Ethereum price set for 15% gains over the weekend

- Ethereum price sees bulls building momentum for an attack on $3,500.

- ETH price takes a small step back with $2,900 as a support level before jumping higher.

- As the weekend begins, ETH bulls will use the drop in headlines and earnings as an open window for a leg higher.

Ethereum (ETH) price is set to jump over the weekend despite the brake worried investors have put on price action in the past week. Although trading volume has been more significant over the past week and should thus come with more solid movements, price reaction has been distorted by geopolitical headlines, earnings, and whipsaw moves in stock markets. All those headline risks are starting to fade into the weekend, resulting in a probable jump higher in prices as bulls use the flatlining Relative Strength Index (RSI) to seize control and ramp price up to $3,500 by Sunday.

ETH price set to wipe to the floor with bears

Ethereum price has given investors and traders a wearing week with big whipsaw moves on the back of earnings, geopolitical headlines and investors switching from risk-on to risk-off as if they were flipping a light switch. But with volatility comes opportunity, and as all these events will start to die down towards and indeed into the weekend, bulls will have the playground for themselves and can ramp the price up, even up to $3,500, if they pick the proper entry levels. Expect the RSI to pop back above 50, with still plenty of room before trading in the overbought.

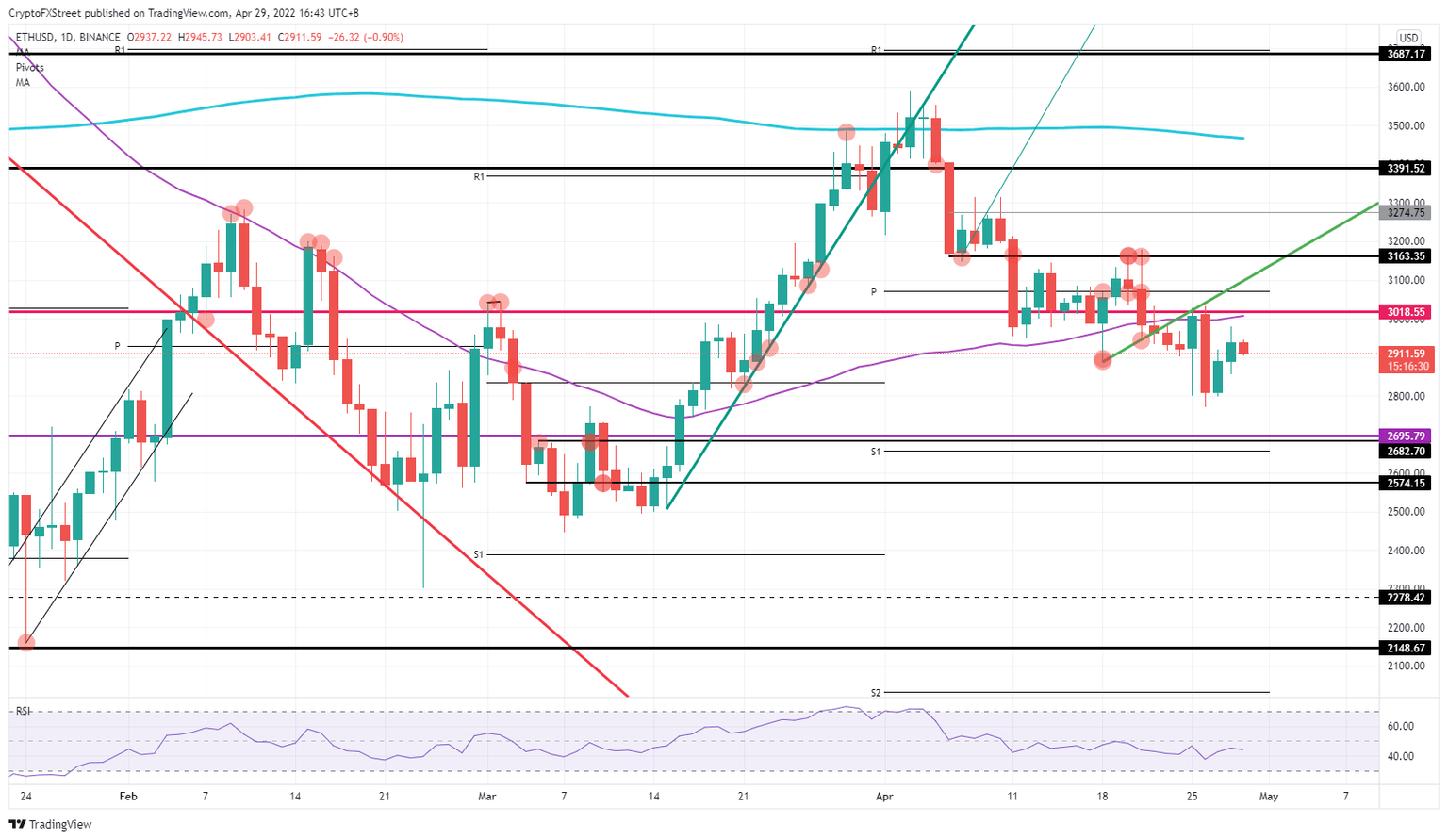

ETH price will first need to address $3,018.55, which is an intersection between the 55-day Simple Moving Average (SMA) and a historic pivotal level. If bulls can make it through there, next up is $3,163.35, which should not be much of a problem, but ideal to settle and search for support before swinging up 10% and testing the 200-day SMA around $3,500. With this two-tier jump, the bulls could see ETH price opening up on Monday in another game.

ETH/USD daily chart

The most considerable risk for bulls could be that they already fail at the first hurdle, at $3,018.55. Over the weekend, investors will be reassessing the situation, and bears could be awaiting the bulls’ attempt and use it as an entry for a short position, pushing price action back down if investors flee further into safe-havens on Monday. Expect a push back in ETH price below $2,800 toward $2,695.79, where double support is awaiting to catch the fall.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.