Have the top coins reached the local bottom by now?

The new week has begun with the ongoing drop of the cryptocurrency market as almost all coins are in the red zone.

Top coins by CoinMarketCap

BTC/USD

Last Saturday, the Bitcoin (BTC) price consolidated around the $45,000 mark and, on Sunday, buyers tried to overcome the resistance of $46,000. The price pierced this level, but the growth was not supported by large volumes, and the pair was unable to overcome the two-hour EMA55.

BTC/USD chart by TradingView

As of this morning, the BTC price has returned to a level below $45,000. During the day, buyers will try to break through the resistance of the average price level and test the $47,745 level.

On the other hand, the weakness of buyers can provoke another wave of sales, and then the price can test the $42,447 level.

Bitcoin is trading at $44,907 at press time.

ADA/USD

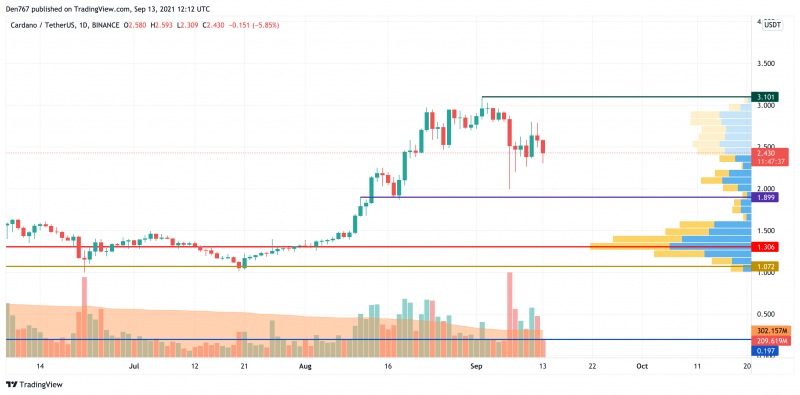

Cardano (ADA) is the main loser from the list today as its rate has dropped by 7%.

ADA/USD chart by TradingView

Despite the price decrease, sellers have not seized the initiative yet as Cardano (ADA) keeps trading above the vital level of $2. Only if bears break it and fix below, the fall may continue to the area around $1.30 where most of the liquidity is focused.

ADA is trading at $2.430 at press time.

BNB/USD

Binance Coin (BNB) has also gone down over the past 24 hours. The decrease was by 4.30%.

BNB/USD chart by TradingView

Binance Coin (BNB) has almost tested the support at $385 one more time; however, the native exchange coin still remains trading above this crucial support.

If sellers make a breakout, there is a good possibility of seeing a sharp drop to $340.

BNB is trading at $398 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.