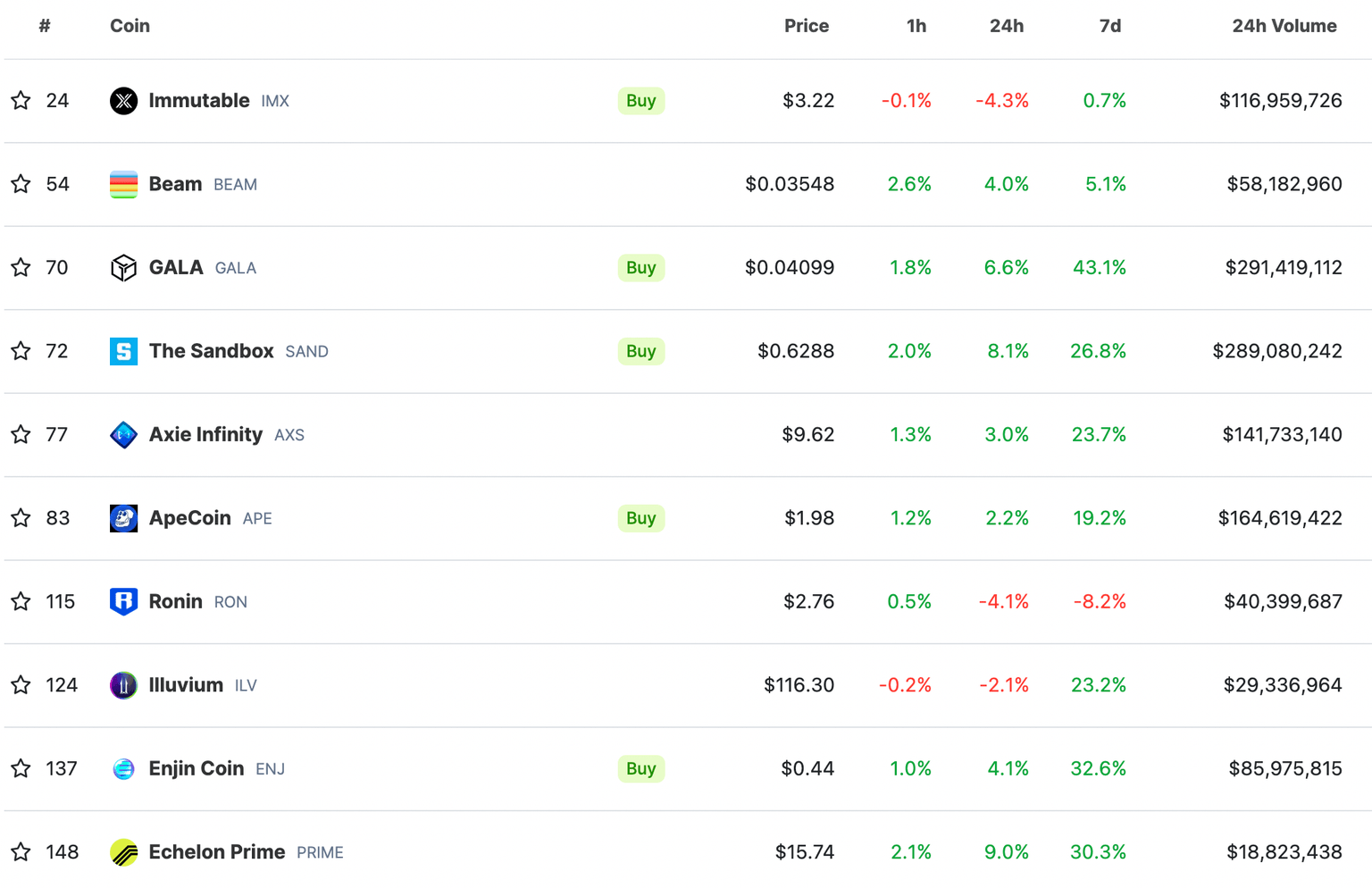

Gaming tokens surge, in spillover effect from Bitcoin price rally: GALA, SAND, ENJ, BEAM, APE

- Bitcoin’s price rally to a local top of $64,000 created winners in different altcoin categories like gaming tokens.

- Gaming assets like GALA, SAND, ENJ, BEAM and APE prices have surged even though BTC price fell to the $61,000 level on Friday.

- Traders realized a record high $5.54 billion in profits on their BTC holdings on February 28, on-chain data shows.

Prices of several gaming tokens increased sharply on Friday, a surge that can be broadly attributed to the overall recent growth in cryptocurrency markets but more specifically to the recent Bitcoin (BTC) price rally to a local top of $64,000.

Profit-taking by BTC holders peaked on Wednesday, making it likely that these investors have realized gains and rotated these profits into other sectors in the market such as gaming tokens.

Also read: ApeCoin price climbs 5% as gaming narrative revitalizes social metrics for APE

BTC profit-taking surge precedes rally in gaming tokens

Gaming tokens such as GALA (GALA), The Sandbox (SAND), Enjin Coin (ENJ), Beam (BEAM), and ApeCoin (APE) have noted a price increase between 2% and 9% on Friday.

The rally in gaming tokens is likely catalyzed by the rotating of capital by market participants who realized profits in Bitcoin on a large scale. Santiment data shows that on Wednesday BTC traders realized $5.54 billion in gains, the largest profit-taking event in the history of Bitcoin.

BTC Network Realized Profit/Loss. Source: Santiment

This may have catalyzed gains in several crypto sectors, gaming tokens included.

Gaming tokens gains on Friday. Source: Coingecko

A key catalyst for this recent upside move is whale activity. Data from Lookonchain shows that a large wallet address changed their position from PEPE to Shiba Inu (SHIB), Decentraland (MANA), The Sandbox (SAND) and GALA (GALA). The whale sold their 1.97 trillion PEPE holdings, worth $6.07 million, at a profit of $3.49 million.

The wallet address then accumulated 75.9 billion SHIB (worth $893,000), 1.6 million MANA (worth $1.07 million), 2.43 million SAND (worth $1.48 million), and 36.88 million GALA ($1.46 million). Sustained buying pressure from large wallet addresses is likely to drive further gains in gaming tokens.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B11.55.54%2C%252001%2520Mar%2C%25202024%5D-638448766903464781.png&w=1536&q=95)