How the Avalanche price could be bottoming before a short-term rally

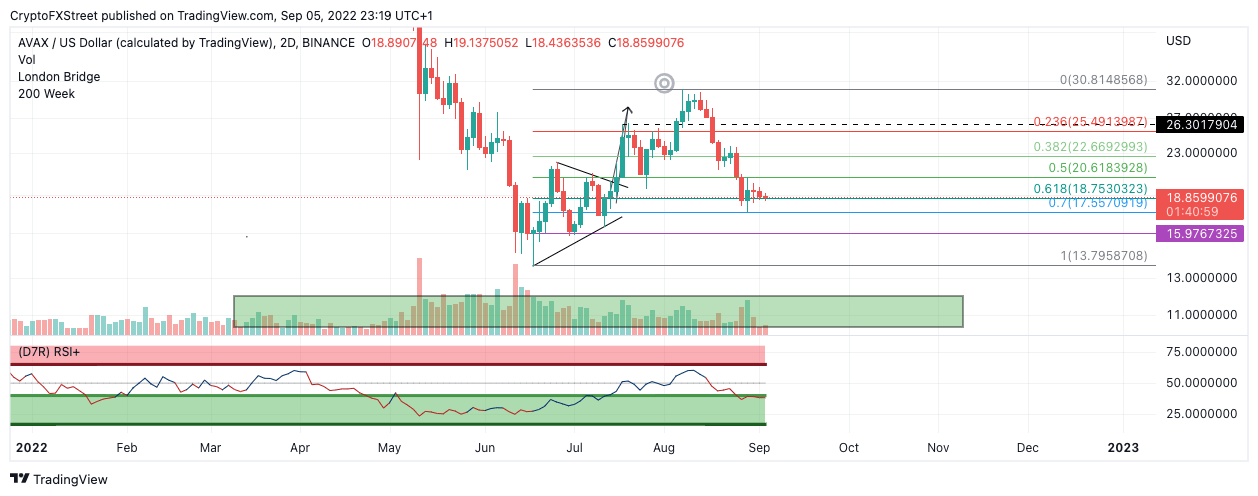

- AVAX price auctions at a key 61.8% Fibonacci Retracement level.

- Avalanche price shows an uptick in volume amidst the contact with the FIB level and RSI support.

- Invalidation of the bullish thesis depends on the June 18 swing low at $13.79 holding as support.

Avalanche price could be bottoming out at the current price level. Any move deeper would be a positive developement for the bearish scenario.

Avalanche price is at a make-or-break level

Avalanche price currently auctions at $18.84 as the bulls and bears wrestle over smaller time frame zones. Since August, the bears have had control over the trend putting an end to the summertime rally, which at its peak was a 120% increase in value for AVAX holders since the June 18 liquidation.

A Fibonacci retracement tool surrounding the entirety of the summertime bull run suggests the current decline is currently the 61.8% retracement. Amongst Elliott Wave and Fibonacci practitioners, the Avalanche price must begin to find support and retaliate against the bears, or the entire uptrend will be in jeopardy.

AVAX USD

The buy is justifiable for traders looking to partake in a speculative play. The Relative Strength Index and Volume profile Indicator both support the idea of a potential market bottom. Bullish targets could rally to $37, a 90% increase from today's market value.

The prospective rally depends on the June 18 swing low at $13.79 remaining unbreached. Early evidence of downtrend continuation could be a close below $17.25.

In the following video, our analysts deep dive into the price action of Avalanche, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.