Here is how DeFi users are gearing up for Optimism summer

- Optimism, an Ethereum scaling solution, is working on a unification of Layer 2 chains through the Superchain framework OP stack.

- The ETH scaling solution’s Bedrock upgrade will lay down the framework for advancing Superchain as early as May 2023.

- Velodrome and Synthetix are the DApp twins that could witness a price rally in response to Optimism’s upgrades.

Ethereum scaling solution Optimism has lined up its Bedrock upgrade, to lay the foundation of its goal to unify Layer 2 chains through Superchain. The development team expects Bedrock upgrade to be shipped as early as May 2023 and this could revolutionize the Ethereum L2 ecosystem, according to experts.

Optimism (OP), Velodrome Finance (VELO) and Synthetix Network (SNX) rank among the DeFi projects set to benefit from the developmental milestones and the upgrade.

Also read: Curve DAO’s latest rollout triggers price rally in DeFi tokens CRV and CVX

What is the Optimism Superchain, Bedrock upgrade

Ethereum scaling solution Optimism is gearing up to ship its Bedrock release and lay the foundation for Superchain. The development team has announced that there is no set date for release and the upgrade could be rolled out as early as May 2023.

Optimism on Goerli testnet has been running Bedrock since January 2023 and developers will announce the timing of release once audits are complete.

The key aspect of the Bedrock upgrade is the critical role it plays in the Superchain. In February, the team introduced the vision for the unification of L2 chains. Experts consider this a bullish catalyst for DeFi summer, a rally in the DeFi ecosystem.

Total Value Locked in Optimism climbs

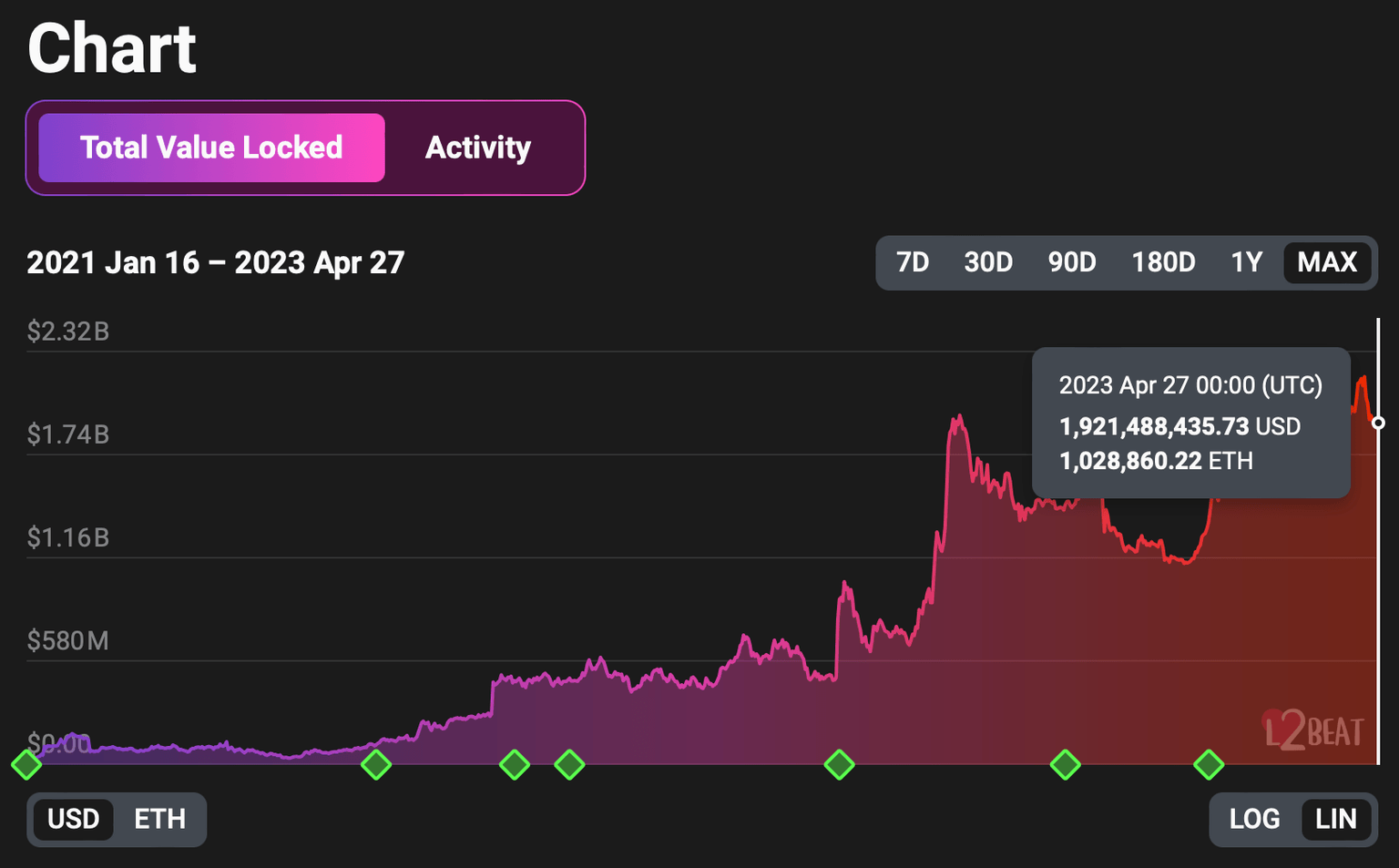

The Total Value Locked (TVL) in Optimism climbed from $1.13 billion to $1.92 billion in 2023, based on data from L2Beat. TVL is a key metric that maps the utility of a Layer 2 scaling solution, therefore a spike in Optimism’s TVL fuels a bullish thesis for the token.

TVL in Optimism

Alongside a rise in TVL, Optimism has support from Coinbase’s BASE that joined its Superchain ecosystem, building on the open-source OP Stack. Experts have evaluated the OP ecosystem's development activity and predicted the arrival of DeFi Summer.

How traders can gear up for DeFi Summer

Experts have identified Optimism (OP), Synthetic (SYN), Velodrome (VELO) and dYdX (DYDX) as the top picks for a rally in DeFi Summer. Captaink.eth, a crypto expert and trader notes that the current crypto ecosystem shows signs of the beginning of an altcoin season as Ethereum absorbs Bitcoin’s rising dominance.

Arbitrum’s ARB token witnessed a massive run up in its price, as capital began rotating out of Bitcoin and into altcoins (alt season) in April. While ARB and tokens in the ARB ecosystem rallied, OP holders awaited a bullish catalyst for the DeFi token.

The Bedrock upgrade, Superchain development and Coinbase building on the OP Stack are the three key bullish catalysts identified by the expert.

18. 먼저 Velodrome의 경우, 작년 12월부터 예고해 온 Velodrome 2.0의 릴리즈를 목전에 두고 있음. Relay라고 칭하는 Voting-Bribe 자동화 기능이 메인인 것으로 보임(Convex의 Votium과 비슷함.). pic.twitter.com/P60400bGbx

— captaink.eth | 강선장 (@captaink180808) April 16, 2023

Experts believe traders can gear up for DeFi summer ahead of the SYN, VELO and DYDX price rallies. SNX and VELO prices declined between 12 and 15% over the past week, wiping out their gains from April 2023. These two tokens are considered the main DApp twins leading the Optimism ecosystem.

Following a smooth Bedrock upgrade, captaink.eth expects these cryptocurrencies to begin their price rallies, yielding gains for holders. Similarly, YouTuber and crypto influencer BitBoy has picked DeFi token DYDX for users preparing for the upcoming rally.

Targets for VELO and SNX

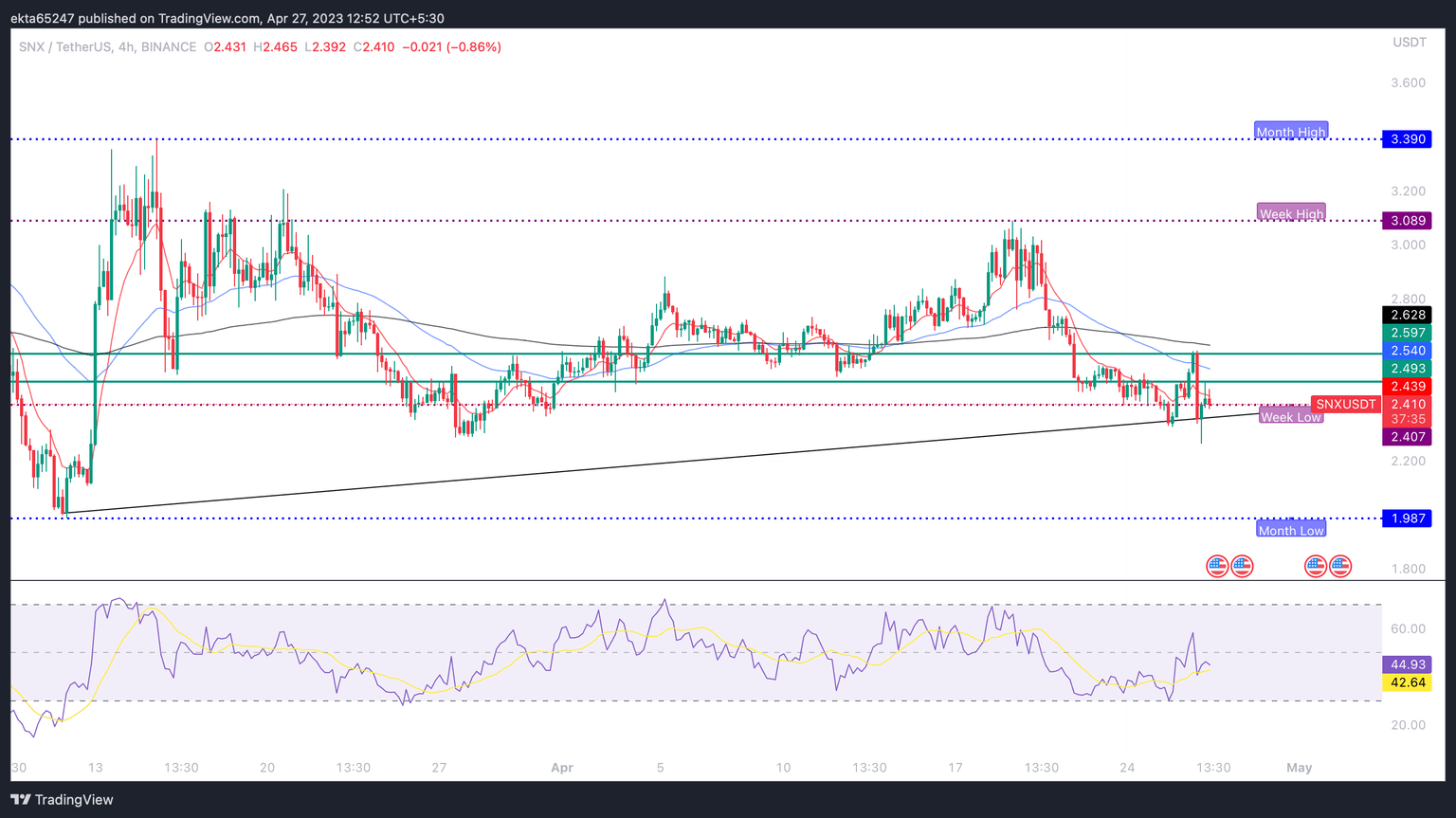

Both VELO and SNX play a key role in the Optimism ecosystem. With a rally in DeFi tokens, SNX and VELO could yield gains for holders. SNX is currently in an uptrend that started on March 13. The immediate resistances for the DeFi token are $2.49 and $2.59, levels that acted as key support during its run up to the monthly high of $3.39.

If SNX price drops below the trendline, at $2.35, the bullish thesis is likely to be invalidated. A candlestick reversal pattern is needed to confirm an uptrend in the DeFi token, there is no sign on the four-hour chart yet.

The Relative Strength Index (RSI) signals that there is room for further growth in SNX price as it is below the neutral level.

SNX/USDT 4H price chart

A definitive close below the trendline could invalidate the bullish thesis for SNX.

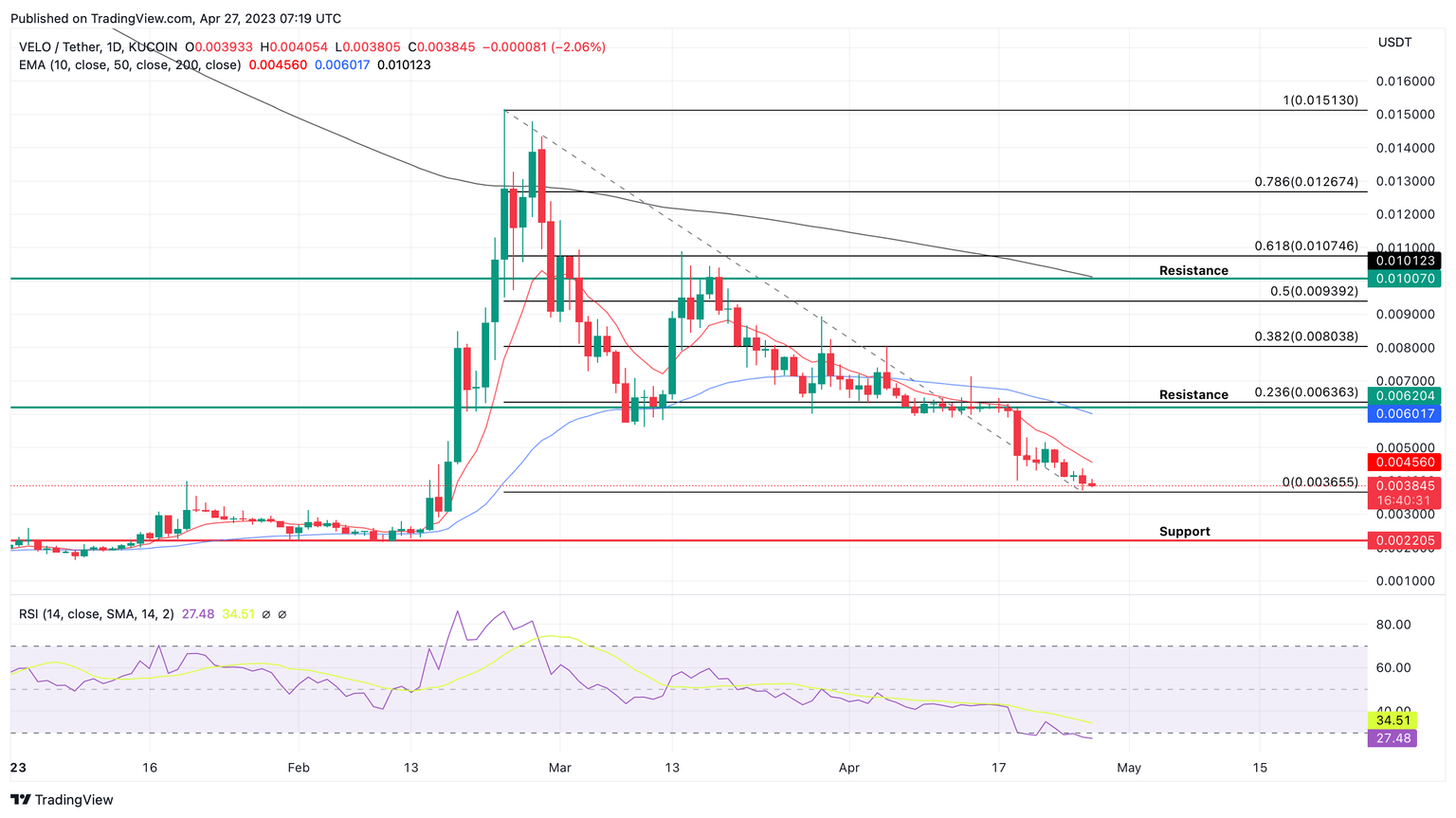

In the case of VELO, the asset is in a downtrend since March, forming lower lows and lower highs as seen below. There is a candlestick reversal pattern, a spinning top on the daily price chart, however traders need to await confirmation before opening a trading position in the DeFi token.

In VELO’s steady decline, $0.01007 and $0.0062 have acted as key support levels and they are immediate resistances for the DeFi token once it begins an uptrend. VELO price is currently below all three long-term Exponential Moving Averages (EMAs), the 10, 50 and 200-day.

VELO price needs to climb above the three EMAs and tackle resistances on its path to $0.0151, its February 2023 peak.

VELO/USDT 1D price chart

As long as VELO price stays above support at $0.0022, there is a likelihood of a shift in its trend. If the DeFi token declines below this level, it could invalidate the bullish thesis for holders.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.