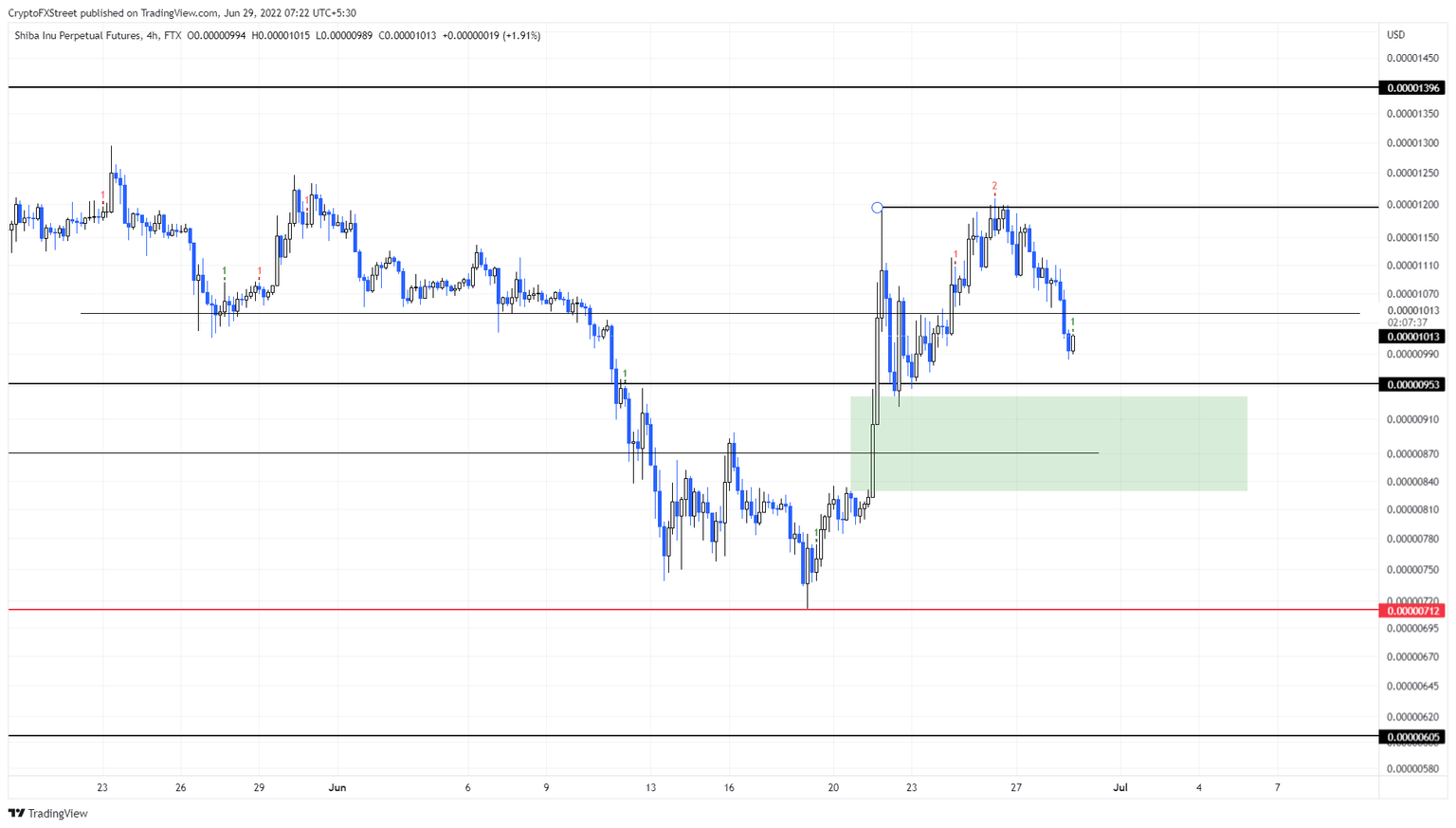

Shiba Inu price rallied 70% between June 19 and June 26, which showed that the buyers were optimistic around mid-June. The impressive recovery bounce set a swing high at $0.0000121 but failed to close above the June 21 swing high at $0.0000119, denoting a weakness.

Since this point, Shiba Inu price has dropped 18%. As a result, the Momentum Reversal Indicator (MRI) has flashed a green ‘one’ buy signal on the four-hour chart. This technical indicator forecasts a one-to-four green candlestick upswing for SHIB.

However, since this signal has appeared on a lower time frame, it is unstable. Regardless, a minor uptick in buying pressure could push SHIB to retest the $0.0000104 hurdle. A rejection here is key and could trigger the next leg-down.

Such a development could see Shiba Inu price drop lower and retest the $0.0000095 support level. This barrier can obstruct the bears’ view, but a breakdown seems obvious so that the fair value gap (FVG) aka the price inefficiency, extending from $0.000093 to $0.0000082 is filled.

In total, this downswing could constitute a 20% descent from $0.0000104.

SHIB/USDT 4-hour chart

While things might seem bearish at first glance, investors need to note that a higher high above the recent swing high could indicate the presence of buyers and keep bears at bay. If Shiba Inu price produces a four-hour candlestick close above $0.0000119, it will invalidate the bearish outlook.

In such a case, Shiba Inu price could continue its ascent to $0.0000139, which would constitute a 16% ascent from $0.0000196.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.