Here is what needs to happen for Ethereum price to rally 20%

- Ethereum price is currently displaying a triple bearish divergence on the four-hour timeframe.

- A 10% retracement will provide long-term holders an opportunity to accumulate before triggering a 20% upswing to $2,022.

- Invalidation of the bullish thesis for ETH will occur below $1,422.

Ethereum (ETH) price shows an exhaustion of bullish momentum after producing a clear sell signal on the four-hour timeframe. This development could result in a quick drop, but from a long-term perspective, it would be an opportunity to accumulate.

Read More: Assessing chances of Ethereum price rally to $2,400

Ethereum price sets the stage for long-term bulls

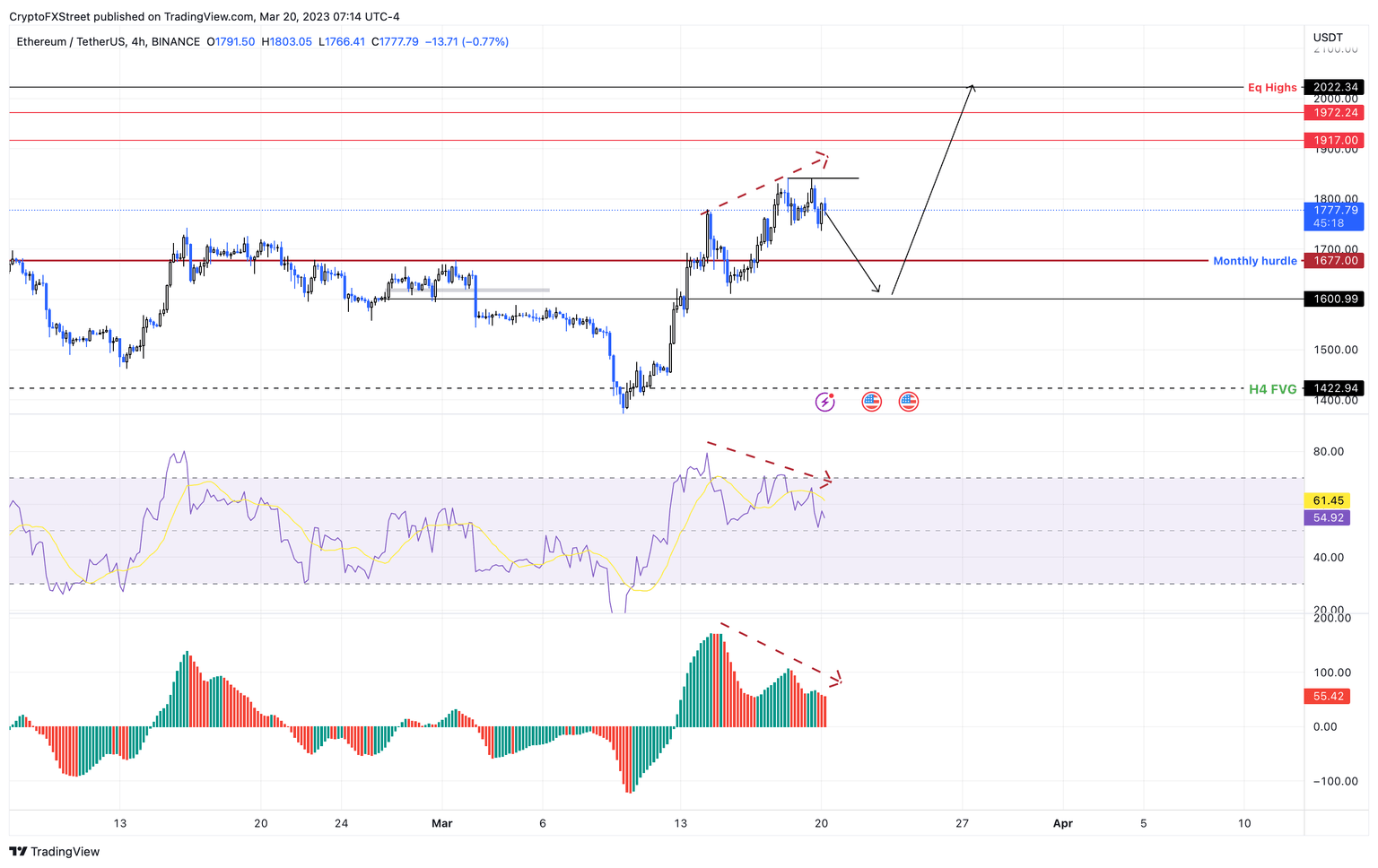

Ethereum price has rallied 34% in the last ten days and has set up a perfect place to trap late bulls. The equal highs at $1,841 and the bearish divergence seen on the momentum indicators are two reasons why investors that got in on the rally late will get punished soon.

Market participants can see that the Ethereum price produced higher highs since March 14, but the Relative Strength Index (RSI) and Awesome Oscillator produced lower highs. This non-conformity is termed as divergence and the declining momentum often leads to a reversal in price.

Therefore, Ethereum price could shed 10% and tag the $1,600 psychological level or the monthly level at $1,677.

While this 10% downswing is a good move for short-term traders, investors should note that this move could be a potential buy signal for long-term holders. If Bitcoin price keeps up its bullish outlook, this retracement will allow buyers to recuperate and extend the rally to $2,022. This move would constitute a 20% ascent for ETH.

ETH/USDT 1-day chart

While the optimistic outlook for Ethereum price makes sense, a breakdown of the $1,600 level would be the first sign to be cautious. If the selling pressure continues to build, leading to a flip of the $1,422 level into a resistance level, it would invalidate the bullish thesis for ETH.

Such a move could trigger Ethereum price to retrace lower and tag the $1,377 support level.

Also read: Why Ethereum will emerge victorious in the ongoing bull rally as Tether mints $2 billion USDT

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.