Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Earning season catalyst to spark a crypto rally

- Bitcoin price set for the second day of gains as the stronger dollar gets outpaced by crypto.

- Ethereum price set for a 20% pop as earnings reveal risk appetite from investors.

- XRP price sees a bounce off a historic pivotal level succeeding.

Bitcoin price, Ethereum and other cryptocurrencies are on the front foot, except for XRP price, which is still pressured by dollar strength. All other major cryptocurrencies, however, are rallying after Facebook surprised to the upside and pushed a sigh of relief through the markets. Next on the docket this evening is Apple, coming out after the close. It will be essential Apple’s earnings are positive for another bullish close, that will see traders continue and follow the trend with solid gains to come into next week.

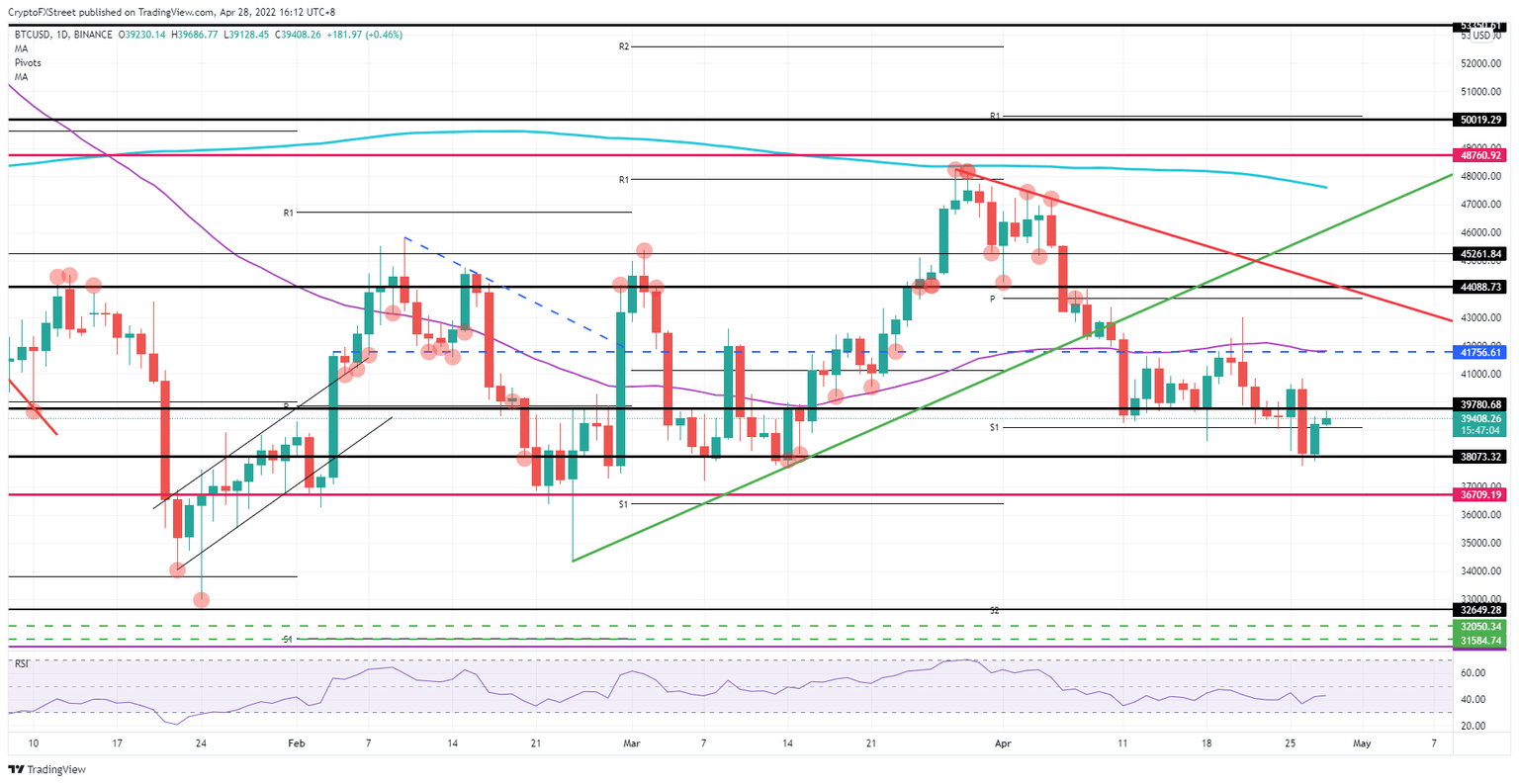

Bitcoin price is set to close above $40,000 if Apple surprises to the upside

There is no denying that Bitcoin (BTC) price is very much correlated to the Nasdaq this earnings season. When the Nasdaq tanked on Tuesday after Alphabet earnings, Bitcoin entered a nosedive move losing over 5% of its market value due to missed earnings. Trader’s witnessed a similar pattern yesterday after the US closing bell, when Facebook’s earnings came out surprising to the upside. BTC price was able to eke out gains with a close above the monthly S1 at $39,099 and use the S1 this morning as a launching platform for another bullish day.

BTC price is thus set to go out with a bang this trading day. Expect to see investors and bulls buying BTC throughout the day, outweighing bears trying to defend that $39,780 level, refraining bulls from popping above $40,000. As already mentioned, the correlation with Nasdaq and Apple this evening will be essential as it will be the spillover effect from the tailwind (or headwind, for that matter) that will lift BTC price above $40,000, from where it will be set to jump up to $42,000 by this weekend, piercing through the 55-day Simple Moving Average (SMA).

BTC/USD daily chart

Risk to the downside comes hand-in-hand with those Apple earnings mentioned. If Apple drops 10% as Alphabet did, expect a severe headwind to push BTC price against the pivotal level at $38,073. If that level breaks, expect to see a further drop to $36,709. If more negative news is added from any geopolitical corner, it is likely there will be a further acceleration southwards to $32,650.

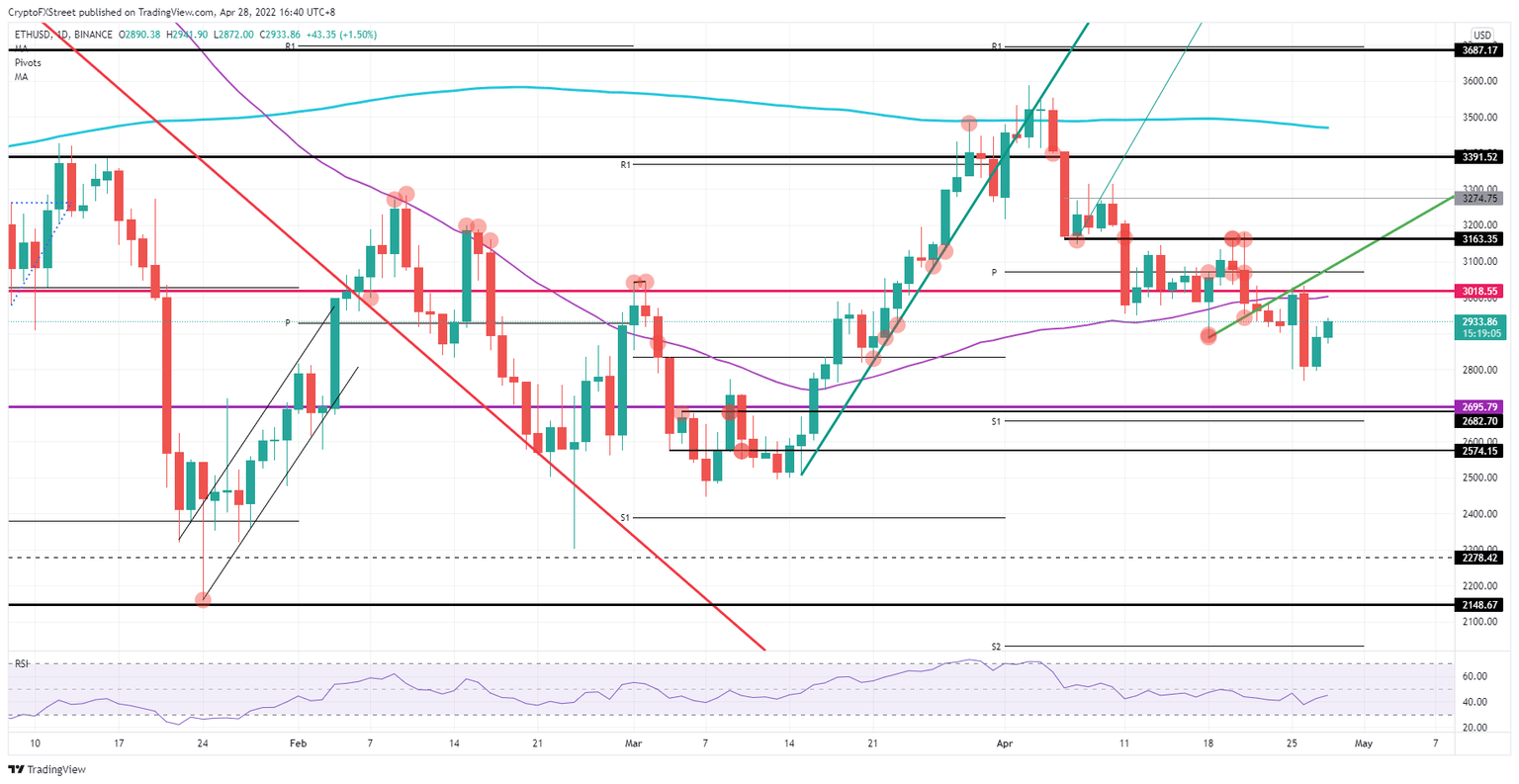

Ethereum price is set to topple the $3,000 target, searching for $3,500 as we advance

Ethereum (ETH) price is on the cusp of booking a two-day win as investors are in a good mood over Facebook earnings, triggering a wave of risk in markets. On the back of that, ETH price is set to rally just shy of 2% at the time of writing, with another 5% to 9% forecasted afterward. With more news coming in and markets on fire, expect a lift throughout the day.

ETH price is thus set to book at least a two-day winning streak and looks to continue that trend into the weekend as more and more geopolitical news moves to the background with tail risks diminishing and buying demand overpowering the stronger dollar. If the buck starts to fade, expect to see an exponential move unfolding as bulls pierce through the 55-day SMA at $3,018 and see a big leg up towards $3,500, towards the 200-day SMA. That would mean jump of 23% for ETH price, on the back of that.

ETH/USD daily chart

Risk comes from a rejection against the double cap at $3,018 and the 55-day SMA nearby. Bears will be more than happy to use those handles to go short, place stops above them and see bulls getting smashed in the process, turning into a long squeeze and seeing bulls take the losses and accelerate the downward pressure as they need to sell as well to get out of their losing trades. That would mean a drop towards $2,700 for ETH, where a double floor is waiting with a failsafe system near $2,680.

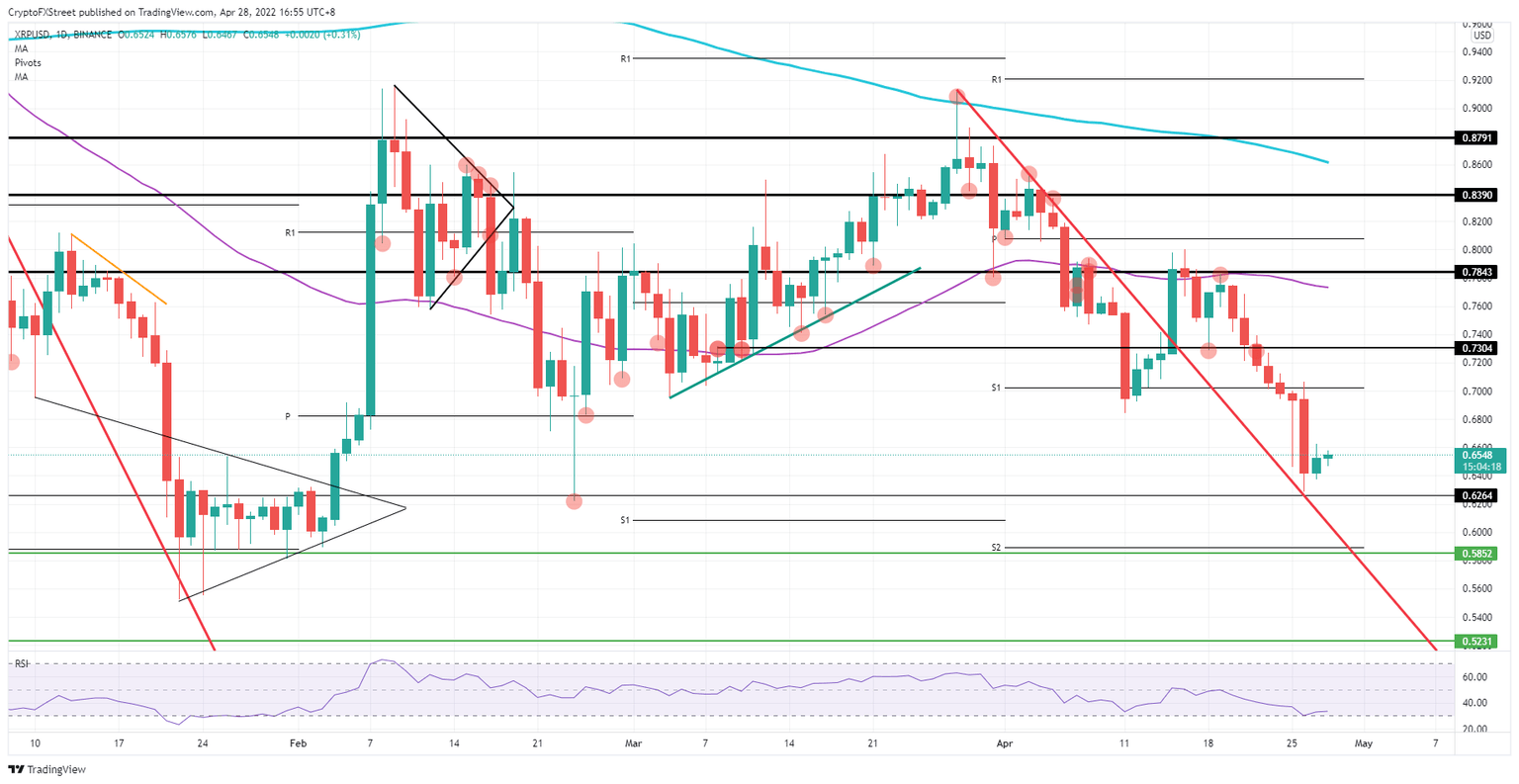

XRP price set to rally 14% as RSI shifts away from being oversold

Ripple (XRP) price can be seen as the perfect technical trade opportunity amongst cryptocurrencies. Ripple price dropped massively on Tuesday after Alphabet earnings gave markets a cold shower and they tanked. XRP price declined over 7% on the back of that and dropped back to $0.6264, which holds a historically significant pivotal level and coincides with the red descending trend line from March 28.

XRP price saw the Relative Strength Index (RSI) touching the ‘oversold’ barrier, and since then has seen both the RSI and XRP price bouncing higher, showing that the technical framework holds logic and has triggered bulls to come in and buy these technical indicators. With that, XRP price looks set to jump back up towards $0.73 as buyers will sit on their hands, refraining from selling and by this, will dry up demand, triggering bears to start selling at higher prices in order and indivertibly trigger a rally squeezing bears themselves.

XRP/USD daily chart

With the penalty drop on Tuesday, it could be that the RSI is just taking a breather before drilling back down to the oversold barrier and trying to punch through it. That would mean that XRP price is unfit to make new highs against the high of yesterday and see the price slowly but surely drop again to the downside. Once bears pierce through $0.6264, the next best level to catch price action is around the monthly S2 and the pivotal level at $0.5852, roughly another 10% drop.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.