Whale activity opens window of opportunity for traders in Cardano, HEX and the Sandbox

- Cardano, HEX and Sandbox have witnessed an increase in whale activity on their networks and this historically implies a future price move in the assets.

- A huge spike in whale activity indicates major interest from large wallet investors and analysts expect a correction in altcoin prices in the short-term.

- ADA, HEX and SAND prices are more likely to do a 180 from their current price direction based on how prominent the whale activity spikes are.

Large wallet investors on Cardano, HEX and the Sandbox increased their activity recently. Experts believe this could trigger a trend reversal in the altcoins, in the short-term.

Cardano, HEX and Sandbox witness increased whale activity

Cardano, HEX and Sandbox rank among altcoins that have witnessed a spike in activity by large wallet investors. Since the beginning of 2023, there has been a spike in volatility in crypto prices. Key stakeholders in the crypto market have displayed more excitement than usual.

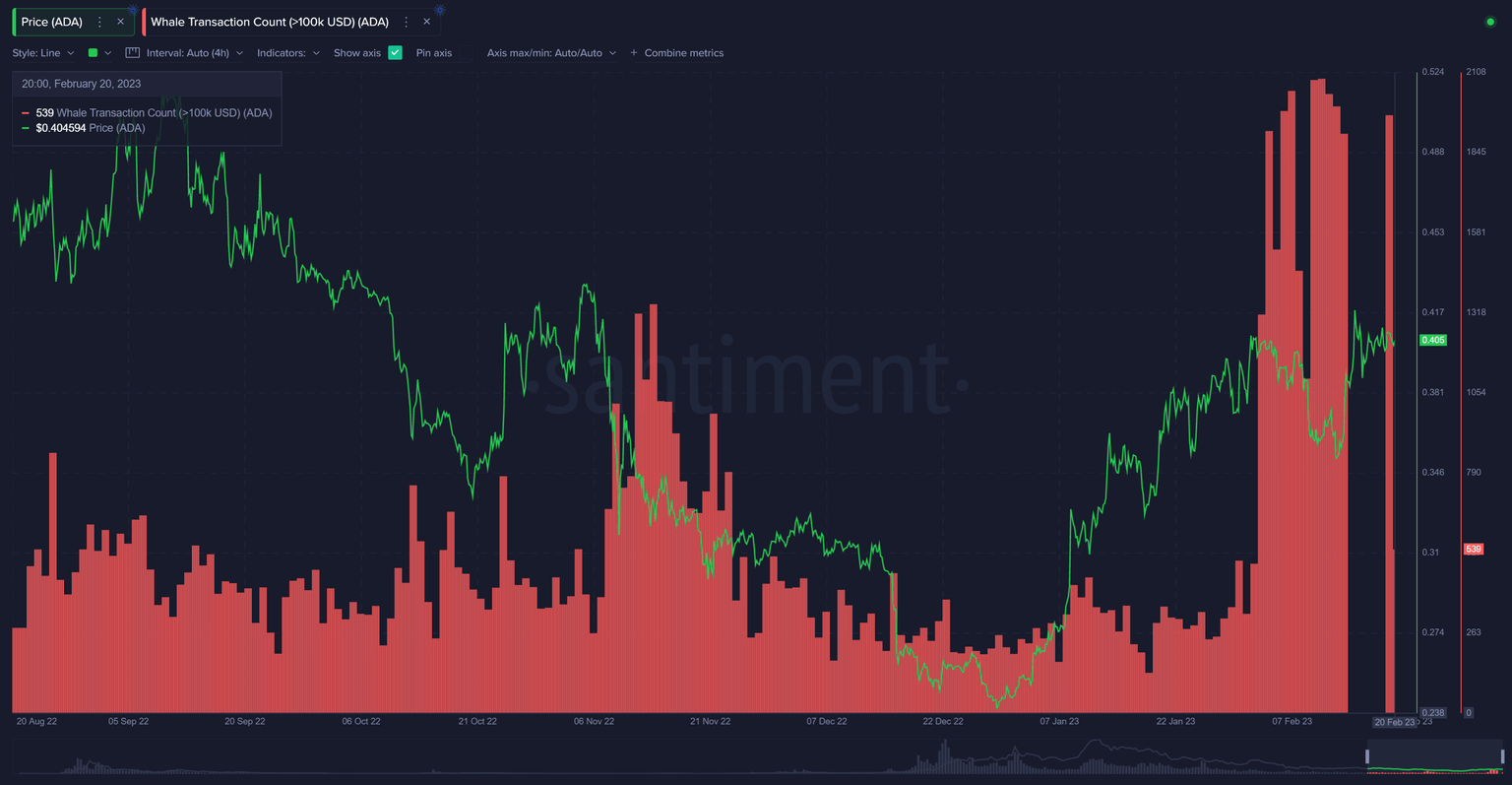

According to analysts at Santiment, volatility is an ideal time to make key moves to yield above average returns in cryptocurrencies. Cardano (ADA), HEX and the Sandbox (SAND) are seeing significantly high levels of whale moves. There is a huge spike in interest from whales in Ethereum-killer Cardano.

Cardano whale activity

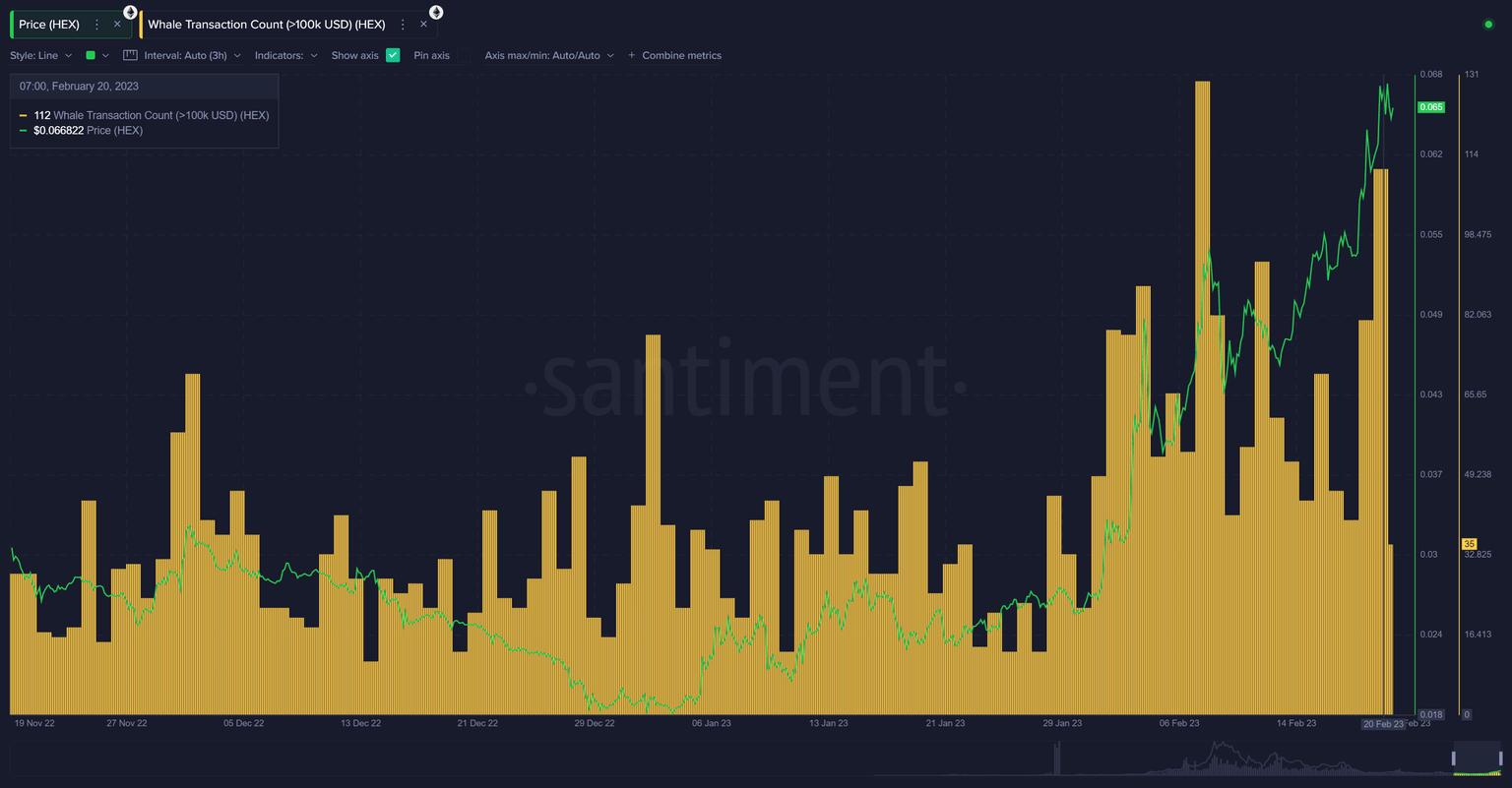

On February 20, HEX witnessed the highest level of whale transactions since February 9. This coincided with a mid-sized correction in the altcoin and experts believe history could repeat itself in the short-term.

HEX whale transactions

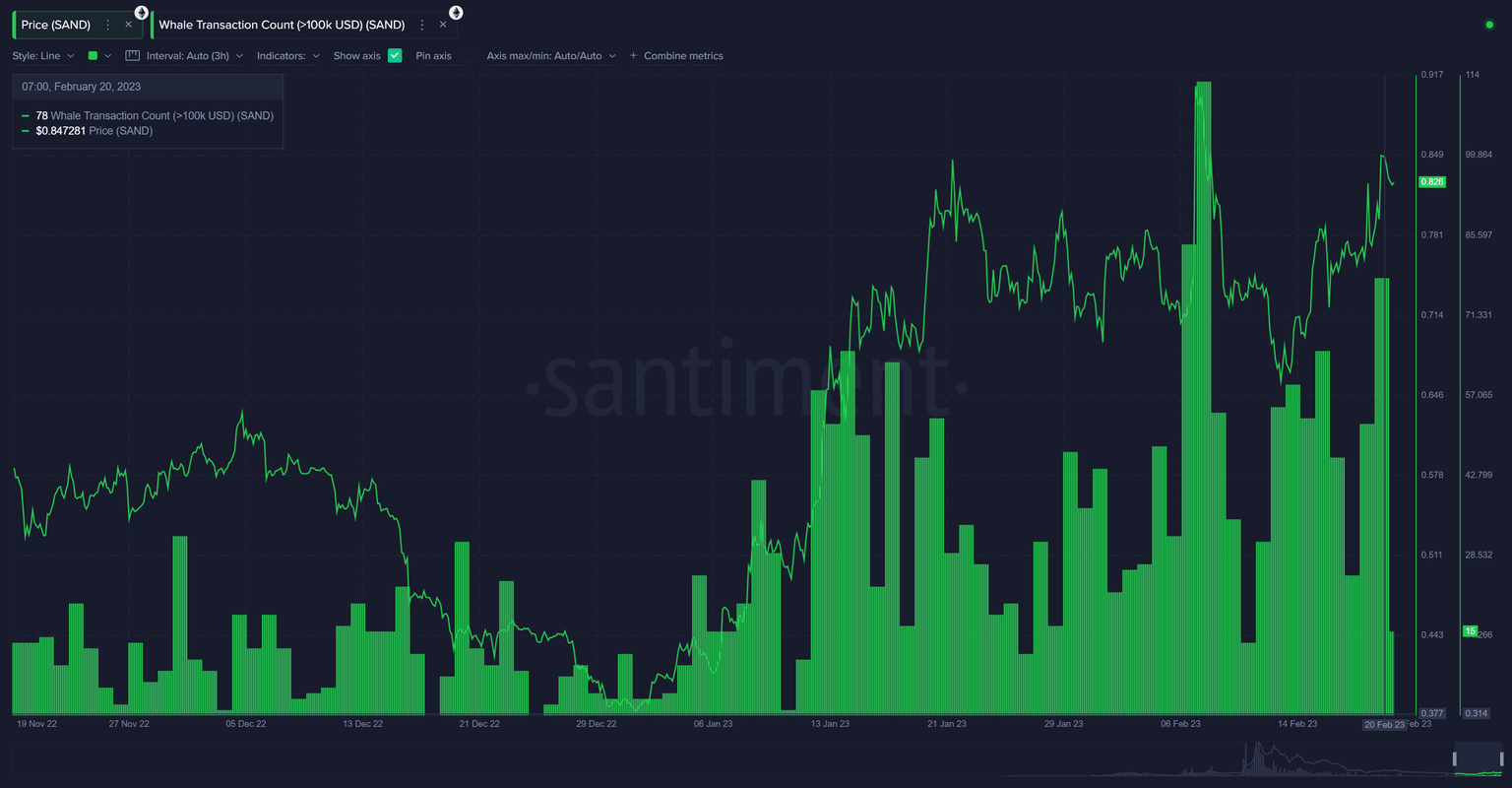

Metaverse token Sandbox witnessed the third-largest spike in three months alongside increase in prices. SAND yielded 16% gains for holders in the past week, and the rising whale activity increases the probability of a short-term correction in the metaverse token.

SAND whale activity

Analysts at crypto intelligence tracker Santiment believe it is important to monitor whale activity as it coincides with price trend reversals. The intensity of the whale activity spike influences the magnitude of price hike.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.