Ethereum Price Prediction: Trading Nonfarm Payrolls, will ETH bulls triumph?

- Ethereum price is expected to take a dip after the release of Nonfarm Payrolls on Friday at 13:30 GMT.

- A retest of $1,227 followed by a recovery above $1,266 could propel ETH to $1,375.

- A twelve-hour candlestick close below $1,215 will invalidate the bullish thesis.

Ethereum (ETH) price is traversing a bearish pattern and is close to invalidating it. However, due to the current market conditions combined with the release of Nonfarm Payrolls (NFP) on Friday at 13.30 GMT, there is a possibility that ETH could correct and retest a stable support level before establishing its direction.

Ethereum price at make-or-break scenario ahead of Nonfarm Payrolls

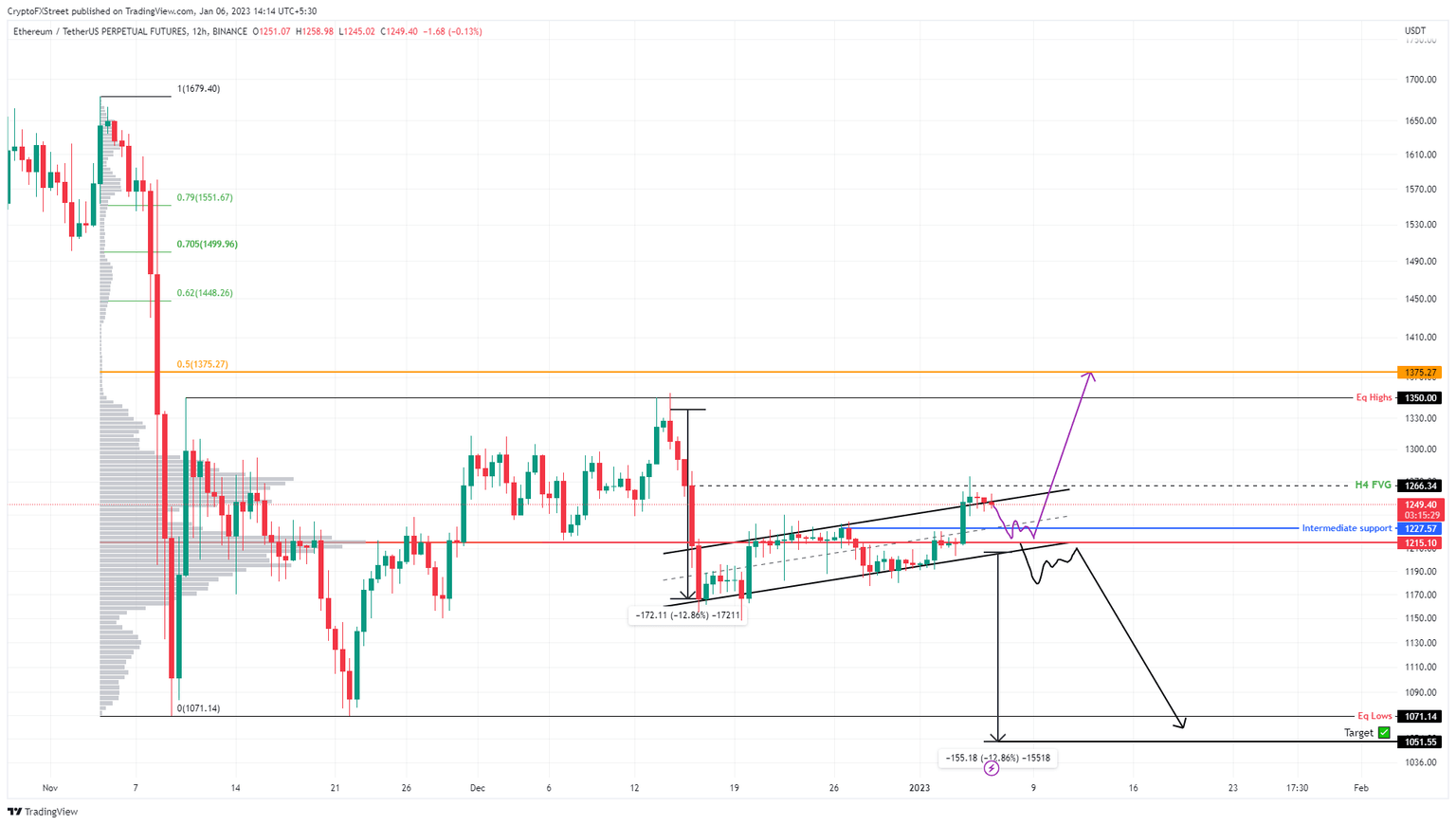

Ethereum price action between December 14, 2022 and January 6, 2023 has produced a bear flag setup. This technical formation forecasts a 13% downswing, as noted in a previous article. A decisive flip of the $1,266 hurdle into a support level will invalidate this pessimistic outlook.

However, the Nonfarm Payrolls numbers are supposed to come in hotter than the expected 210K, which is good for the US Dollar but will cause the stock and crypto markets to tank. Therefore, investors can expect the Ethereum price to slide lower into the bear flag pattern

The intermediate support level at $1,227 is the best place for sidelined buyers to step in. Additionally, Ethereum price could even retest the $1,215 barrier before triggering a reversal or recovery rally.

The resulting upswing needs to bounce higher and flip the $1,266 hurdle into a support floor. This confirmation will propel ETH to collect the liquidity resting above equal highs at $1,350 and potentially tag the $1,375 resistance level.

ETH/USDT 1-day chart

On the contrary, if the NFP result causes Ethereum price to slide below the $1,215 support level and flip it into a resistance level, it will invalidate the bullish outlook. Such a development could see ETH crash 13% to collect the sell-stop liquidity resting below $1,051.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.