Why Solana price is hanging by a thread

- Solana price dropped on Monday, finishing the day with a 9% fall.

- SOL price is facing more issues and challenges as we advance.

- With cryptocurrencies already battered, fewer investments are forecasted for SOL trading volume.

Solana (SOL) price is under pressure from Europe after news that the European Union created a framework for cryptocurrencies, limiting the possibility to make payouts towards investors without being taxed and making it more difficult for Europeans to invest in cryptocurrencies overall. To make matters even worse, the European bloc is facing the most significant energy crunch, putting households on rationing and passing on elevated prices to households not seen since the world wars. This means that European households will have no funds to allocate towards cryptocurrencies, making the industry miss out on billions of possible investment flows for at least this year.

The EU energy crunch makes SOL miss out on billions

Solana price will depend on the Americas, the Middle East and Asia to fill up the gap of the missing billions of investments from the EU bloc as households slash their spending and are shifting away their cash from cryptocurrencies. Even local investment funds are decreasing their stake in cryptocurrencies against their overall balance sheet. This means SOL price is missing a substantial part of the volume going forward.

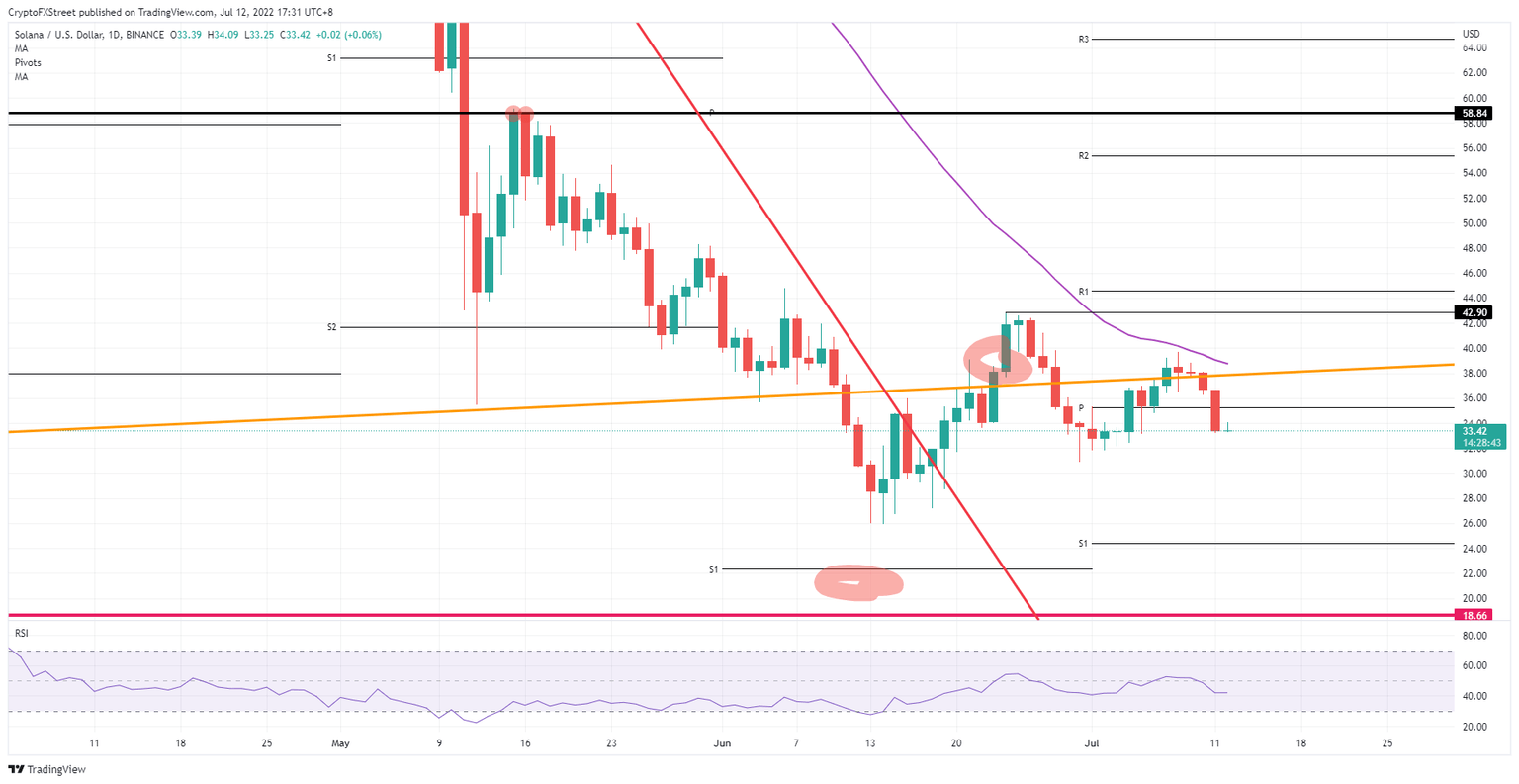

SOL price will take another leg lower as that volume is very much needed to trigger a recovery. Expect to see price action fall back to the low of July and hit around $30.96, the low of June 30. From there, a stretched area with no support opens up and could see SOL dipping towards an even $26.00 with a new low for 2022 in the making. A significant level to mark up yet again is $18.66, which is a longer-term low and vital support level to watch.

SOL/USD Daily chart

A rebound or uptick looks unlikely, but it still could be in the cards. As investors usually buy dips during a recession, such capial moves could be the preposition for a rally towards $38.00. That would press against the orange ascending trend line and the 55-day Simple Moving Average this time. If bulls can break that downtrend, expect a quick test near $42.90, making it a nice 27% return.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.