Dogecoin bulls out to defend $0.075 support, will DOGE resume its uptrend?

- Dogecoin price witnesses pullback, drops close to key support level at $0.075.

- The meme coin rallied over the weekend, showing signs of decoupling from Bitcoin and the crypto market.

- Whales holding between 1 million and 10 million DOGE have continued their accumulation of the meme coin, buying the dip.

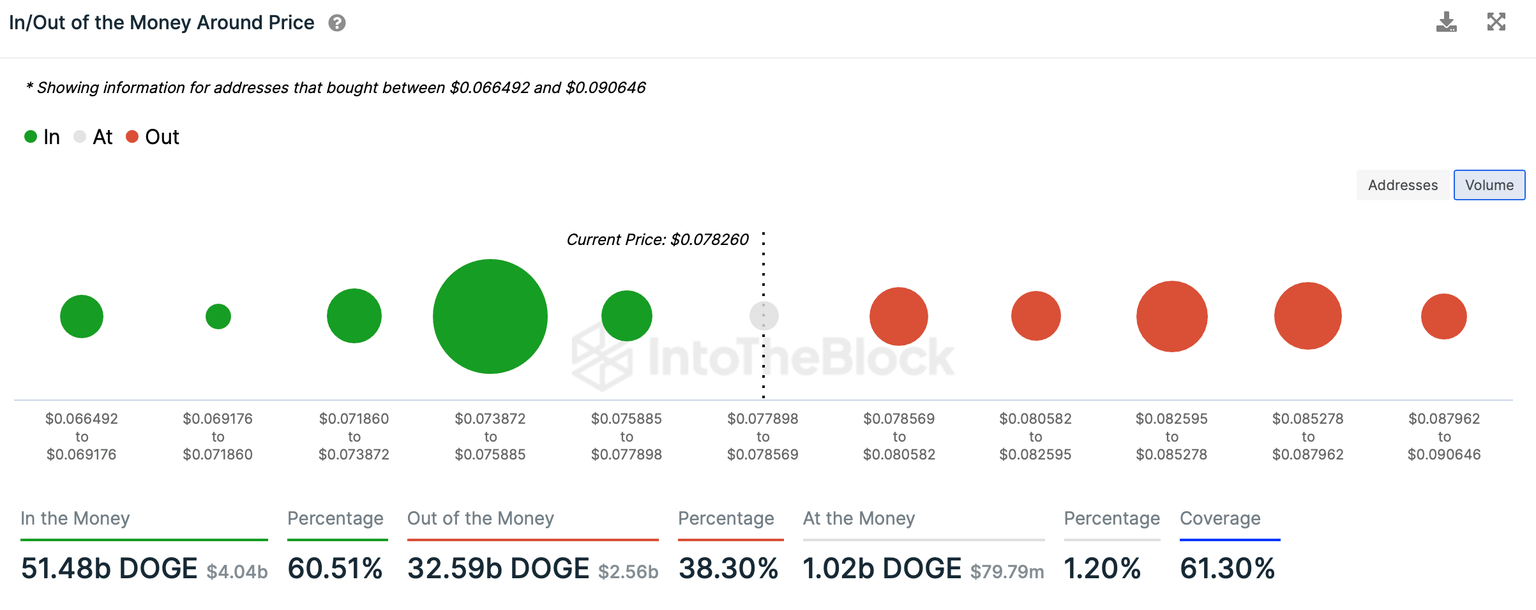

Dogecoin price went through a correction and nosedived close to support at $0.075, a crucial level for the meme coin. DOGE bulls need to defend this level as more than 42,000 wallet addresses accumulated the Shiba-Inu-themed cryptocurrency at or close to the $0.075 level.

Also read: Dogecoin whales are buying the dip: Will DOGE lead a meme coin price rally?

Will Dogecoin bulls defend $0.075 support and push DOGE higher?

Dogecoin price declined nearly 7% since April 2, wiping out its gains from the weekend. There is a key support zone between $0.075 and $0.077 that DOGE bulls need to defend to push the meme coin higher.

As seen in the chart from crypto intelligence tracker IntoTheBlock, over 4 billion DOGE was accumulated by nearly 42,000 wallet addresses.

DOGE key support at $0.075

Over the weekend the Dogecoin speculated the addition of DOGE as an accepted payment method at Burger King, with the mention of the meme coin’s ticker in the fast food chain’s UK account’s tweets.

The on-chain metric supporting Dogecoin’s price recovery and bullish thesis is on track.

Whale accumulation of DOGE

Based on data from Santiment, Dogecoin wallets holding between 1 million and 10 million DOGE have consistently added more tokens of the meme coin to their portfolio. Typically, Dogecoin notes cycles of accumulation and dump by large wallet investors.

%2520%5B13.16.05%2C%252003%2520Apr%2C%25202023%5D-638161050739429462.png&w=1536&q=95)

DOGE whale accumulation

Based on Santiment’s chart, DOGE is currently in the accumulation phase. Other bullish factors that support the meme coins recovery are Musk’s support for DOGE and the recent update on the $258 billion lawsuit. Find out more about it here.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.