Ethereum Price Prediction: ETH to consolidate after setting up record levels above $3,000

- Ethereum price reveals a correction could be underway after hitting an all-time high at $3,454.

- The MRI forecasts a cycle top signal, suggesting that a reversal is around the corner.

- ETH could set up a swing low at $2,853 as it kick-starts a consolidation phase.

Ethereum price has seen an explosive rally over the past week that led to a new all-time high. However, a consolidation might follow ETH as bulls take a breather.

Ethereum price slows down

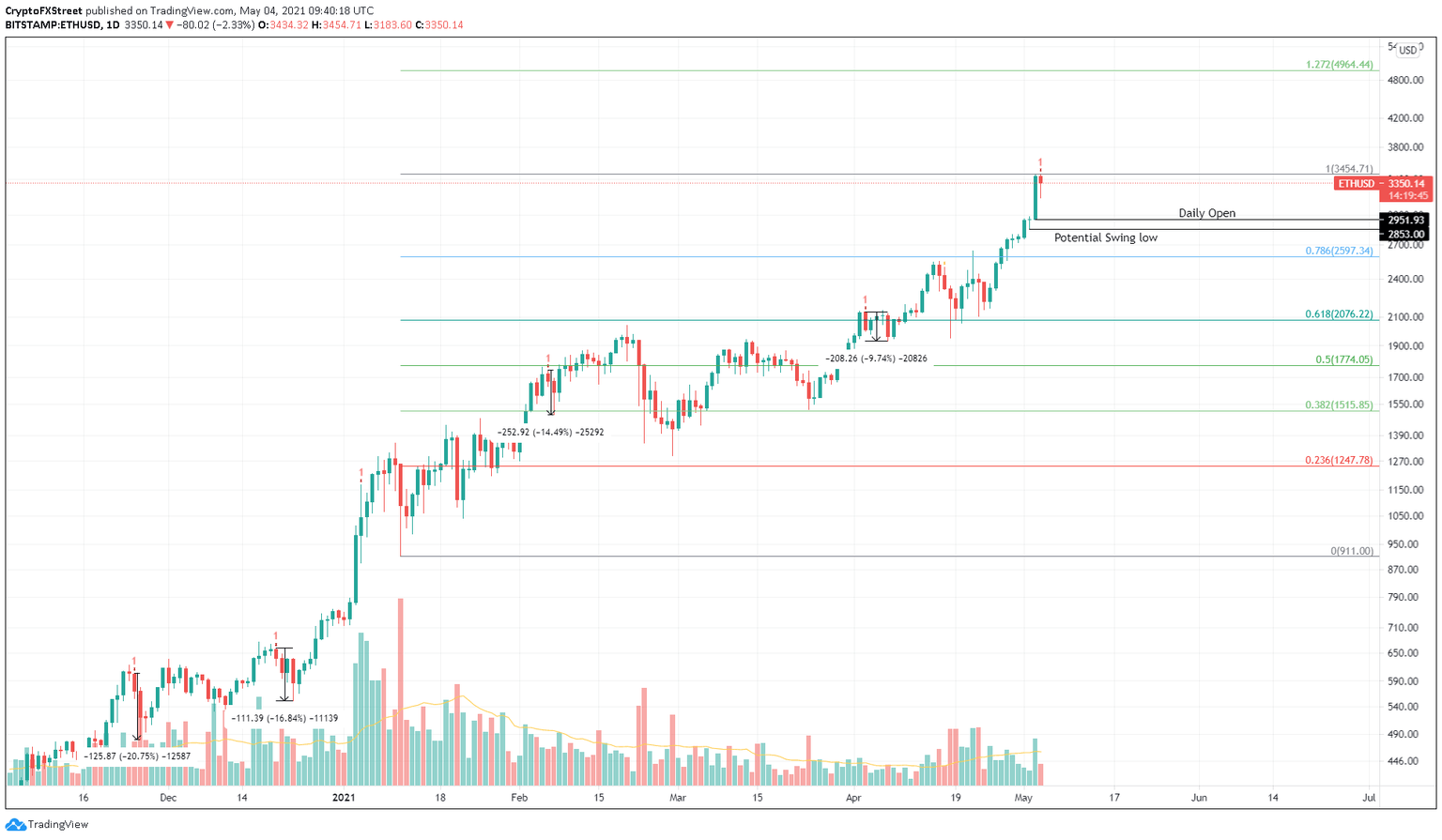

Ethereum price has dropped nearly 7.85% on the daily chart but is trading at $3,350 at the time of writing. However, this correction could extend further as the Momentum Reversal Indicator (MRI) flashed a reversal signal in the form of a red ‘one’ candlestick.

This setup forecasts a one-to-four candlestick correction that could stretch up to $2,951, Monday’s open. The sellers might even try to create a swing low at $2,853, a 15% retracement from the current price levels.

Since December 2020, the last four out of five times this indicator flashed a cycle top signal, ETH price slid an average of 15%, which coincides with $2,951. Hence, investors need to keep a close eye on a 15% drop in the smart-contract token.

Once the swing lows are established, Ethereum price will likely consolidate in this range until buyers overwhelm the selling pressure, pushing it through the current all-time highs to set up a new one.

Under these circumstances, market participants could see ETH climb to 127.2% Fibonacci extension level at $4,964.

ETH/USD 1-day chart

While this consolidation scenario seems likely, Ethereum price could turn bearish if the 78.6% Fibonacci retracement level at $2,597 is shattered. This move would invalidate the range-bound thesis that could provide ETH with a platform for its next leg, and trigger a 9% correction to $2,359.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.