IOTA price prepares to rebound after the Foundation parts ways with creator David Sønstebø

- IOTA price has lost 37% of its value in the past two weeks and is ready for a rebound.

- David Sønstebø was kicked out of the IOTA Foundation Board of Directors and Supervisory Board.

On December 10, the IOTA Foundation Board of Directors and Supervisory Board announced that David Sønstebø was no longer part of it after a unanimous decision made by the rest of members in the best interest of the project.

David has been instrumental in founding the project and helping to build the initial team, vision, and ecosystem. However, it has become clear that David’s interests and the interests of the IOTA Foundation have diverged significantly.

IOTA price could be poised for a bounce in the short-term

Although David Sønstebø was an important pillar in the business activity, the IOTA Foundation states that, ultimately, this resolution was good for the ecosystem of the same one. IOTA price is trading in a significant downtrend on the daily chart but looks ready for a bounce.

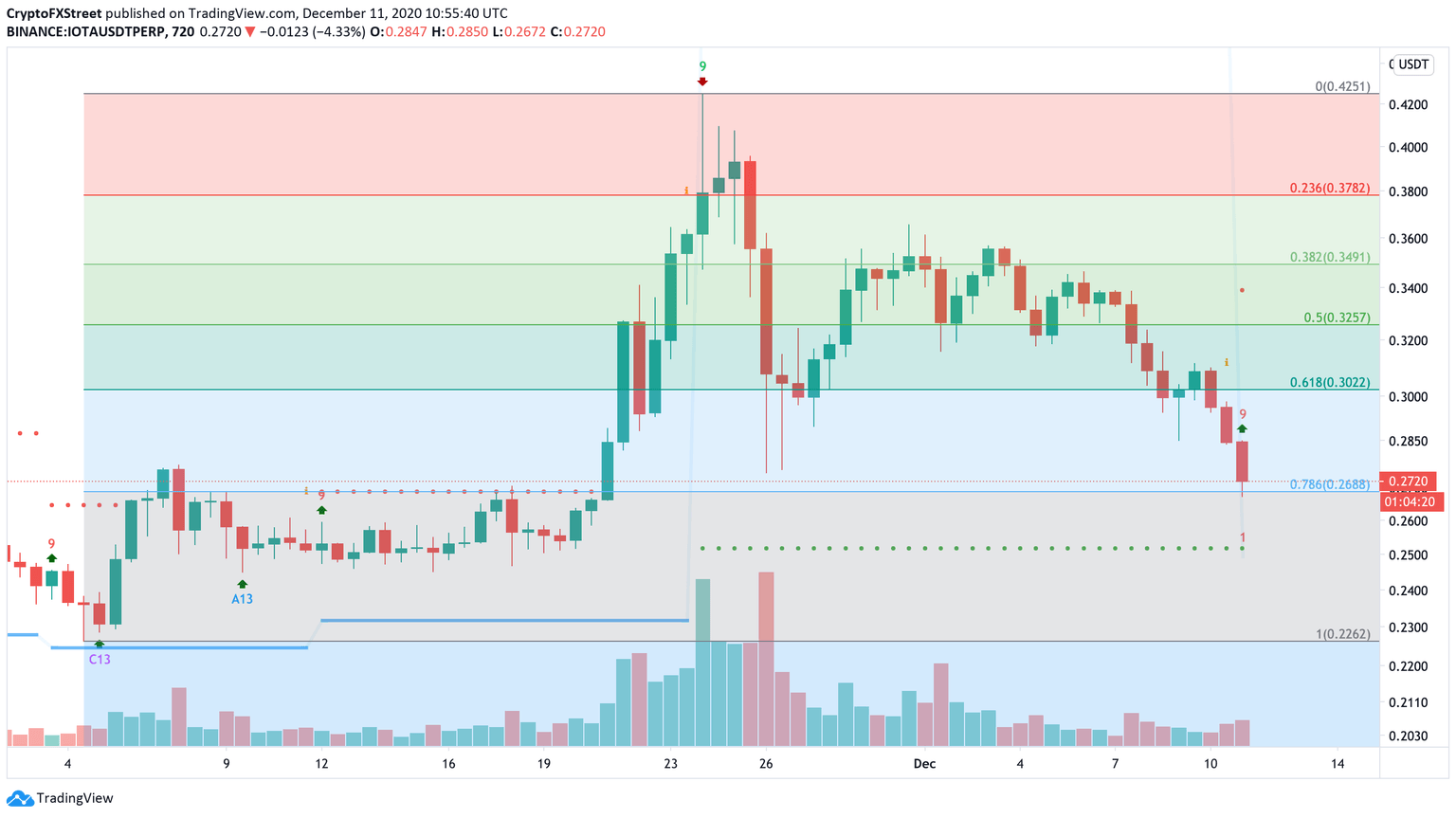

IOTA/USD 12-hour chart

The TD Sequential indicator has just presented a buy signal – in the form of a red nine candle – on the 12-hour chart, which could drive IOTA price towards the 0.618 Fibonacci retracemenet level at $0.30. Other potential price targets include the 0.5 Fibo level at $0.325 and the 0.382 level at $0.35.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.