AVAX price begins rally after massive spike in activity on Avalanche

- AVAX price has started its recovery, yielding 5% overnight gains for holders post the launch of the Cortina upgrade.

- Avalanche network begins its three key optimizations with the recent upgrade, fueling a spike in social dominance.

- AVAX price chart shows a candlestick reversal pattern that signals bulls are likely taking control of Avalanche and set to push prices higher.

Avalanche network’s Cortina upgrade optimized the blockchain and acted as a bullish catalyst for AVAX price. The Ethereum alternative token’s price climbed, yielding nearly 5% gains to holders since Tuesday.

The AVAX price chart signals the recent gains are likely sustainable and the token could continue its uptrend.

Also read: After Shanghai, this is the next Ethereum update to watch out for

AVAX price rallies in response to Cortina upgrade on Avalanche

Avalanche’s Cortina upgrade, a long awaited technical development went live on the mainnet on Tuesday. The upgrade is focused on enhancing the experience of developers and boosting the utility of the AVAX blockchain.

Cortina is live!

— Avalanche (@avax) April 25, 2023

Cortina is the latest version of AvalancheGo, with 3 key optimizations that will provide a better developer experience on #Avalanche

✅ X-Chain Linearization

✅ Batched Delegator Rewards

✅ Increased C-Chain Gas Limit https://t.co/1ZukgJ1avm

The Ethereum-rival token’s price climbed in response to Cortina’s launch and price witnessed a bullish break from its week-long slumber. The sentiment among AVAX holders improved and the “social dominance” metric can be used to gauge the impact.

Social dominance on crypto intelligence tracker Santiment reveals the share of discussions on social media platforms that refer to Avalanche, compared to other cryptocurrencies. As seen in the chart below, dominance witnessed a spike on April 25.

The spike in dominance was echoed in the increase in AVAX price, represented by a green line in the chart below.

%2520%5B16.53.40%2C%252026%2520Apr%2C%25202023%5D-638181058394010477.png&w=1536&q=95)

AVAX social dominance v. price

Typically, a spike in social dominance precedes a rally in Avalanche, as noted in October 2022 and January 2023.

On-chain activity in AVAX recorded a spike, fueling bullish thesis

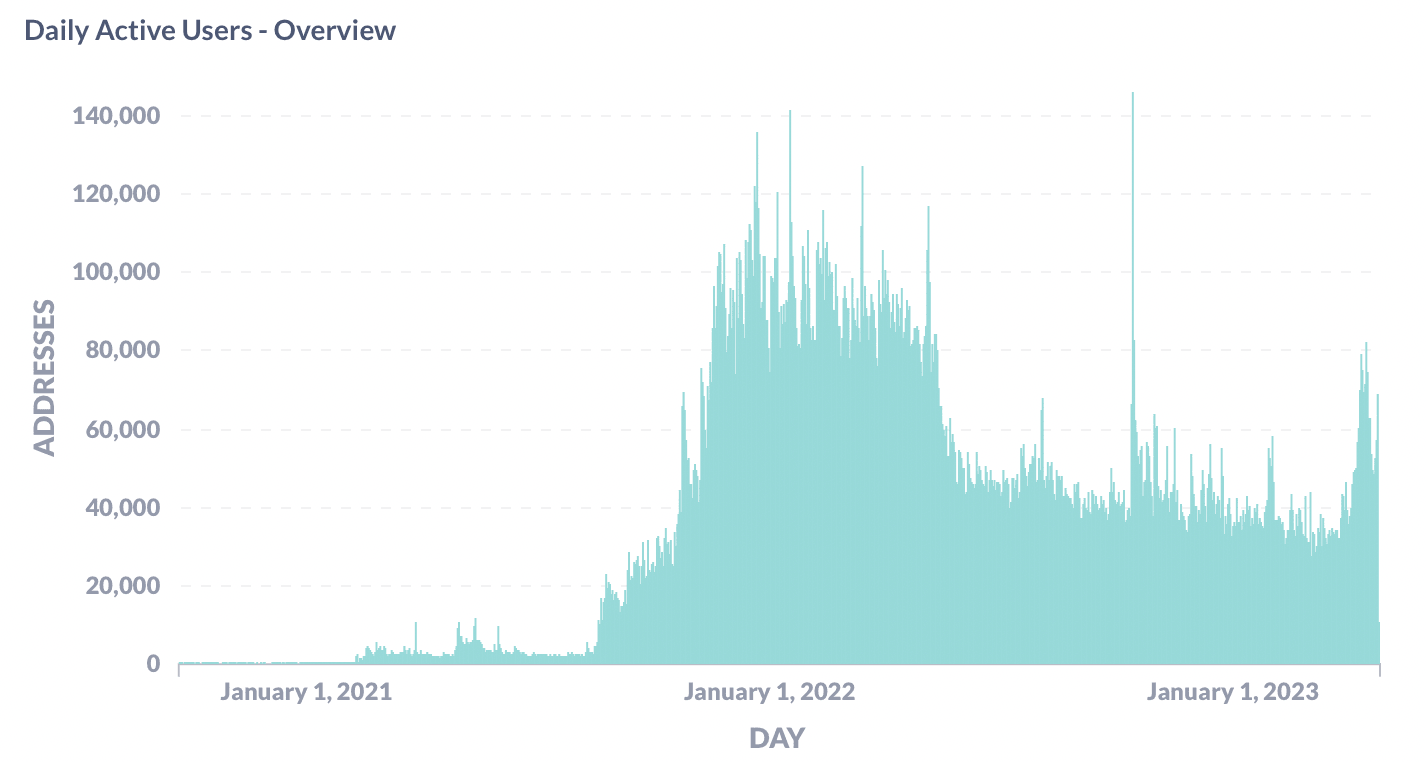

On-chain activity like daily active addresses is a metric that tracks the utility and relevance of Avalanche in the crypto ecosystem. An increase in daily activity is considered a sign of higher utility and corresponds to a bullish thesis for the asset’s price.

In the case of AVAX, based on data from stats.avax.network, daily active users climbed significantly, to nearly 70,000. This corresponds to levels previously noted ahead of a rally in AVAX price.

Daily Active Users on Avalanche Network

The spikes in AVAX represent significant gains on the daily timeframe, for holders.

Are AVAX price gains sustainable?

Avalanche yielded nearly 5% gains for holders, breaking out of a week-long downtrend. A bullish reversal candlestick pattern on the AVAX price chart could act as confirmation for the end of the downward trend.

As seen in the AVAX/USDT four-hour price chart below, after a significant decline from the $21.56 level on April 17 to $16.59 on April 24, AVAX price began an uptrend. The spinning top candlestick pattern that occurred on April 25, at the base of the Ethereum alternative token’s downtrend is considered a sign that bears are losing control of the asset and bulls are likely to take over.

AVAX/USDT 4H price chart

The spinning top candlestick pattern was confirmed with a change in trend and the formation of higher highs and higher lows in AVAX. As long as AVAX price stays above support at 38.2% Fibonacci retracement at $16.88, the asset’s uptrend could remain intact. A decline below this level could invalidate the bullish thesis.

The targets on the upside are 200-day Exponential Moving Average (EMA) at $17.95, and the weekly and monthly high at $18.25 and $21.56. On the downside, AVAX could find support at $16.88, $16.66 and the weekly low at $16.49.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.