Ethereum price jumps to new all-time highs as eBay is reportedly exploring NFT auctions

- Ethereum price has hit a new all-time high of $3,204 amid strong buying pressure in the market.

- The giant e-commerce platform eBay is reportedly looking into NFT auctions as well as Bitcoin payments.

- Ethereum faces practically no resistance ahead with strong on-chain metrics supporting it.

Ethereum has exploded in the past 24 hours reaching a new all-time high of $3,204 outperforming Bitcoin and the rest of the market. ETH hit $370 billion in market capitalization almost quadrupling Binance Coin even though it also saw a massive rally.

eBay is exploring NFT auctions and Bitcoin payments

Jamie Iannone, CEO of eBay has stated in a CNBC interview that the company is looking into new form of payments. eBay has recently introduced Apple pay and Google pay to give users more options.

Iannone mentioned that cryptocurrencies are interesting as payment options and also NFTs as eBay is known as the place to transact goods adding:

With 170 million buyers on the platform, this is the place that sellers come to get scale demand. We are looking at it and exploring opportunities. When you think about collectibles, everything that is collectable has been on eBay for decades and will continue to be for the next few decades.

The CEO also stated that it would still take eBay some time to enable NFT auctions. It’s important to understand that the term NFT, comes from Non-Fungible Tokens which were built on Ethereum. About 99% of all NFTs are on Ethereum and will most likely stay there. Anything that benefits NFTs, benefits Ethereum.

Ethereum price could see even higher highs

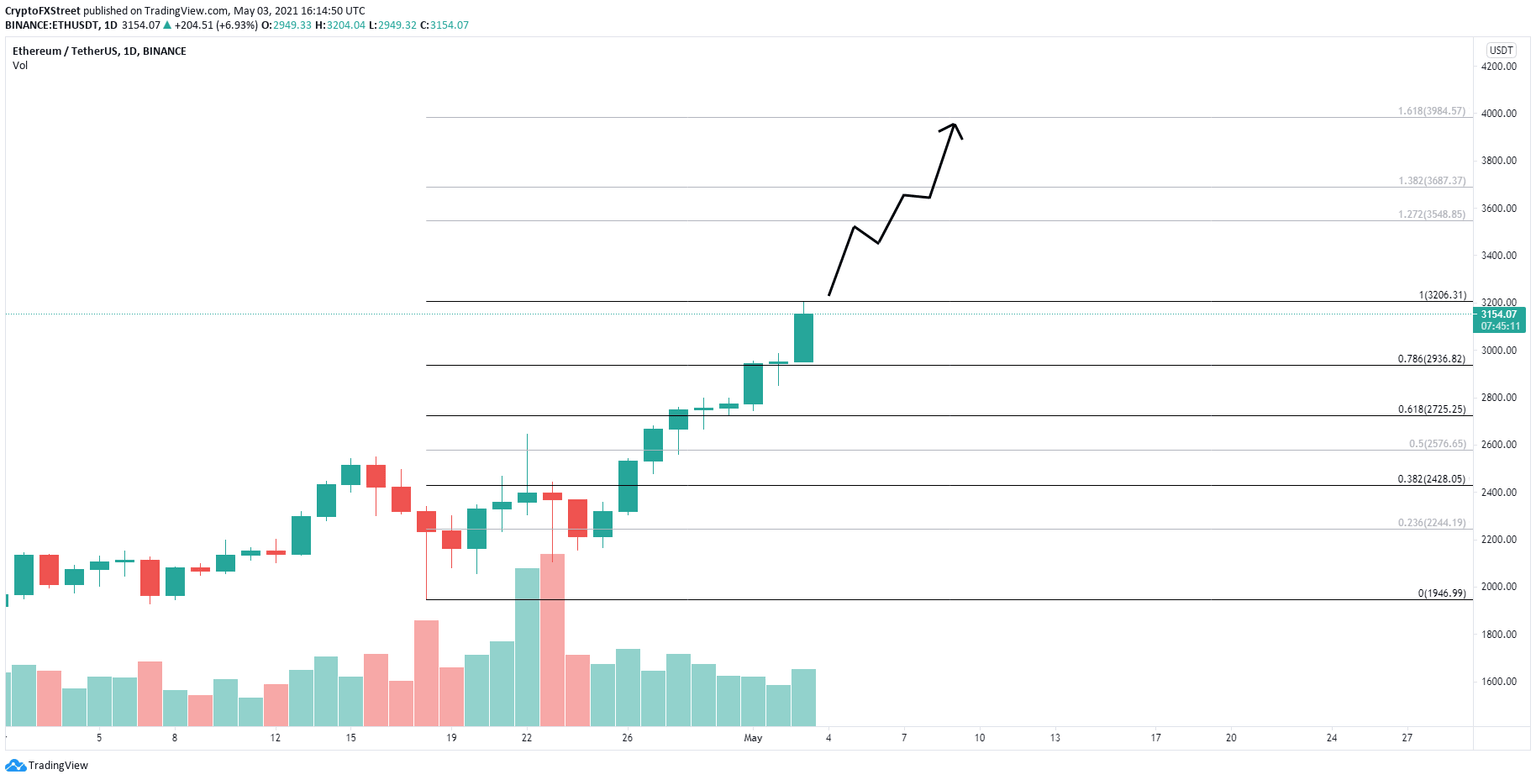

Ethereum price hit a new all-time high of $3,204 in what seems to be an unstoppable rally. The digital asset’s next price target is located at $3,548 which is the 127.2% Fibonacci retracement level.

ETH/USD daily chart

To add credence to the bullish outlook, it’s important to check the significant number of Ethereum coins locked away from exchanges. Currently, about $69 billion worth of ETH is locked inside DeFi protocols.

ETH Locked away

Additionally, inside the Ethereum 2.0 contract, 4.14 million ETH have been locked which represents $13 billion. This means that a total of $82 billion worth of ETH is locked away, which is about 22.5% of the total market cap of Ethereum.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B20.28.35%2C%252003%2520May%2C%25202021%5D-637556564497605222.png&w=1536&q=95)