Is the 2023 crypto rally a bull trap or prelude to alt season?

- Bitcoin liquidity is stacked at the $29,000 level, experts caution traders to trade without bias and watch for a pullback or correction in BTC.

- Altcoins are finding support on April 3, traders closely watch Bitcoin’s price for likely liquidity grab at $28,990, fueling alt season narrative.

- Analysts watch ARB, MAGIC and Ethereum Layer 2 for gains in the alt season.

Experts examine Bitcoin's liquidation levels for signs to determine when the alt season price rally could kick in. Altcoins wiped out all gains from the past week, before starting a recovery on the daily price chart.

Analysts remain bullish on alt season narrative, list top picks from blue chip altcoins and Ethereum Layer 2 tokens.

Also read: Major MEV event wipes out $25 million: How this affects Ethereum validators and ETH holders

Bitcoin liquidity stack at $29,000: What this means for alt season

One of the crypto liquidation experts CrypNeuvo speculated the possibility of Bitcoin run up to $29,000 before a pullback. The expert identified BTC liquidity stacked at the $29,000 level where there is a series of “stop loss” set up by traders. The analyst supports his theory of a “bull trap” with an imbalance on the one-hour time frame at $29,000.

CrypNeuvo is convinced of a pullback after Bitcoin’s run up to $29,000, based on the liquidation levels heatmap.

Bitcoin liquidation levels heatmap

While Bitcoin yielded massive gains since the beginning of 2023, emerging as one of the highest performing assets, this is likely to end soon.

Kyledoops, a YouTuber at Crypto Banter uses CrypNeuvo’s thesis to support the alt season narrative. When Bitcoin completes the “correction” or pull back, it is likely to fuel capital rotation in altcoins, as seen typically in previous alt seasons.

Altcoins are finding support, steadying before alt season kicks in

Altcoins wiped out their gains over the weekend with the exception of few in the top 30 assets by market capitalization. In his latest YouTube live stream, Kyledoops noted that altcoins have started their recovery against Bitcoin, gearing up for alt season.

Analysts are closely watching Bitcoin’s price chart and key resistance levels for signs of the alt season.

Altcoins to watch: ARB, MAGIC, Ethereum Layer 2 coins

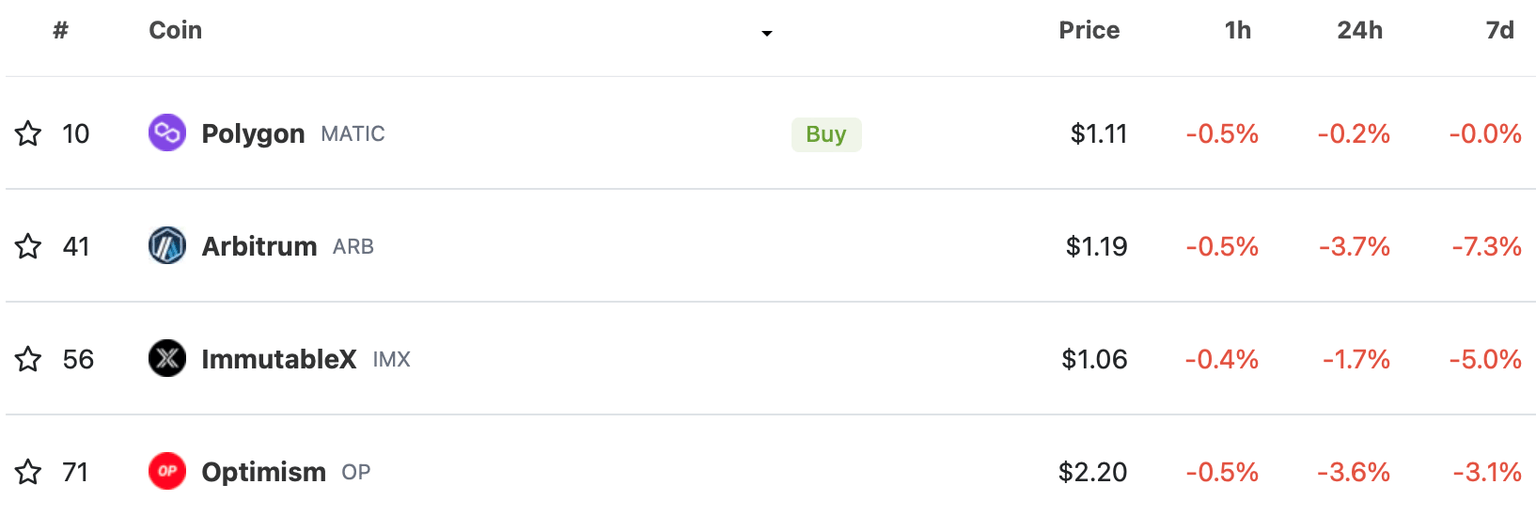

In addition to blue chip altcoin projects ImmutableX (IMX), Polygon (MATIC), Avalanche (AVAX), analysts are closely monitoring Arbitrum (ARB), Magic (MAGIC) and Layer 2 coins for gains this alt season.

Among all narratives this cycle, the Ethereum Layer 2 narrative is heating up with the announcement of airdrops and rewards in the ecosystem. MATIC, ARB, Optimism (OP) and IMX are the most popular tokens in the Layer 2 ecosystem and these cryptocurrencies are likely to recover in the short-term. These tokens witnessed a rally in the past week before wiping out gains over the weekend.

Layer 2 coins

Despite the controversy surrounding ARB, there are wallet addresses on-chain, accumulating the token. A recovery in ARB is likely once the uncertainty surrounding the token settles. Hustle, a pseudonymous analyst on Crypto Banter, is bullish on ARB and MAGIC in the next phase of alt season.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.