SOS Stock Price: Sos Ltd jumps as equities rebound alongside Bitcoin and Ethereum

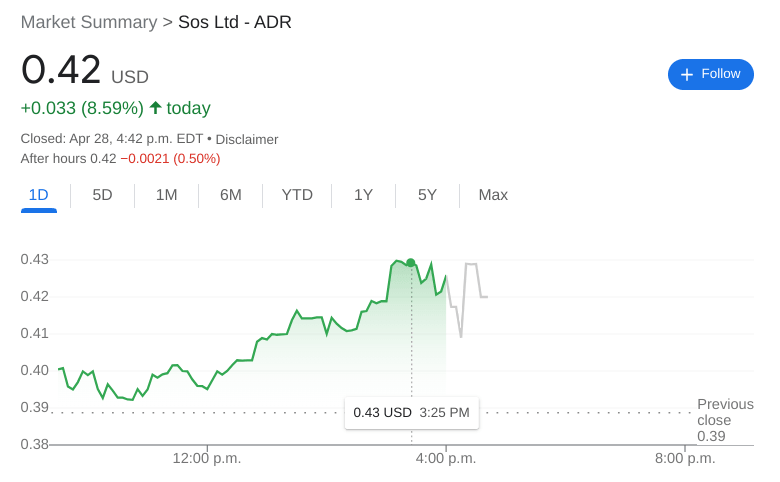

- NYSE:SOS gained 8.70% during Thursday’s trading session.

- Bitcoin mining stocks soar as crypto price tops $40,000 again.

- Fort Wayne, Texas becomes the first US city government to mine Bitcoin.

NYSE:SOS bounced back alongside the broader markets on Thursday as the stock managed to bounce off of its all-time low price levels. Shares of SOS soared by 8.70% and closed the trading session at $0.42. It has been a difficult year for SOS investors, who have seen the price fall by more than 51% since the start of 2022. Thursday saw a relief rally from the markets following a better than expected earnings from Meta Platforms (NASDAQ:FB) on Wednesday. All three major indices soared as the Dow Jones gained 614 basis points, the S&P 500 rose by 2.47%, and the NASDAQ led the way by adding 3.06% during the session.

Stay up to speed with hot stocks' news!

Bitcoin mining stocks were one of the sectors that were trading higher on Thursday. Along with SOS, Marathon Digital Holdings (NASDAQ:MARA), Hut 8 Mining Corp (TSE:HUT) and Bitfarms Ltd (NASDAQ:BITF) were all in the green. UK mining company Argo Blockchain ADR (NASDAQ:ARBK) jumped by 10.68% after the company announced that it is boosting its 2022 hashrate guidance from 3.7 EH/S to 5.5 EH/S for the rest of the year. Bitcoin reclaimed the $40,000 price level on Thursday after gaining more than 2.0% during intraday trading hours.

SOS stock forecast

Fort Wayne, Texas has officially become the first city government to mine for Bitcoin after a vote passed last week. The city will mine Bitcoin directly from its City Hall, with three Antminer S9 rigs which will run twenty-four hours per day and seven days per week. The city is starting small, but it could open the door for more cities to look into Bitcoin mining as an extra source of revenue.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet