Is Cardano’s Vasil hard fork a ‘sell the news’ event?

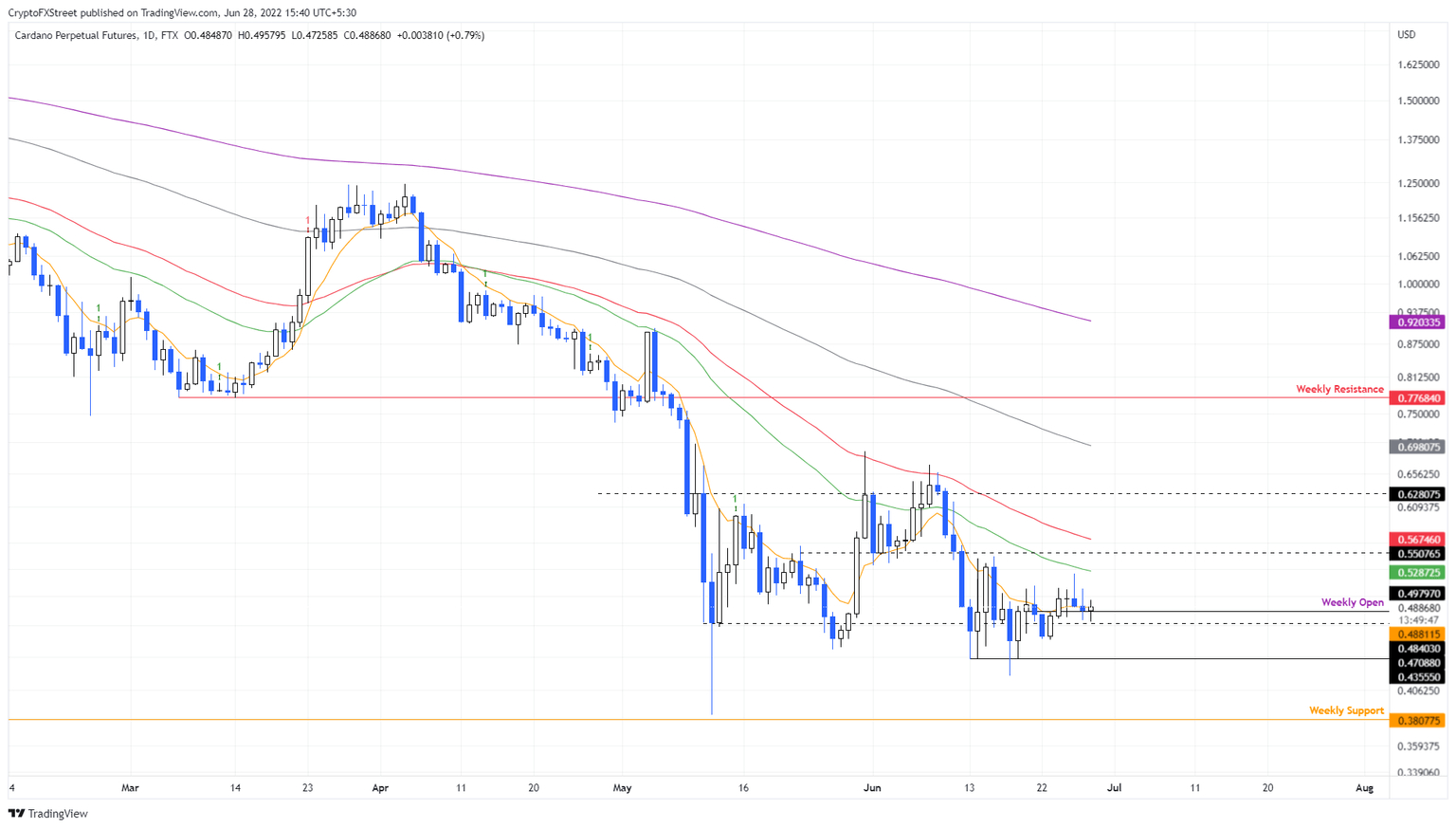

- Cardano price faces an uphill battle against multiple hurdles ranging up to $0.628.

- A swift recovery above $0.487 will be key to triggering a run-up to $0.550 and subsequent resistance.

- A daily candlestick close below $0.435 will invalidate the bullish thesis for ADA.

Cardano price looks like it will face a massive amount of selling pressure that could lead to choppy price action. However, the fundamental side of things looks good for ADA considering the recent update regarding the highly anticipated Vasil hard fork.

One step closer to Vasil hard fork

As explained in previous articles, this upgrade will take a three-fold approach to improve the Cardano blockchain - scaling, smart contract capabilities and block transmission latency. The first major update regarding this upgrade was provided on June 27 when IOHK, the developer team behind Cardano announced the launch of node 1.35.0.

Stake Pool Operators (SPOs) need to upgrade to the latest version of the node to participate in the Vasil hard fork testing that will begin soon. IOHK CTO Romain Pellerin announced,

We reached 50% of stake controlled by 1.35.0 nodes on the #Cardano testnet, 25% more to go

When this number reaches 75%, the Vasil hard fork event can take place on the Cardano testnet. As of June 28, this number currently stands at 53.2%, which suggests that there is a long way to go.

Cardano price faces off against blockades

Cardano price is attempting to overcome its immediate hurdle at $0.488 aka the 8-day Exponential Moving Average (EMA). ADA is trading between the 8-day and 34-day EMAs since June 24 and remains that way as of June 28.

However, the recent recovery above the weekly open at $0.484, suggests that the bulls are in control.

The resulting rally is likely to propel Cardano price to $0.550, which is just above the 34-day EMA. Overcoming these two blockades will put ADA against the 50-day EMA. This is likely where the upside is capped for the so-called “Ethereum-killer.”

Therefore, the journey for ADA is an uphill battle although it is likely to continue heading higher. However, if Bitcoin price starts to rally, it will improve the chances of an upswing for Cardano price and other altcoins as well.

Hence, a decisive move above $0.550 could push ADA to $0.628, where it is likely to form a local top.

ADA/USDT 1-day chart

Although things might be looking optimistic for ADA, it faces headwinds. If Cardano price crashes lower and produces a daily candlestick close below the $0.435 support level, it will create a lower low and invalidate the bullish thesis.

Such a development could see the ADA price dive another 12% to retest the $0.380 foothold.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.