What do institutional giants know about GMX: Do Amber Group and Arca expect a 20% rally?

- Institutional giants are scooping up tokens of the decentralized exchange as centralized exchange outflows pick up pace.

- Crypto asset manager Amber Group scooped up $9.8 million in GMX tokens from Binance

- Fellow giant Arca bought $4.4M worth of the token from decentralized exchanges.

- GMX price rose 16.8% over the past week, local price peaks coincide with peak outflows from Binance and centralized exchanges.

GMX, the native token of a decentralized exchange by the same name, yielded double-digit gains for holders over the past week.

This comes as institutional giants Amber Group and Arca scoop up millions in the GMX token over the past month, and flow data from the exchanges appears to suggest institutional take-up is a leading factor in the rally.

Also read: Whale activity opens window of opportunity for traders in Cardano, HEX and the Sandbox

GMX token is being scooped up by institutions at a fast pace

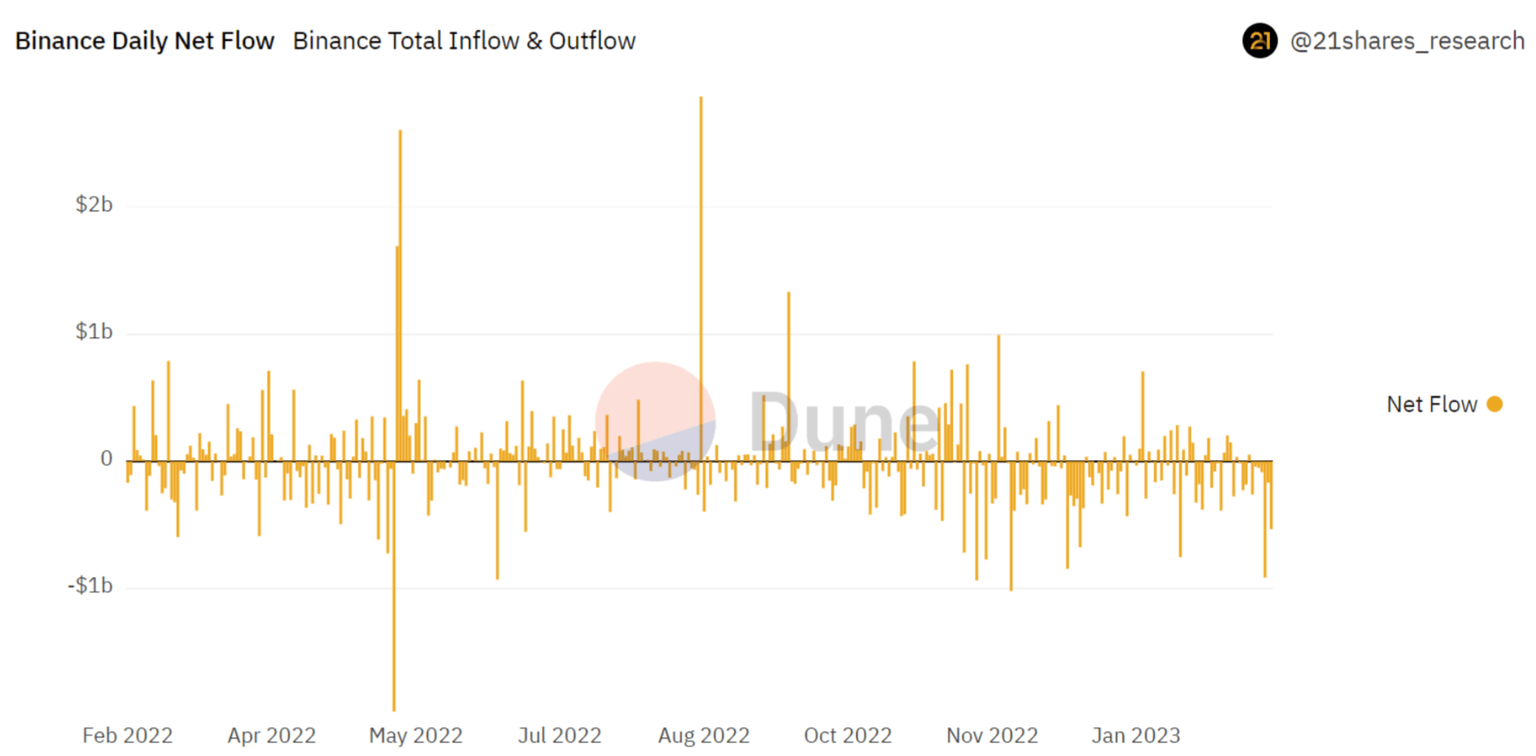

GMX token has witnessed a boost in its price every time centralized exchanges have registered high outflows.

On February 13, Binance witnessed net outflows reaching $788 million in a 24-hour period and this pushed GMX to a new all-time high of $83.02.

Binance outflows

On February 15, Binance saw another $535 million in net outflows, on the same day GMX price also climbed to the $78 level.

Based on the data above, sustained outflows from centralized exchanges like Binance are fueling a bullish sentiment among GMX holders. GMX ranked tenth by market capitalization on February 14, yielding 16.8% gains for holders over the past week.

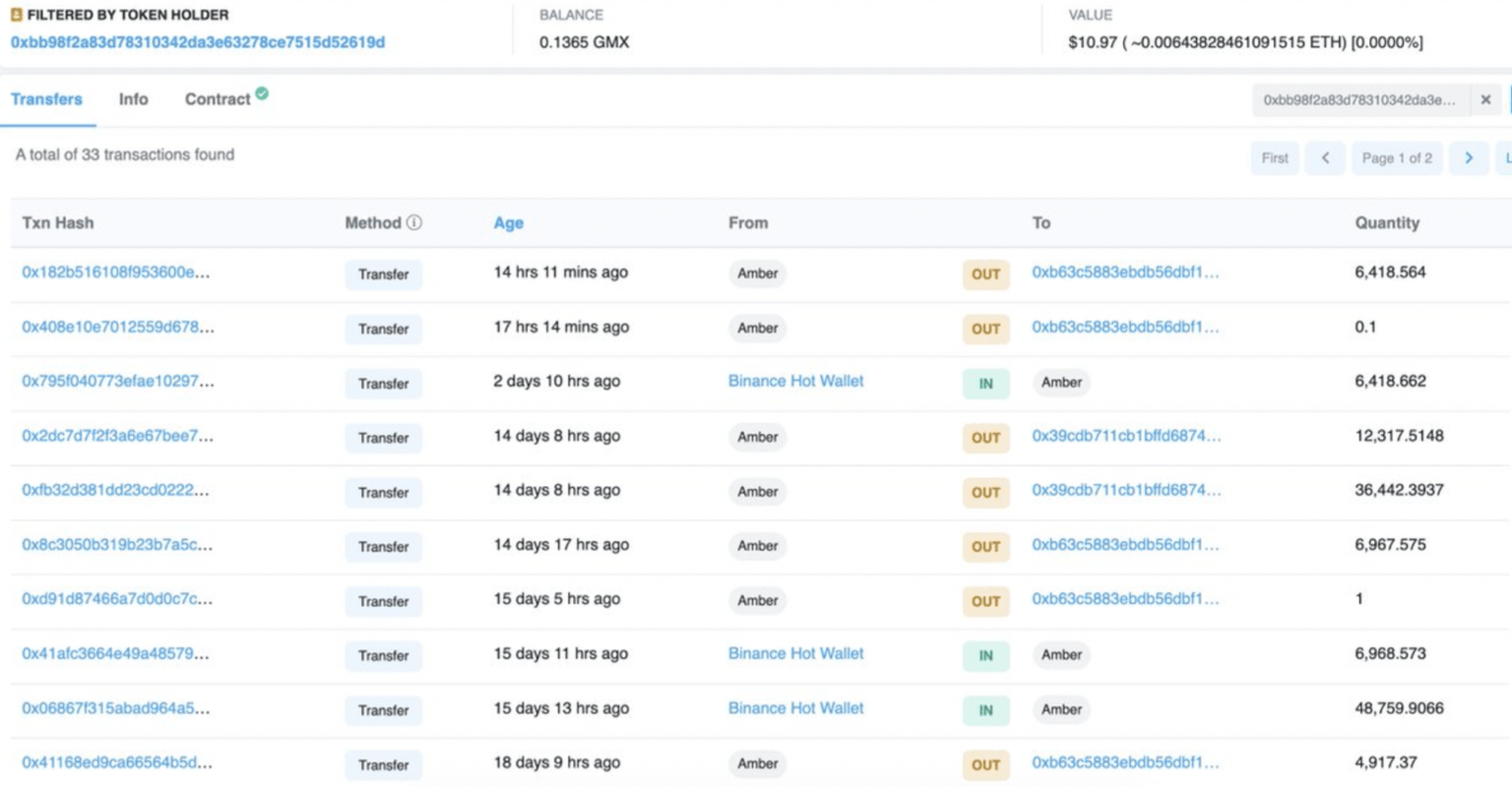

Amber Group, a digital asset management and trading company and Arca, an asset management firm have scooped up over $10 million worth of GMX tokens over the past month. The firm received 122,144 GMX from Binance in the past one month at an average receiving price of ~$61.9. The firm transferred these GMX holdings to three new addresses.

Amber Group scoops up GMX

Digital asset management firm Arca bought 42,972 GMX in exchange for 2,065 ETH at an average price of ~$81.5 in the past 3 days.

In January the firm scooped up $1 million worth of GMX at an average price of ~$42.6.

Is GMX price set to rally?

Analysts are predicting a massive GMX price rally with a bullish target of $100. @JJcycles, crypto analyst and trader, shared his target for GMX’s current uptrend. The native token of decentralized exchange GMX started its uptrend on January 9, 2023 and continued its rally throughout February.

GMX/USDT price chart

As seen in the chart above, the analyst expects GMX to sustain its short-term uptrend and climb 22% from $78 to hit the $100 target.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.