How Solana price will react after Solend attempts to take over investor’s wallet

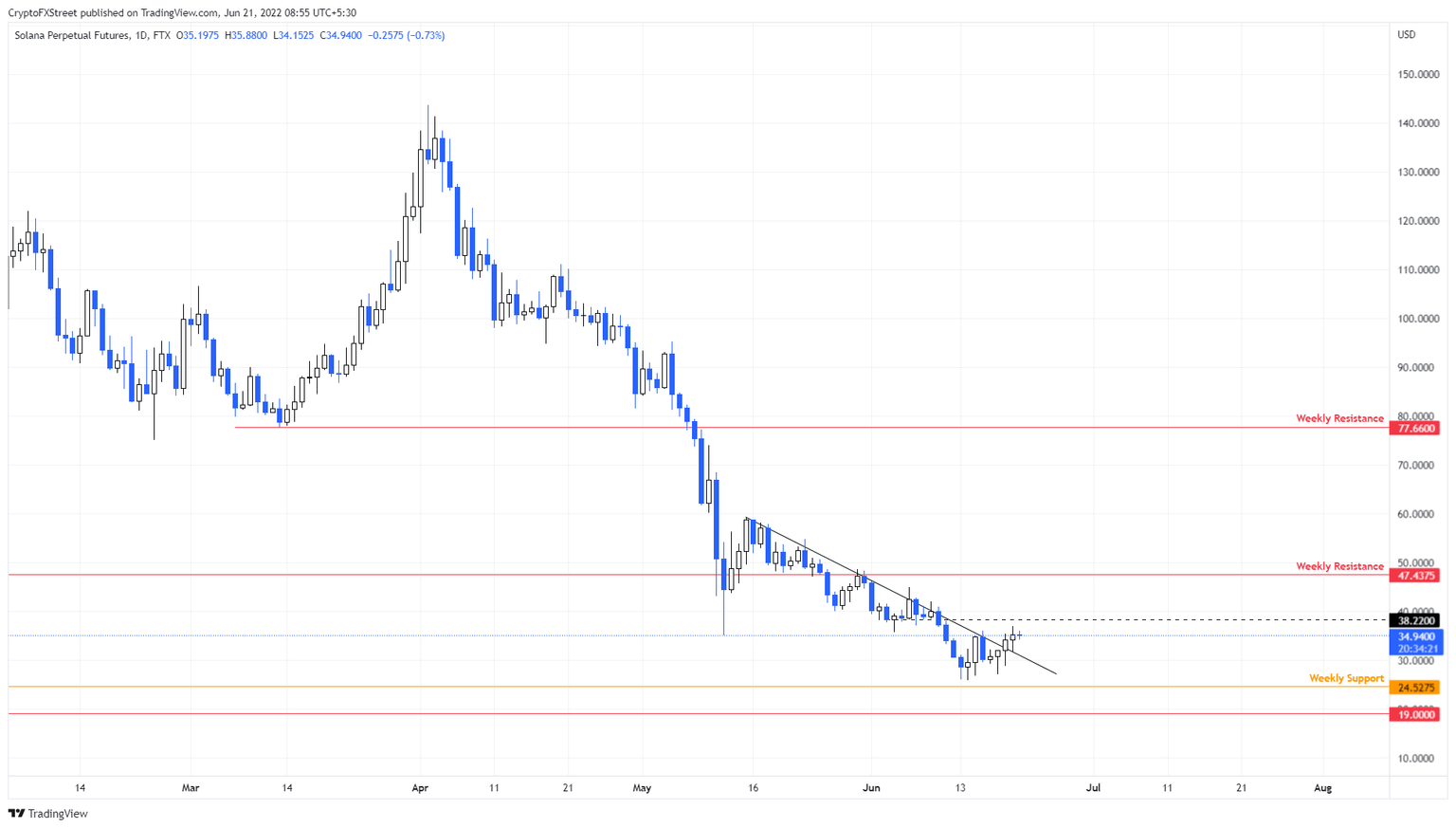

- Solana price is looking top-heavy as it hovers below the $38.2 hurdle.

- Solend, a lending/borrowing platform voted to take control of a whale’s account to prevent a cascade of liquidation.

- Rejection at $38.22 and the fallout from this fiasco could trigger SOL to crash to $25.

Solana price breached a month-long declining trend line in a bullish move, but the recent developments could flip the narrative bearish for SOL.

Solend takes a jab at decentralization

Solend, a Solana-based lending and borrowing platform recently voted to take control of a whale’s account that was close to being liquidated. The said account borrowed $108 million USDC with 5.7 million SOL tokens as collateral.

Roughly 20% of the whale's account would be liquidated if Solana price slides below $22.30. Often, liquidation involves selling tokens on exchanges, which would have a huge market impact.

However, Solend’s move is unprecedented in the DeFi ecosystem because it violates one of the main tenets of Web3 - decentralization. This caused many in the space to critize Solend’s decision.

Insanity, what a joke

— Cobie (@cobie) June 19, 2022

Interestingly, a new proposal that aimed to overturn the previous one was started on Monday and received 99.8% of the votes in its favor.

Solana price at a junction

Solana price has produced lower highs since May 15, which can be connected using a trend line. The June 14 swing low at $25.17 formed a base, just above the $24.52 support level. A surge in buying pressure here, pushed SOL to rally 36% in a week.

The run-up also breached the declining trend line and is currently hovering around $34.93. Any attempts at recovery will be neutralized by the $38.22 hurdle. Therefore, the likely direction for SOL would be to retrace and recuperate.

As a result, Solana price is likely to tag the declining trend line, but in a case with high selling pressure, investors can expect SOL to head toward the weekly support level at $24.52. If the sellers push through this support floor, things could turn ugly.

In such a case, Solana price could retest the $19 support level. Investors need to be cautious here as this development could trigger a liquidation of the whale’s wallet. This fallout could further drive SOL prices lower.

SOL/USDT 1-day chart

On the other hand, if Solana price produces a daily candlestick close above $38.22, it will temporarily keep the bears at bay. This move will allow SOL bulls to climb up by 23% to encounter the weekly resistance barrier at $47.43.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.