How to navigate this Solana price breakout and market manipulation?

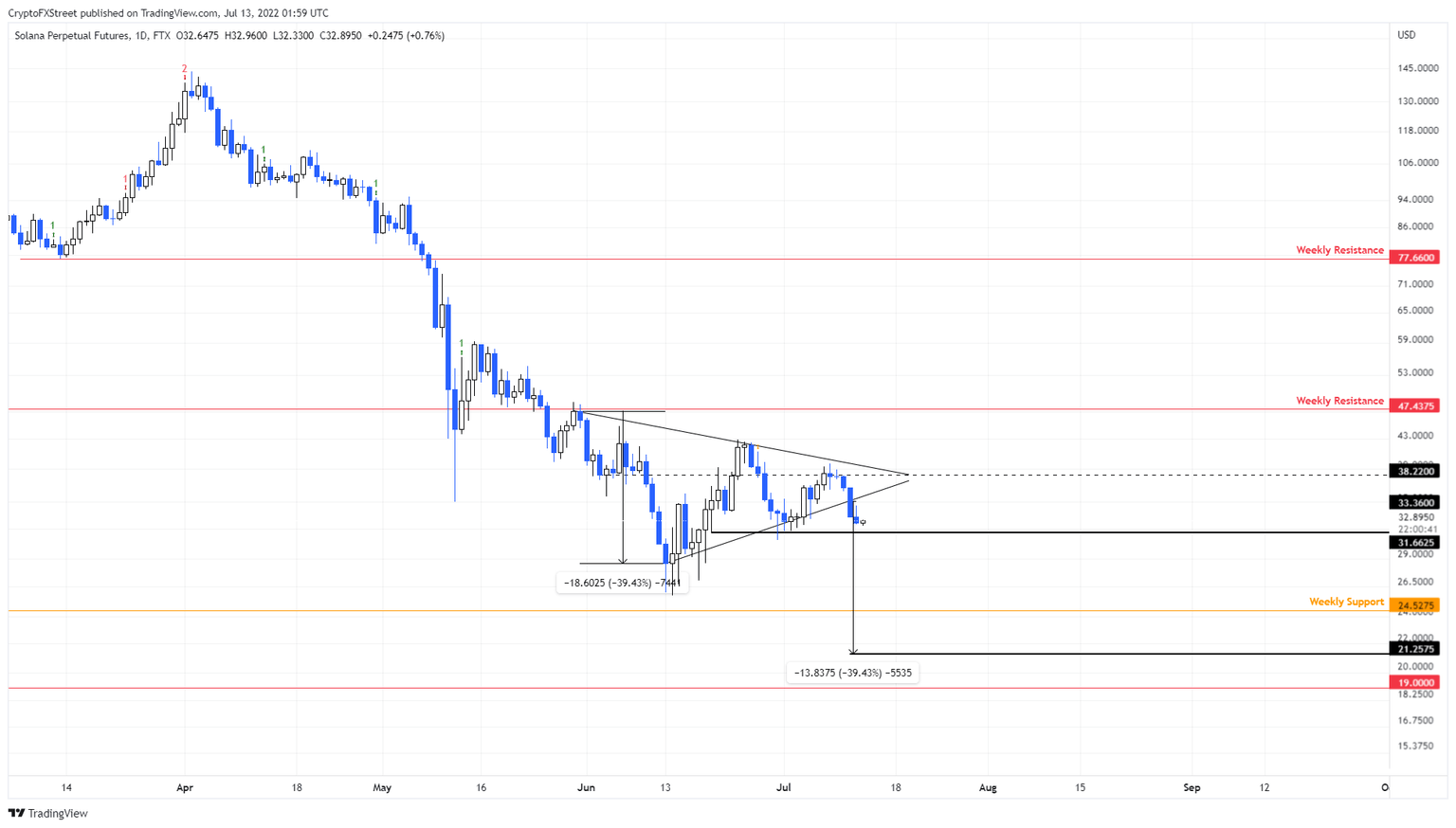

- Solana price was coiling up inside a symmetrical triangle for roughly a month.

- The recent breakout indicates that SOL is due for a 40% crash to $21.25.

- A flip of the $47.43 hurdle into a support floor will invalidate the bearish thesis.

Solana price has ended its coiling up phase that lasted for more than a month. The sudden spike in selling pressure over the last three days, triggered a breakout, indicating that a further downswing is plausible.

Solana price prepares for the worst

Solana price breached its symmetrical triangle setup on July 11. This technical formation contains three lower highs and two higher lows, which when connected using trend lines, reveal a symmetrical triangle.

The target for this setup is obtained by measuring the distance between the first swing high and swing low and adding it to the breakout point. Based on the measurement rule, SOL is due for a 39% crash to $21.25.

So far, Solana price has triggered a bearish breakout and is likely to continue going lower. The $31.62 support level will its first hurdle. Breaking below this level will put a stable weekly foothold at $24.52 in its path.

Investors can expect the downswing to stabilize here, allowing buyers to step in. But if sellers are in control, then a retest of $21.25 seems plausible for Solana price.

SOL/USDT 1-day chart

On the other hand, market participants need to note that sometimes a breakout is actually manipulation and better termed as fakeout. Hence investors need to keep a close eye on reversal in Solana price that pushes back into the symmetrical triangle and produces a bullish breakout.

While this move could be tempting to long, traders should wait for a secondary confirmation, which will arrive after Solana price flips the $47.43 hurdle into a support floor.

Such a development will invalidate the bearish thesis for SOL and further propel it to $77.66.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.