GMX price could make a 50% climb as GMX’s daily chart is governed by a bullish pattern

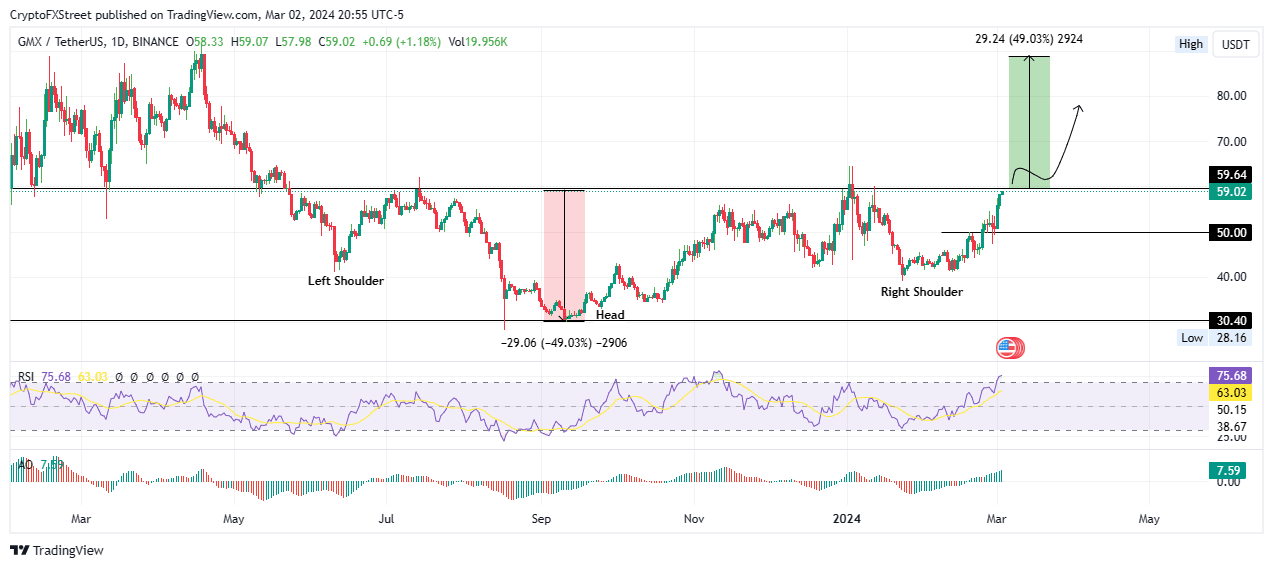

- GMX price has formed an inverse head and shoulder pattern on the daily timeframe.

- GMX could make a 49% climb if the price manages a daily candlestick close above $59.64 bullish.

- A break and close below $50.00 would invalidate the bullish thesis.

GMX (GMX) price has been trading within a range for months, forming a series of higher highs and then higher lows, culminating in an inverse head and shoulder pattern. This is a reversal pattern where two higher lows (shoulders) form on either side of a lower peak (head) in price action in the middle.

Also Read: Three sectors that could thrive as 2024 bull market warms up

GMX could make a 50% climb

The target of an inverse head and shoulder pattern is estimated by measuring the distance between the foot of the pattern to the peak of the head. This vertical distance is then superimposed at the breakout point.

If the GMX price manages a break and closes above $59.64, it could activate the governing chart pattern, with the altcoin likely to shoot 49.03% to $89.00. In a highly bullish case, the gains could extend for GMX to reclaim the $91.40 range high, levels last seen on April 18, 2023.

Notice the trajectory of the Relative Strength Index (RSI), suggesting momentum is still rising. The Awesome Oscillator (AO) indicator is also in positive territory with green histogram bars, suggesting a strong presence of the bulls in the GMX market.

GMX/USDT 1-day chart

On the other hand, a rejection from $59.64 could send GMX price south, likely to retest the $50.00 psychological support. A break and close below this level would produce a lower low, making leeway for the bears to recover the market.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.