Dogecoin emerges as worst performer among the top 50 cryptocurrencies, pushes alt-season farther away

- Dogecoin price declined by over 26% in the last season of 90 days, performing worst than the likes of Luna Classic and Huobi Token.

- The last altcoin season was observed back in August - September 2022, when Bitcoin price fell by 23% in three weeks.

- If DOGE falls any further below $0.067, the altcoin would become vulnerable to slipping to September 2022 lows.

Dogecoin has anchored the altcoins in terms of growth, as the meme coin itself has noted no growth over the last couple of months. The impact of this lack of rise on the market has been pretty significant when compared to the rest of the cryptocurrencies in the list.

Alt-season stands far away

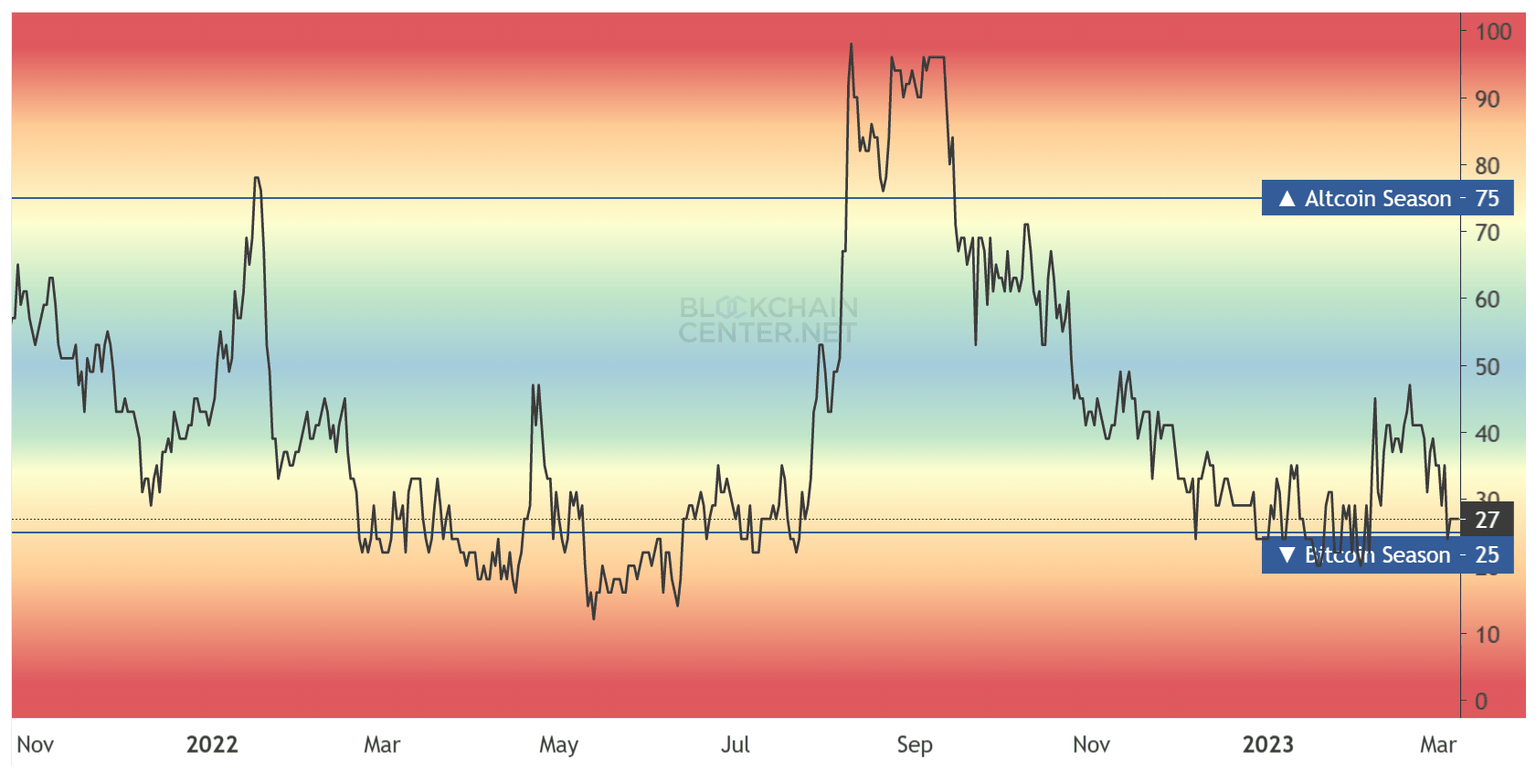

Alt-season, put simply, is considered to have arrived when 75% of the top 50 altcoins happen to perform better than Bitcoin. This performance is measured over the period of one season, which constitutes 90 days.

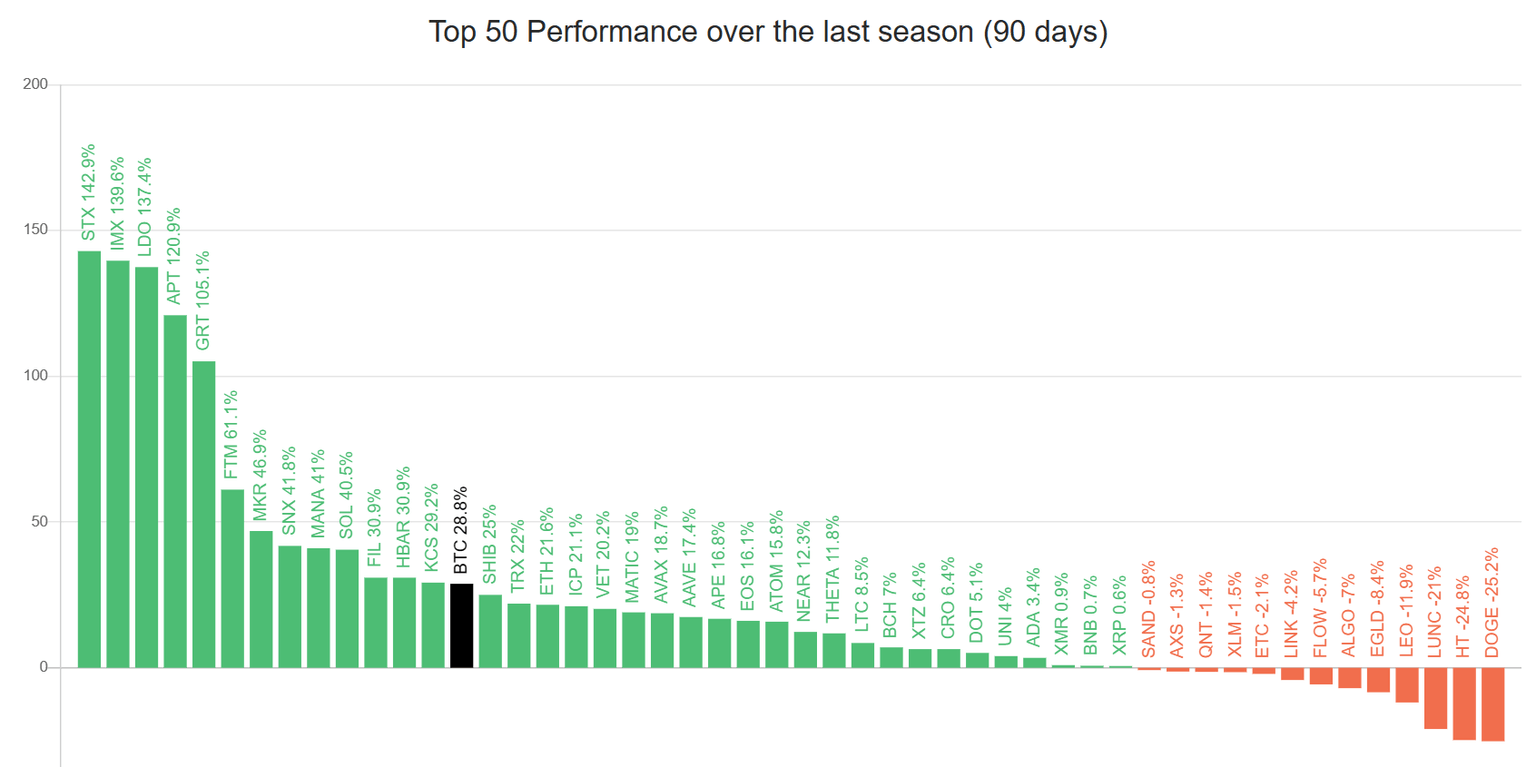

Although Bitcoin surpassed most of the altcoins on the list, a few of them ended up not only performing worse than Bitcoin but terribly in general. The leading cryptocurrency on that front is Dogecoin.

Alt-season index

Down by nearly 26% in the span of three months, Elon Musk’s favorite cryptocurrency has fallen behind the likes of Luna Classic (LUNC) and Huobi Token (HT). Both LUNC and HT declined by just 21% and 24%, respectively. This is despite LUNC being the token of a once-collapsed blockchain.

Performance of top 50 cryptocurrencies

With Dogecoin pulling the altcoins down, the crypto market has descended into experiencing a Bitcoin season at the moment. The last altcoin season was observed from August to September 2022, when BTC happened to decline by more than 23% in the span of three weeks.

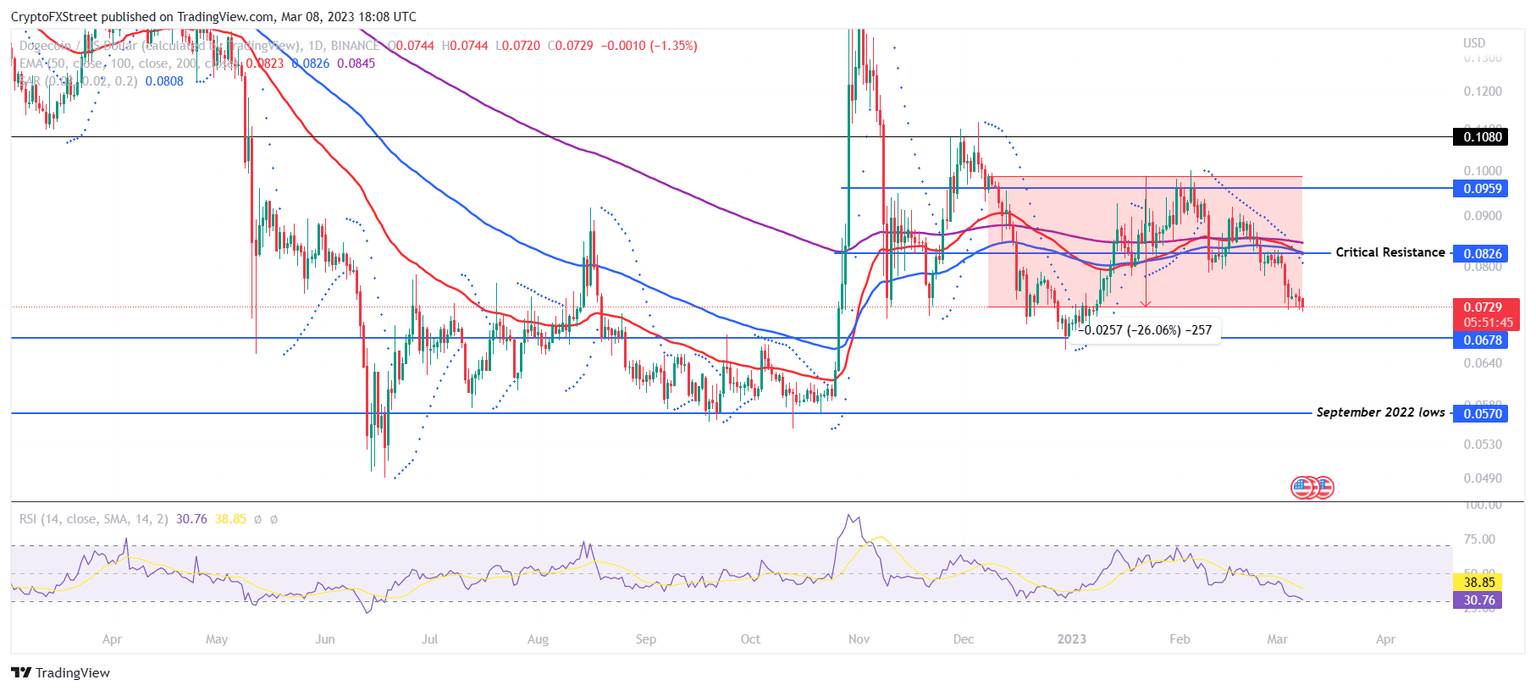

Where Dogecoin price stands right now

Dogecoin price can be seen trading at $0.072 at the time of writing. Despite having fallen about 25% over the last month, DOGE holds slightly above the 2023 opening price. Still, the meme coin is inching closer to the critical support level at $0.067, which also marks the year-to-date low.

If DOGE falls through this support level, it will become vulnerable to falling right away to $0.057. These lows were last witnessed by Dogecoin holders back in September 2022, and such a plunge would result in a 20% crash.

The chances of the same seem likely since main Exponential Moving Averages (EMA) are acting as resistance levels. The Parabolic Stop and Reverse (SAR) indicator is also highlighting an active downtrend, evinced by the presence of the blue dots above the candlesticks.

DOGE/USD 1-day chart

But the Relative Strength Index (RSI) is nearing the oversold zone below the 30.0 mark. This area is historically known to trigger a trend reversal, which might result in a recovery in the Dogecoin price.

However, in order to invalidate the bearish thesis, DOGE would need to rally by about 16% and breach the critical resistance at $0.082. This would allow the altcoin to eventually rise to the year-to-date highs of $0.095 and even tag the $0.100 mark.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.