FTT collapse: How $1,000,000 invested in FTT was slashed to $180,000 overnight

- FTT price declined 70% overnight, reminding crypto traders of Terra LUNC (formerly LUNA) and UST’s collapse.

- Following massive liquidations FTX exchange’s BTC reserves have hit near zero.

- $1,000,000 invested in FTX exchange’s native token FTT turned to $180,000 overnight.

Samuel Bankman-Fried’s FTX exchange was the fourth largest by trade volume until rumors of a bank run drained it of reputedly all its Bitcoin reserves. As a result of this 94% of SBF’s net worth of $16 billion was wiped out overnight.

Also read: Bitcoin price loses ground ahead of crucial US Midterm Elections and CPI inflation release

FTT price bleeds, traders reminded of Terra LUNA-UST’s collapse

FTT, the native token of the FTX exchange, witnessed a massive drawdown as large wallet investors exchanged it for stablecoins and US Dollars. FTT price nosedived 70% overnight, bringing the token’s total decline from $22 to $4.68 since the conflict between FTX exchange and Binance began.

The CEO’s of the two exchanges crossed swords after FTX CEO Samuel Bankman Fried’s controversial views on crypto market regulation were made known. SBF recommended regulators shift their focus away from centralized exchanges to DeFi platforms instead. This made SBF an unpopular figure in the DeFi industry which interpreted it as an existential threat.

Changpeng Zhao (CZ), CEO of Binance, was one of SBF’s critics and recently liquidated over half a billion of its FTT holdings in what was viewed as an attack on SBF. In a veiled warning about the vulnerability of ETX exchange CZ reminded traders of Terra’s collapse.

In the latest twist and turn in the story, FTX has been reported as reaching out to Binance for help in the ongoing crisis. The latter now appears to have signed a letter of intent to acquire SBF’s exchange. Binance’s acquisition of FTX will be the largest in crypto history.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ Binance (@cz_binance) November 8, 2022

Terraform Labs sister tokens LUNC (previously LUNA) and UST imploded and wiped out $41 billion from the crypto market capitalisation. FTT’s decline and the near zero Bitcoin reserves of FTX exchange have reminded users of the Terra implosion.

SBF’s net worth of $16 billion has been reduced by 94% to less than a billion overnight. SBF was considered one of history’s wealthiest individuals under the age of 30. SBF’a influence on crypto earned him the title of the “JP Morgan” of the cryptocurrency world.

These numbers signaled FTX’s collapse

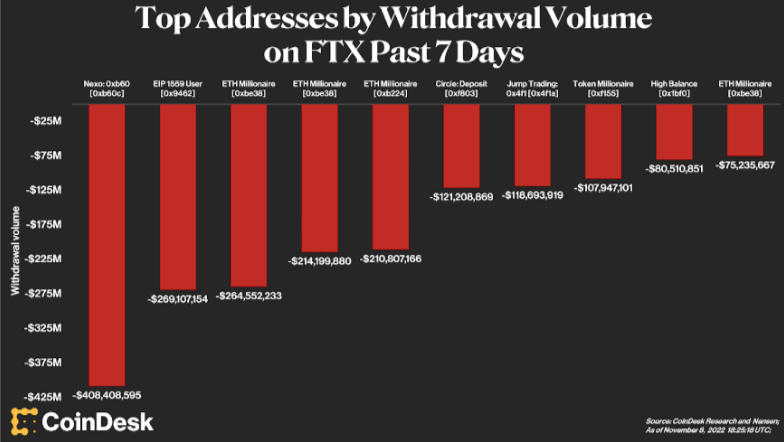

FTX is being bled dry. Withdrawals by the top 10 addresses on FTX hit a peak days before the exchange’s reserves were wiped out. Based on data from crypto intelligence tracker major holders Nansen, Nexo, Circle and Jump Trading pulled out $1.87 billion within a week.

Top addresses withdrawal volume on FTX

Nexo withdrew upwards of $408 million in Ethereum through several transactions on FTX. Market participants pulled out $121 million USDC and the exchange reserves were drained of nearly 19,000 BTC overnight.

Before halting withdrawals, FTX processed nearly $450 million in stablecoins, more than the total combined outflow from exchanges like KuCoin, Crypto.com and OKX.

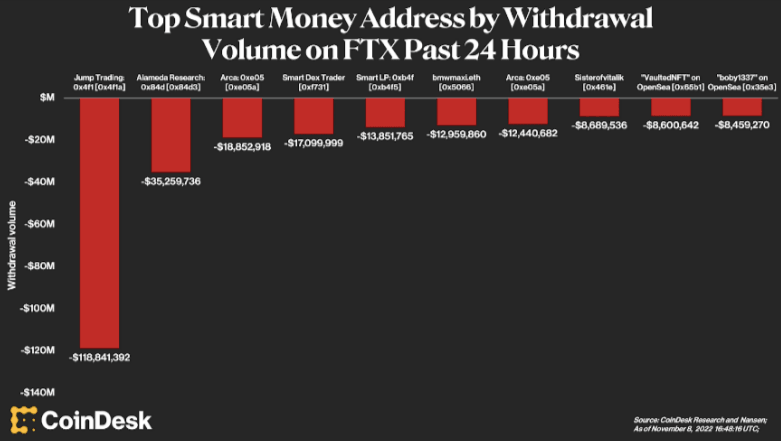

Investment funds that provide liquidity to DeFi protocols, termed as smart money, have pulled out $246.6 million worth of tokens from FTX overnight.

Smart Money Addresses by Withdrawal Volume

If a trader purchased $1,000,000 worth of FTT tokens before the collapse it would be worth less than $180,000 today. The massive decline has yielded nearly 75% losses for FTT holders.

The FTT decline echoes Terra’a collapse during the initial phases of the bear market.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.