Ethereum releases plan to address scaling issues amid high gas prices

- The upcoming release of Eth2 is the most significant update for the Ethereum network.

- Vitalik Buterin has released a report explaining the next steps and his plans for ETH.

The official team of Ethereum has released the newest plan to address all scaling issues in the short-term. According to the report, the intention of eth2 is to offer scalability, but base-layer scalability for applications is only coming as the last phase of the update.

Vitalik Buterin, co-founder of Ethereum, said:

Base-layer scalability for applications is only coming as the last major phase of eth2, which is still years away, adding, If you are not convinced to go 'all the way' on the 'phase 1.5 and done' direction, there is a natural compromise path to take: having a small number of execution shards (eg. 4-8) and many more data shards.

The final testnet of Ethereum 2.0 Spadina is live already, reported here. According to beaconcha.in, Spadina passed phase 0, while the validators' involvement is about 45%, which is less than expected. However, the experts note that the same situation happened with Medalla.

The short-term plan for Eth1 rollup

According to the most recent report, the initial mission of Eth1 will be focused on 'scaling how much data blocks can hold.' There is also a need for the infrastructure to adapt quickly to the Rollups.

Currently, users have accounts on L1, ENS names on L1, applications live entirely on L1, etc. All of this is going to have to change. We would need to adapt to a world where users have their primary accounts, balances, assets, etc entirely inside an L2

L1 and L2 refer to layers. A Layer 2 protocol is built on top of an existing blockchain to solve speed or scaling issues.

The long-term plan for Ethereum

As the second-largest cryptocurrency, Ethereum faces notable scaling issues. The network can only process around 15 transactions per second, which is simply not enough. According to the report, if everyone moves to rollups, the speed would increase to 3,000 TPS.

Of course, the transition from Proof-of-Work to Proof-of-Stake would also happen here. Vitalik Buterin also noted that because phase 1.5 is already good enough, perhaps no one will care about it.

It seems very plausible to me that when phase 2 finally comes, essentially no one will care about it. Everyone will have already adapted to a rollup-centric world whether we like it or not, and by that point it will be easier to continue down that path than to try to bring everyone back to the base chain for no clear benefit and a 20-100x reduction in scalability.

Ethereum crashes, but it's attempting to bounce back up

Following the news of BitMEX being accused by the CFTC, Ethereum saw a 9% crash wiping $3 billion of its market capitalization.

ETH/USD 1-hour chart

The price is currently bouncing from a low of $334, and ETH has managed to flip the MACD in favor of the bulls. The last MACD bullish cross pushed the digital asset by 4% within the next 24 hours.

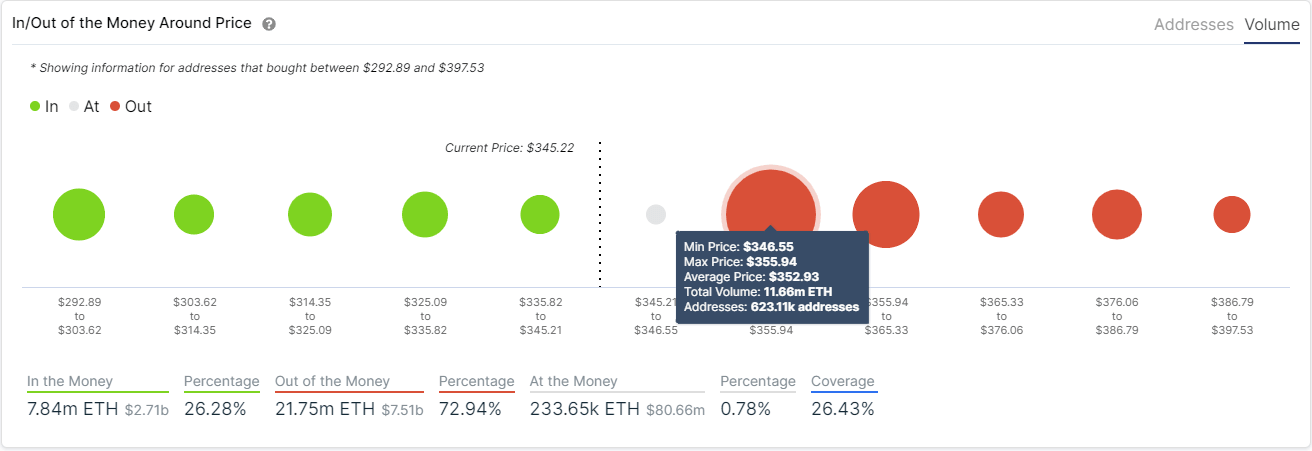

ETH IOMAP Chart

The next most likely price target for the bulls is the $355 resistance level created on October 1, coinciding with the 50-SMA. Looking at the In/Out of the Money Around Price chart by IntoTheBlock, there is a lot of resistance between $346 and $355. In this range, 11.6 million Ethereum coins were bought.

On the other hand, support levels pale compared to only 1 million ETH coins bought between $335 and $345, which means that the price is at risk of free-falling towards the last low at $334.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637372498048627279.png&w=1536&q=95)