Here’s what Cardano’s biggest sell signal in seven months means for ADA holders

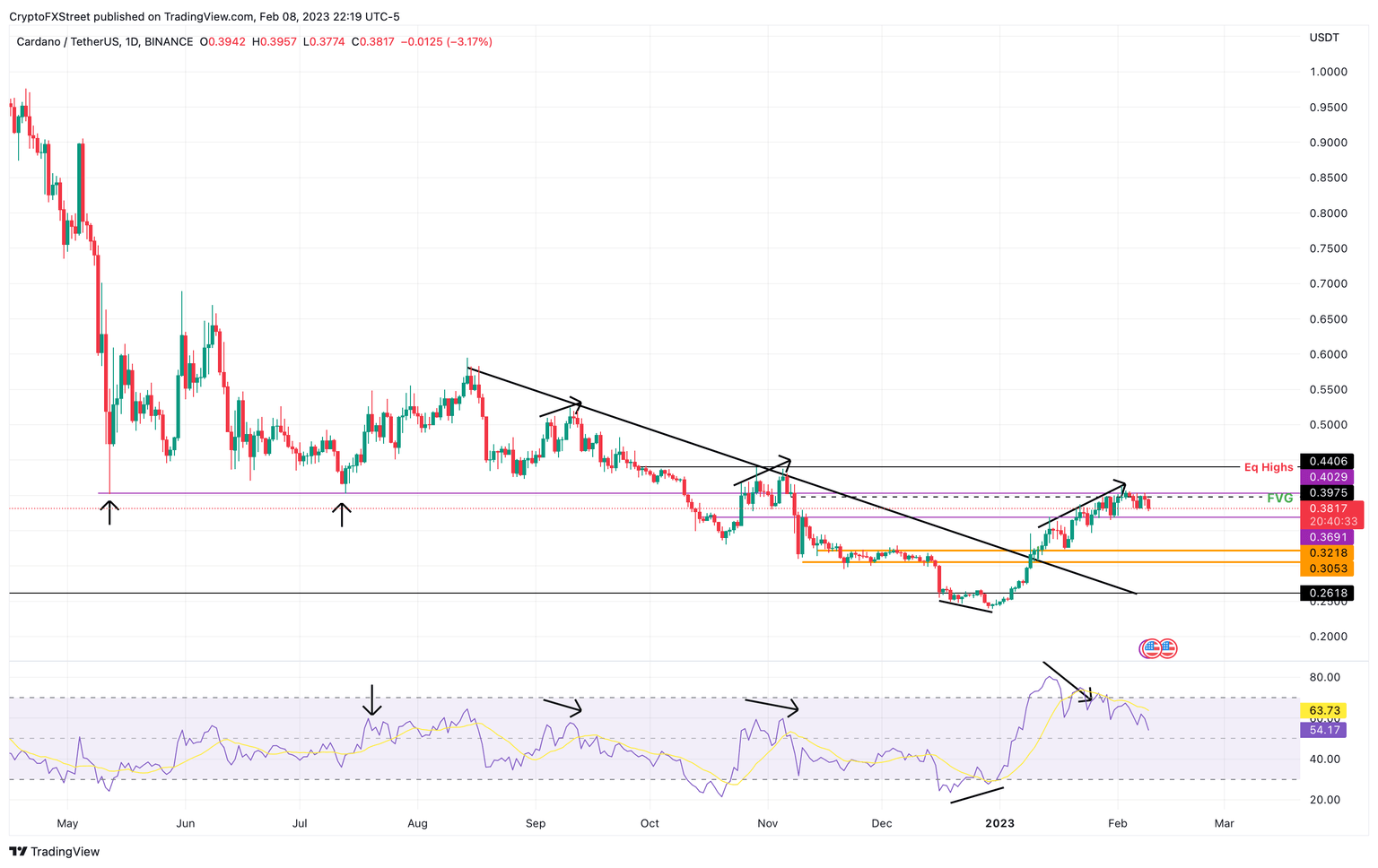

- Cardano price tugs the $0.402 resistance level after its 72% rally.

- Investors should expect a steep correction to $0.321 due to the ongoing bearish divergence.

- A daily candlestick close that flips the $0.402 hurdle into the support floor will invalidate the bearish thesis for ADA.

Cardano price has shown a steady uptrend since December 30, 2022. However, in the last six days, ADA has been facing consolidation since it approached a major resistance level. Rejection at this level could trigger a steep correction for ADA.

Cardano price ready to nosedive

Cardano price action for the last six months shows a distinct top formation signal, i.e., bearish divergence. This formation is when the asset’s price produces higher highs, but the momentum indicator produces lower highs. This non-conformity or divergence indicates that the rally is not backed by anything and that a trend reversal is likely.

This signal was seen twice in the last six months, and currently, Cardano price has formed the longest bearish divergence. This sell signal has extended for more than three weeks while ADA has been tightly wound.

A sudden spike in selling pressure could spell disaster for Cardano price and trigger a 15% crash to the $0.321 support level.

ADA/USDT 1-day chart

A daily candlestick close that flips the $0.402 hurdle into the support floor will invalidate the bearish thesis for Cardano price. This barrier was a stable support level for nearly six months between May and November 2022 and was flipped to a blockade thereafter. Hence, reconquering this hurdle will attract more buyers that could trigger Cardano price to rally by 10% to $0.440.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.